- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

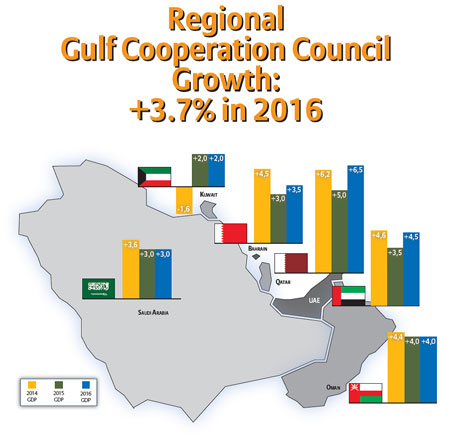

In the GCC region, after a tough year in 2015 (GDP growth +3%), 2016 will generate a modest economic rebound for most countries (+3.7%).

“Global GDP growth will remain below +3% for the third consecutive year (+2.5% in 2015).

Mature markets have remained reasonably stable, whereas we have seen clear signs of deterioration in emerging economies.

Global trade is set to lose at least USD400bn in 2015, reflecting strong deflationary pressures in the short-term. Our expectations for the global economy remain conservative for 2016 (GDP +2.9%), although with some signs of improvement.

In the GCC region, after a tough year in 2015 (GDP growth +3%), 2016 will generate a modest economic rebound for most countries (+3.7%).This should be led by a slight rebound in oil prices - forecast to reach USD60/barrel and supported by strong financial assets – as four of the top 10 sovereign wealth funds globally are based in the GCC.

In 2016 GCC countries will absorb adverse external headwinds, and most of them will record higher GDP growth than in 2015 and continue to present solid risk profiles.

As major producers and exporters of oil and gas, recent downward pressures on prices are clearly detrimental to these countries’ economic performance. Proactive steps are already underway by local governments and economic institutions to reduce the dependency on oil, for example by further increasing industrial diversification and sector promotion.

Opportunities for GCC businesses

Opportunity #1: Renewable Energy

The current economic situation is an opportunity for GCC countries to press ahead with diversification – not just away from energy, but also within the energy sector itself. Given climatic and meteorological conditions, and the current appetite for policies promoting the green economy, solar energy is high on the list (e.g. Solar GCC Alliance).The UAE plans to invest USD35bn in “clean energy” by 2021 and Saudi Arabia plans to spend USD100bn on solar projects by 2030.

Opportunity #2: HUB in three directions

The finance belt - GCC economies will also press ahead with expanding their geographic advantages (at the crossroads between Europe, Asia and Africa) to promote their countries as a regional hub for financial services. In addition to Bahrain (with limited domestic hydrocarbon resources), financial services are important for the UAE and of growing importance for Oman (small scale). Saudi Arabia. Islamic finance has enjoyed dynamic development, with 16% annual growth on average over the last 5 years.

The transport belt – Dubai has been a maritime hub for many generations but the UAE is now a major air hub. Emirates became the 6th largest global aeronautic company with 3.5% of worldwide market share.

The trade belt – Iran is back in the game and Chinese development towards Europe and Africa positions the GCC as a major crossroad hub.

Opportunity #3: Tourism

The UAE leads tourism development in the region with activity multiplied four-fold over the past 10 years. Qatar’s momentum is growing, with the staging of major events boosting infrastructure projects up to USD90bn.

Opportunity #4: Boosting retail sales

GCC could leverage on wealth based in its own domestic markets. In particular, UAE and the Dubai International Airport are already retail centers.

“This is the right time for the GCC countries to make some significant improvements,” concluded Subran. “Its structural business environment needs transparency and less bureaucracy, the private sector needs to be promoted, further trade liberalisation is required and aspects of competitiveness need to be addressed.

The GCC influence worldwide is based on real estate, financial services and energy, but key for future growth is promoting regional cooperation rather than national competition.”

The author is Euler Hermes chief economist. Euler Hermes is a worldwide leader in trade credit insurance.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.