- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:26 05:44 12:20 15:47 18:50 20:08

Investment flows from the six-nation Gulf Cooperation Council (GCC) to India are lopsided, with only the UAE and, to some extent, Oman being major source countries, according to a US-based think-tank centre.

The UAE alone accounts for nearly 80% of the GCC FDI inflows into the subcontinent while it is also India's largest trade partner in the region, the Washington-based Middle East Centre said in a recent study on foreign direct investment flows into India.

"That said, the pattern of UAE investment in India represents fairly well that of GCC investment in India in general.between 2000 and 2012, the power sector attracted the highest investment from UAE, followed by the metallurgical and construction industries."

The study showed other leading sectors are services and computer hardware and software. It said that this distribution of investments suggests that the GCC has responded well to India's financing requirements for infrastructure projects and is also making a mark in other sectors.

UAE firms gain ground

The report showed that GCC firms have emerged as major investors in India in the past few years, adding that UAE-based companies in particular have gained prominence given the growing ties between the emirates and New Delhi.

It noted that in an effort to build on this momentum, India and the UAE established a High Level Task Force (HLTF) in 2012.

The two countries also agreed to establish sub-committees to explore investment opportunities in infrastructure, energy, investment and trade, manufacturing and technology, aviation and transport.

In addition, an initial allocation of $two billion for investments in infrastructure projects in India and support for the establishment of a strategic oil reserve in India was also announced, the report said.

It showed that the services sector has been a the key sector for FDI flow into India but added there has been a steady rise in the share of construction, a sector whose expansion India has assigned high priority and has sought to mobilize investment.

"Importantly, the recent surge of GCC FDI into India, and of UAE investment in particular, has been funneled into the power, metallurgy industries and construction development sectors ― aligning closely with India's needs and priorities."

"This surge is, in itself, an encouraging sign of progress in the development of a multidimensional strategic partnership. Even more encouraging is the fact that much of this new investment is being funneled into the power, metallurgy industries, construction development sectors ― the very sectors whose advancement is critically important to India's future growth.at the same time, however, it is necessary to keep these recent, positive developments in perspective."

The report noted that rapid growth of GCC investment in India started from a very low level while investment from the UAE constitutes a disproportionate share of FDI from the Gulf. "The challenge, therefore, is twofold: how to boost GCC investment in India and how to attract FDI from GCC countries besides UAE," it said.

"Given the investment opportunities that exist in India and the sheer size of Gulf sovereign wealth funds (SF) it is fair to say that this important dimension of GCC-India relations is far from having realized its full potential. There are, in fact, numerous impediments to investment, ranging from non-tariff barriers such as multiple-level clearances at the state level, to lack of transparency, infrastructure bottlenecks, and possibly language barriers. High corporate and individual income taxes constitute additional disincentives."

The report said it believes that the proposed GCC-India free trade agreement (FTA), along with the signing of the Bilateral Investment Promotion and Protection Agreement (BIPA) between India and UAE, are likely to help create a more favorable climate for increased Gulf investment in India.

Pattern of GCC Investment in India

According to the study, the pattern of GCC investment in India has three notable characteristics. First, over the past decade, the aggregate value has risen dramatically, albeit from a small base. Second, the UAE has emerged as the most important source by far of Gulf FDI. Third, the surge in UAE investment in India is illustrative of the broader trend in Gulf FDI, namely that it has targeted those sectors of the economy that Indian authorities have designated as their highest priorities and that it is marked by a proliferation of entities investing in an ever-widening array of projects.

It showed that aggregate FDI inflows from the GCC countries to India from 2000 through 2014 total roughly $ 3.2 billion.

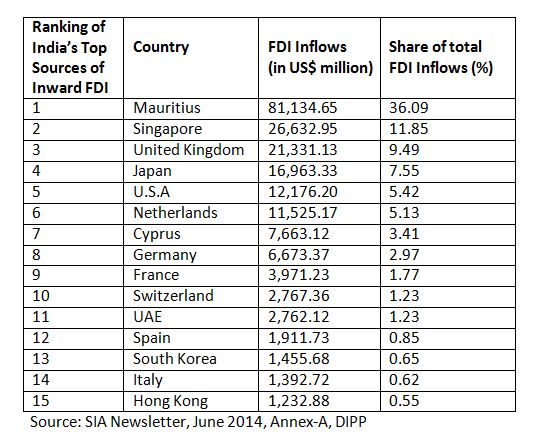

Compared to FDI inflows from India's leading partners such as Mauritius, Singapore, and the United States, GCC investment in India is quite modest.

Yet, over the past decade, GCC investments in India has surged, with those from the UAE, in particular, rising sharply, from less than $50 million in 2006 to more than $200 million in 2012. "Nevertheless, it is important to mention that this growth occurred from an admittedly very small base."

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.