- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

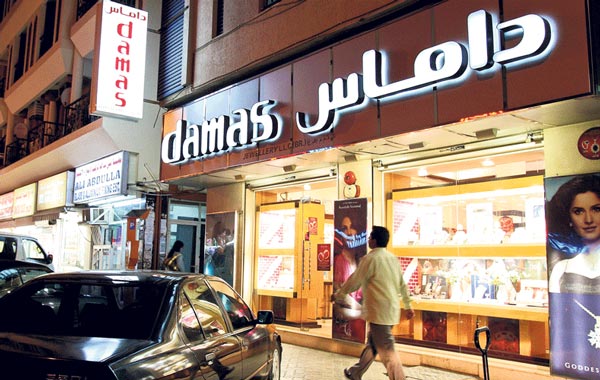

According to sources close to lenders and the group, the negotiations for the Cascade Agreement are progressing satisfactorily, but have not been concluded. (SUPPLIED)

Even as the standstill period on the Damas debt is nearing its latest deadline on December 31, 2010 after a series of extensions, it is reliably learnt that the company most likely will get six years to clear its debts with the banks.

As of September 30, 2010, total bank borrowings of Damas Group stood at Dh3.3 billion, which includes Dh800 million, the value of unfixed gold positions with a number of banks that extended gold loans to the group.

The lenders to the group comprise about 20 banks that include foreign names like Barclays and BNP Paribas. A company statement said the borrowings were secured by various tangible securities, including the joint and several guarantees of the Abdullah Brothers.

The proposed restructuring plan being worked out between the lenders and the group will enable Damas to have access to certain working capital facilities that are required by the company to achieve its business plan.

The remaining debt, comprising the existing term debt outstanding prior to the restructuring and a proportion of the working capital debt, considered surplus to the company’s requirements, will be converted into an amortising facility.

And based on the projected cash flows of the company, the amortising debt should be paid off within six years. The cash flows from operations provide for the servicing of the entire repayment of entire debt at the interest rates proposed.

”However, these are to be agreed in the restructuring agreement,” notes a company statement that has come out as part of the interim financials for the quarter ending September 30, 2010.

“The repayment of bank debt could also be accelerated from the sale of assets or the recovery of amounts due from the Abdullah Brothers. The group is in the process of negotiating a cascade agreement with the banks and the Abdullah Brothers, which will enable an orderly realisation of the assets of the Abdullah Brothers,” it further added.

According to sources close to lenders and the group, the negotiations for the Cascade Agreement are progressing satisfactorily, but have not been concluded.

The seriousness of the Damas’ indebtedness came to the fore during the first quarter of the current year. During the year ended March 31, 2010, the Group was unable to meet some of its financial commitments to the banks, resulting in an event of default and breach of financial covenants in relation to these borrowings.

This situation arose due to a significant decline in the Group’s liquidity as a result of unauthorised withdrawals by the Abdullah Brothers and an unprecedented increase in gold prices, which resulted in significant margin calls by financial institutions and a downturn in the Group business.

On March 24, 2010, a majority of the lending banks signed a Standstill Agreement allowing the company to undertake a restructuring of its operations and debt obligations. Following extensive discussions during the standstill period, the lending banks’ Steering Committee has in principle agreed to recommend the terms of the proposed debt restructuring plan for the company’s total borrowings, to the lending banks for approval and documentation

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.