- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:32 05:49 12:21 15:48 18:47 20:04

Qualifying stage of competition at Yas Marina Circuit. (Supplied)

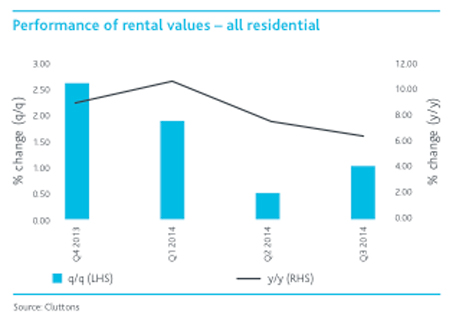

The fear of landlords resorting to arbitrary rent hikes following removal of the annual five per cent cap of rental increases in Abu Dhabi this year has proved far less controversial than expected with the pace of rent increase slowing down, says a new report.

Rents in the capital’s freehold areas rose by mere 2.7 per cent in the first nine months of 2014 compared to nearly 9 per cent in 2013, Cluttons, a global real estate consultancy, said in its 'Winter 2014 Abu Dhabi residential market outlook'.

“Landlords have been sensitive to the threat of affordability emerging as a core issue for tenants, with many containing rent increases in order to avert an increase in vacancy levels.

"This behaviour is occurring despite removal of the government enforced rent cap earlier this year,” the consultancy said.

“The slowing rental value growth rates will, however, offer some respite to households concerned about further substantial rent rises,” it added.

Cluttons states mature global real estate markets operate freely without government intervention with Abu Dhabi’s rental market subject to the usual economic influences, along with the fundamental demand-supply equation.

The consultancy believes a 'light touch' version of the Dubai’s rent index will suit the Abu Dhabi market. It had been reported earlier that authorities in the capital have been planning to launch a rent index, but nothing has been announced.

Apartments edge villas

Rate of rent increases rose to one per cent in the third quarter 2014 compared to a marginal 0.5 per cent in the second quarter 2014, which Cluttons says is not reflective of tenant demand that remains stable, but strong.

Overall, apartments rose 1.4 per cent, while villas saw a 0.7 per cent rise in the third quarter.

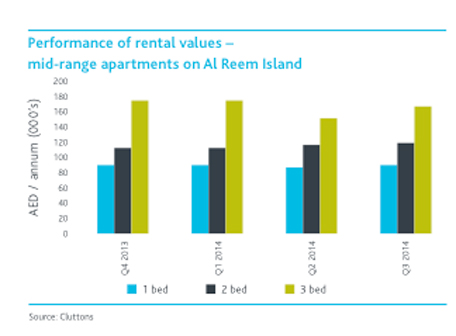

Mid-range apartments on Al Reem Island registered the highest rent increase of almost 6 per cent in the third quarter with rents on the Al Reem Island are likely to go up gradually in coming months as the overall supply pipeline remains thin.

Abu Dhabi government’s drive for economic diversification also remains a critical element in tenant demand equation, with the education, healthcare and aviation sectors being amongst the most rapidly expanding.

The Cleveland Clinic, set to open next year, has recruited 3,000 healthcare professionals this year, which has contributed to the scarcity of lettings stock across the city. In addition, Etihad Airways is continuing to lease substantial stock before it is released in the market, worsening supply drought in pockets of the capital.

Price increase slows down

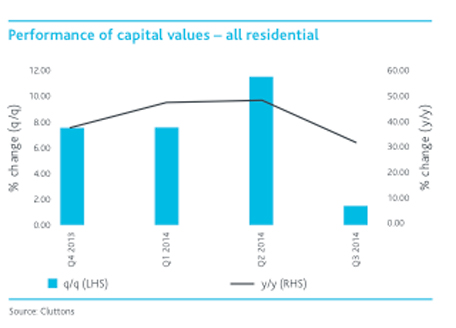

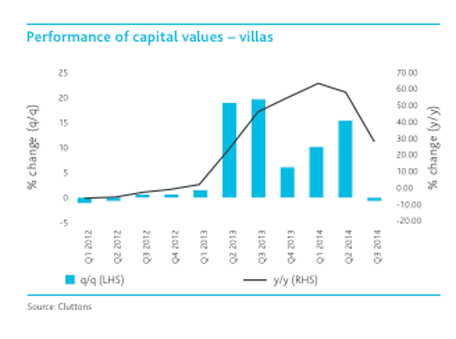

According to the report, the pace of residential value appreciation slowed, with house prices rising by just 1.6 per cent during the third quarter. The overall growth during first nine period of this year was 19 per cent, against a 39 per cent increase in 2013.

Apartment values outpaced villas during in the third quarter, rising by 4.1 per cent. Villa values saw a drop of 0.6 per cent with the villa segment recording a 24 per cent price rise between January and September 2014.

In contrast, apartment values on Saadiyat Island grew by 2.4 per cent in the third quarter, as demand for property on the island continues to gather momentum with the Louvre Abu Dhabi nearing completion, Cluttons said.

In contrast, apartment values on Saadiyat Island grew by 2.4 per cent in the third quarter, as demand for property on the island continues to gather momentum with the Louvre Abu Dhabi nearing completion, Cluttons said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.