- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:33 05:50 12:21 15:48 18:46 20:03

Businesses in Dubai are taking up more office space as they increase the size of their workforces, with rents likely to jump 20 per cent this year, according to Knight Frank.

“Dubai’s office sector made a strong start to the year, with the number of leasing transactions up significantly in both annual and quarterly terms in Q1 2014,” the UK-based consultancy said in its latest Dubai office report.

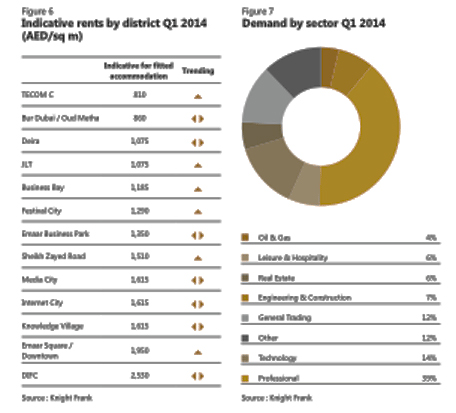

In the first quarter of this year, demand was strongest from the professional sector, which accounted for almost 40 per cent of all enquiries. The technology (14 per cent) and general trading (12 per cent) sectors were the next biggest sources of demand, while engineering & construction (7 per cent), leisure & hospitality (6 per cent), real estate (6 per cent) and oil & gas (4 per cent) sectors featured further down the list.

The Dubai economy is expected to sustain its growth momentum with the Department of Economic Development expecting GDP to grow 4.7 per cent in 2014, driven by tourism, trade, transportation and real estate.

Besides, the business outlook for Dubai continues to improve with the Department of Economic Development survey finding businesses willing to invest in expansion, recruitment and technology upgrades.

--Vacancy rates fall

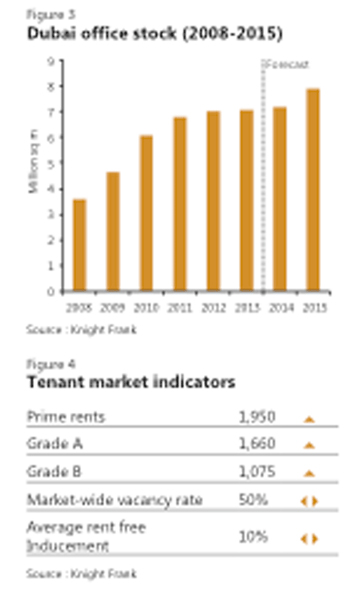

Though office take-up in Dubai has been rising, new supply continues to be released into the market.

Knight Frank estimates the market-wide vacancy rate has held steady at 50 per cent over the past year.

“That said, the prime vacancy rate edged down to 16 per cent as strong economic conditions provided corporates with the impetus to expand their operations,” the consultancy states.

Prime office buildings under sole ownership have seen rents double in the past one year with Emaar Square/Downtown, Tecom C and Business Bay witnessing double-digit increases.

JLL, a global property consultancy, stated earlier occupier demand remains focused on high quality office space in prime locations.

“Due to limited availability within these offerings, some corporates are considering built-to-suit options. Single ownership buildings continue to account for the majority of demand, while strata projects remain less popular,” the consultancy said.

According to Knight Frank, the value of transactions declined compared to the last quarter 2013, primarily because corporates signed a flurry of high-value leasing contracts before year-end.

--Expect rent rise

The consultancy expects office rents to rise by 20 per cent in 2014.

“Underpinned by rising demand from corporates and SMEs, and the low supply of good quality office space in prime locations, rents in Dubai are projected to see annual increases of around 20 per cent and 10 per cent in 2014 and 2015, respectively,” the report said.

JLL, however, believes Dubai will continue to see a two-tier office market with secondary locations likely to benefit as occupier interest increases.

“The strong pipeline is likely to restrain any pressure for rental increases in secondary locations but further declines are considered unlikely,” it states.

[Homepage Image via Shutterstock]

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.