- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:26 05:44 12:20 15:47 18:50 20:08

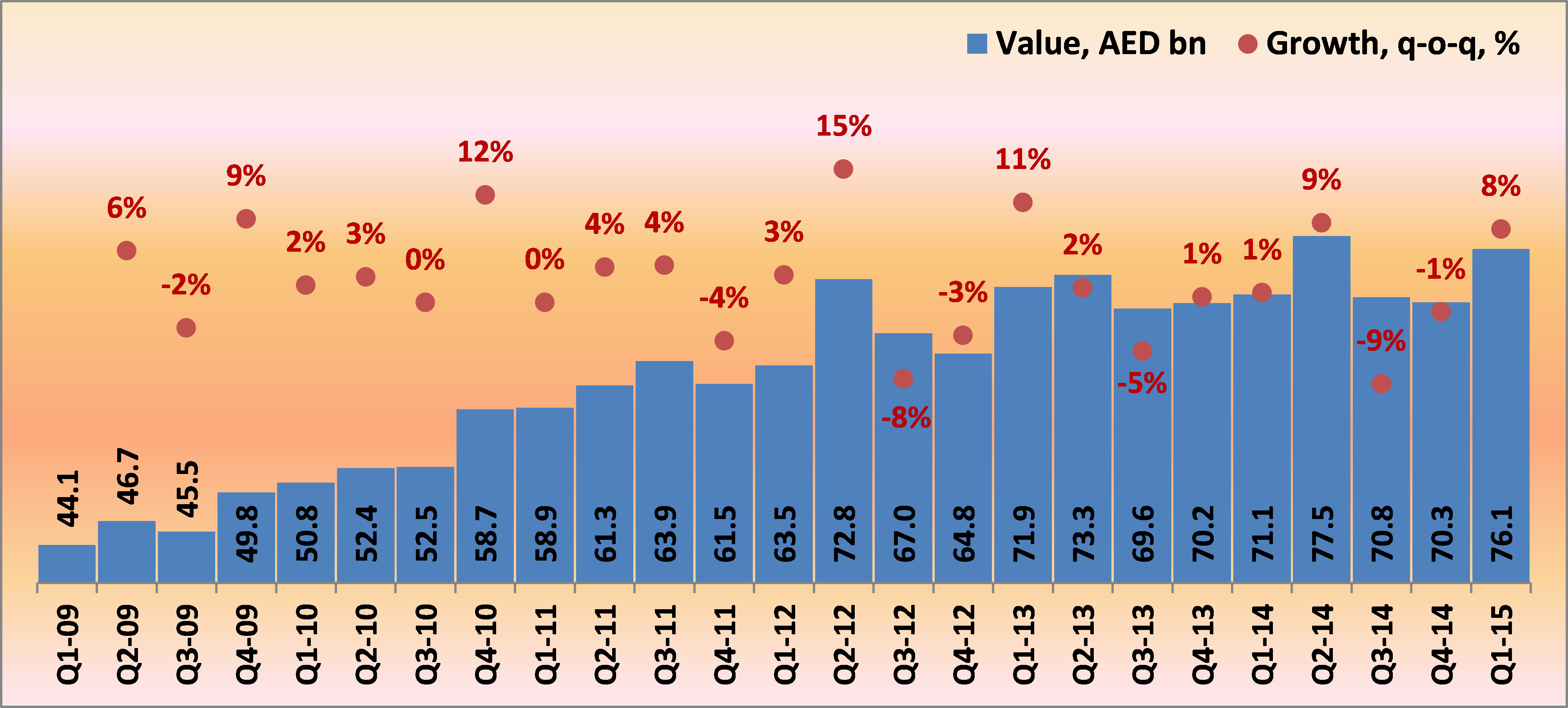

Exports of Dubai Chamber of Commerce & Industry members in March reached an all-time high of Dh28.1 billion, pushing the total export value for the first quarter of 2015 to Dh76.1 billion.

The latest export data released by Dubai Chamber shows an 8 per cent increase on the previous quarter’s value of Dh70.3 billion and a 7 per cent rise from the Dh71.1 billion for the same quarter a year ago.

The number of Certificates of Origin (CO) issued by Dubai Chamber also increased to a total of 228,000, up by 8 per cent from 221,000 during the same quarter last year.

In addition, Dubai Chamber’s active exporters in Q1 2015 reached 8,231, represented a 3 per cent increase over both Q4-2014 and Q1-2014.

GCC continues to be the largest export market The GCC has been the largest export market of Dubai Chamber members, with export to the region accounting for more than half of the total quarterly export.

The region’s dominance has grown significantly in the recent years. The total exports to the region of Dh50.6 billion in Q1 2015 was equivalent to 67 per cent of the total export to all destinations during the period.

Compared to previous quarter’s exports to the region of Dh44.5 billion, a 14 per cent increase is noted. Year-on-year growth was even more significant at 19 per cent, from year ago value of Dh42.4 billion.

Leading the growth was Saudi Arabia, the largest destination of members’ exports to the GCC. The total value of export to the country during Q1 2015 reached Dh28.9 billion, or 38 per cent of the total. This represents a y-o-y growth of 26 per cent from a year ago value of Dh22.9 billion; and a q-o-q growth of 20 per cent, from Q4-2014 value of Dh24.2 billion.

General year-on-year improvements were noted in exports to all other GCC countries, with exports to Qatar rising by 13 per cent to Dh7.3 billion; to Kuwait, by 11 per cent to Dh5.3 billion; and to Oman and Bahrain by 5 per cent to respective figures of Dh2.9 billion and Dh1.9 billion. Compared to previous quarter’s export values, however, exports to Kuwait and Oman slowed down by 2 per cent and 6 per cent, respectively.

On the other hand, trade between companies in the customs territory of Dubai/UAE and those in the free zones/duty free shops and special areas of Dubai registered a yoy growth of 17 per cent to Dh4.3 billion, which was just about equal to the previous quarter’s value.

Total export to Iraq during the quarter reached Dh3.9 billion, higher by 22 per cent than the previous quarter’s record, though lower by 22 per cent, yoy.

Egypt was the next largest non-GCC export destination, with the total Q1 2015 export to the country reaching a value of Dh2.6 billion, a yoy comparison showed a 15 per cent increase, though qoq decline of 7 per cent was noted.

The recent surge in exports to Switzerland pushed the country in the list of largest non-GCC export destinations. However, exports to the country in March 2015 represented a mom decline of 85 per cent to a total of Dh143 million. Nonetheless, the country remained in the major export destination in Q1 205, with the total export value of Dh2 billion representing qoq increase of 363 per cent.

Other large non-GCC export destinations in Q1 2015 were India with exports valued at Dh1.4 billion; Jordan, Dh1.1 billion; Ethiopia, Dh944 million; and Algeria, Dh783 million.

Saudi Arabia most popular export destination In the 1st quarter of the year, 8,231 members exported to various destinations, increasing by 3 per cent from 7,973 exporters during the previous quarter and in the same quarter in 2014.

Saudi Arabia continued to be the most popular destination of exporters, with 3,308 exporters actively trading with the country, or 40 per cent of the total number of active exporters during the quarter. The number was 3 per cent higher than the corresponding number a year ago, and 4 per cent higher that the number in the previous quarter.

That the country is a popular export destination is not at all surprising, considering that it is the largest in the GCC, both in population size and land area. In addition, all modes of transport for goods from the UAE to the country are readily available. Although some border problems come up from time to time, authorities are quick to respond to the situation and normal trade generally resumes immediately.

Qatar continued to be 2nd only to Saudi Arabia, destination of exports of 2,958 exporters during the quarter; followed by Kuwait, with 2,074 exporters; Bahrain, 1,717 exporters; and Oman, 1,190 exporters.

The number of exporters to all the other popular export destinations registered increases over the respective numbers in the previous quarter, except for the number of exporters to Iraq, which dropped by 9 per cent. Compared to year ago numbers, the respective rate of decline was 23 per cent.

The number of traders between the UAE’s domestic territory and the free zones remained nearly constant.

Export market penetration and export performance Of the 8,231 exporters active during Q1 2015, 50 per cent or 4,121 exporters were exporting to only one market.

In contrast, only 355 exporters or 4 per cent were active in 10 or more export markets. Exporters with only two export markets numbered 1,470 exporters or 18 per cent of the total active exporters during the quarter, while those with three to four export markets numbered 1,300, or 16 per cent of the total. Exporters with five to nine export markets numbered 985, or 12 per cent of the total.

On the other hand, of the total export of Dh76.1 billion during the three month period, exports of members with at least 10 markets accounted for 40 per cent, for an average of Dh84.5 million per exporter.

Although exports of members with only one export market accounted for 15 per cent of the total, the average export value per exporter was lowest at Dh2.8 million. Share to total and average export per exporter of members with two markets were 7 per cent and Dh3.7 million; of members with three to four markets, 14 per cent and Dh8.0 million; and of members with five to nine markets, 24 per cent and Dh18.8 million.

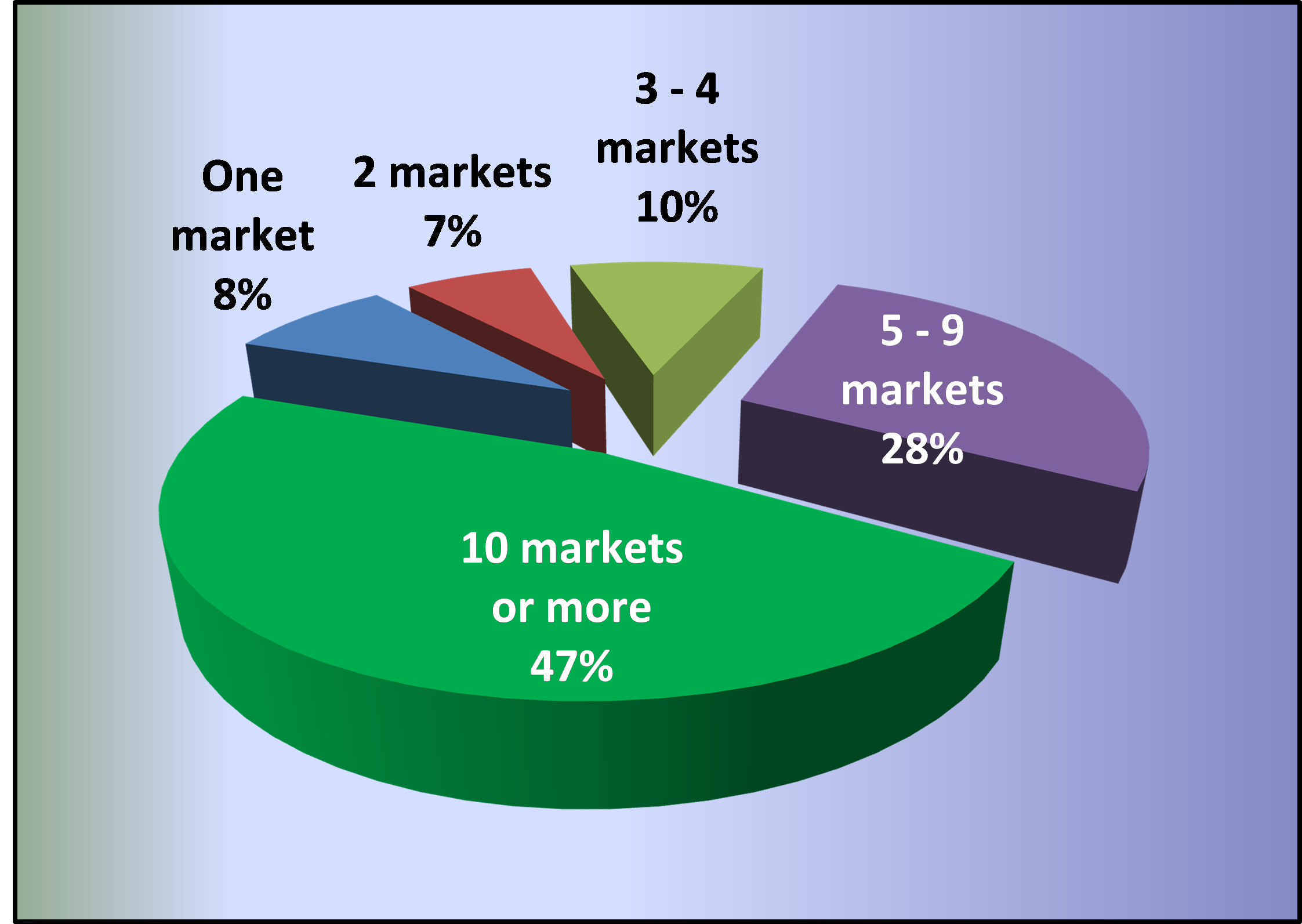

Of the 228,000 COs issued during the quarter, 107,000 were issued to members with at least 10 export markets, for a share of 47 per cent to the total, and an average of 301 COs per exporter during the period.

The number of COs issued to members with five to nine export markets accounted for 28 per cent of the total, with an average of 64 COs per exporter.

Although the shares in the number of COs were comparable for members with less number of markets; i.e. at 10 per cent for those with three to four export markets, 7 per cent for both those with two export markets, and 8 per cent for those with only one export market, the respective averages per exporter were declining at 18 COs, 10 COs and five COs per exporter in the respective groups.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.