- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:28 05:46 12:20 15:47 18:49 20:07

Cayan Tower in Dubai Marina, formerly known as Infinity Tower (Imre Solt)

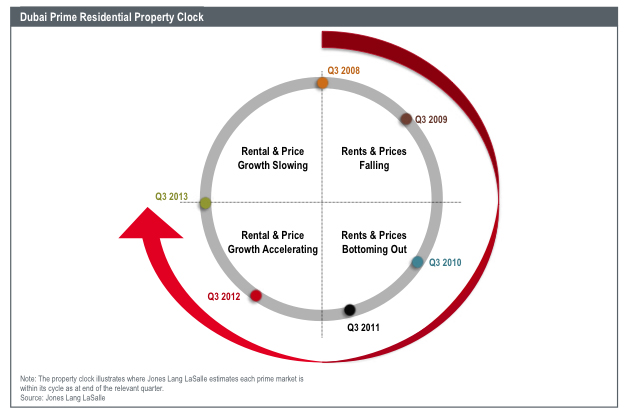

Driven by improvement in market fundamentals and return of confidence, Dubai’s real estate market will see prices and rents rise over the next 12 to 24 months, according to a new report.

“With population and employment increasing again, there is clearly support for additional levels of residential development. Providing that effective controls are applied to ensure that the future supply pipeline is not expanded too quickly, these improvements would suggest the residential market is likely to see continued pressure for increases in rents and prices over the next 12 to 24 months,” Jones Lang LaSalle (JLL) said in its latest update.

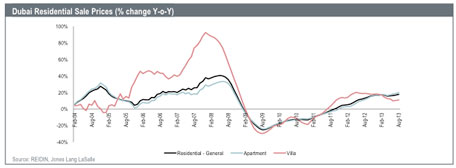

Knight Frank, a UK-based consultancy, has said property prices in Dubai jumped 22 per cent in the past one year. Real estate consultancy Asteco said on Tuesday rental recovery was well under way with apartments and villas, registering 23 and 19 per cent growth year-on-year (Q3 2013-Q3 2012).

Strong fundamentals

JLL attributed the price increases to solid market fundamentals and a return of confidence and sentiment although some signs of overheating were visible.

Dubai’s economy is recovering on the back of the trade, transport and tourism, with the Dubai Statistics Centre stating real GDP growth of 4.1 per cent over the first half of 2013 — the fastest growth rate since early 2008.

Besides, the emirate benefits from its status as a “safe haven” in a volatile and unstable region. The Arab Spring did fuel the demand for residential units, but now expatriates are preferring to buy than pay rent.

Based on anecdotal evidence, JLL said Dubai's population was increasing at around five per cent per annum. Given a population of around 2.1 million (as at the end of 2012), this would indicate a growth in the order of 100,000 persons per annum. Thus taking an average household size of three persons, it would result in demand for around 35,000 new households per annum.

The consultancy believes around 45,000 new houses will be released into the market before the end of 2015, representing an annual increase of mere 16,000 units. Even after taking into consideration the additional supply within the non-freehold areas, supply will lag demand over the next 12 to 18 months.

Better regulations

Despite the economic and demographic fundamentals have improved, residential prices have increased at a far higher rate, suggesting speculative activity in the market. But not just the Dubai government, developers have too introduced and included new clauses to control flipping in their projects. To state, Emaar Properties does not allow resale unless an investor pays 40 per cent down payment.

“The Dubai market now appears broader based and better regulated and therefore less susceptible than in 2008, This reduces the likelihood that the increased speculative activity now being seen will result in a re-occurence of such a sharp downturn,” JLL said.

But to stop these “quick” sales, Dubai has increased transaction fees to 4 per cent of the property value from 2 per cent, effective October 6. Even the UAE Central Bank is likely to introduce tighter restrictions on mortgage lending before year-end.

Moreover, Real Estate Regulatory Authority, the regulatory arm of Dubai Land Department, now requires developers to lodge between 30 and 40 per cent of the total construction costs of projects in a project specific escrow account, before any pre-sales can be launched.

Slow growth is good

JLL believed a slower and more subdued growth will be far more beneficial for the market, which is currently witnessing an incessant price rise.

“The Dubai property market is currently seeing prices increase at an unsustainable rate, but this does not represent another bubble,” the consultancy said.

“An extended period of slower and more subdued growth would be far more beneficial for the overall market than a continuation of the current rates of increase, followed by another severe correction,” it said.

Dubai will be hosting Cityscape Global next week, which is likely to see a flurry of real estate project being launched. On Wednesday, the government of Dubai launched the $2 billion Water Canal project that will connect Business Bay with the Arabian Gulf. The project is set for completion in 2017.

A series of mega developments including Mohammed Bin Rashid City, Dh6-billion Bluewaters Island and Dh10-billion Jebel Ali theme park project are already under construction.

Though some worrying signs of overheating are visible, JLL states conditions are sufficiently different this time around that another bubble can be avoided.

The price increase does reflect rise in speculative activity, it is not that significant as seen in 2007/8. The market has matured and reflects growth based on solid fundamentals such as population growth and supply still lagging demand over the next 12 to 18 months

Standard Chartered came out first with a report last month that rubbished the talks of a imminent crash, stating that despite prices soaring Dubai's property market was not heading towards another crash with the market now being more sustainable, influenced by an improved economy rather than speculation that will not repeat the same boom-and-bust cycle of 2008.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.