- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:27 05:45 12:20 15:47 18:49 20:07

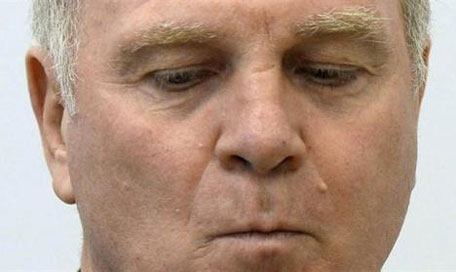

Bayern Munich President Uli Hoeness arrives for the verdict in his trial for tax evasion at the regional court in Munich March 13, 2014. (REUTERS)

A German court convicted Bayern Munich president Uli Hoeness of tax evasion on Thursday and sentenced the man who turned the soccer club into one of the world's most successful sports dynasties to 3-1/2 years in jail.

Judge Rupert Heindl ruled that Hoeness's voluntary disclosure that he had failed to pay taxes had been incomplete and thus did not meet a vital requirement needed for amnesty under laws designed to encourage tax evaders to come clean.

Hoeness has admitted evading 27.2 million euros in taxes on income earned in secret Swiss bank accounts, but the soccer club executive was hoping for leniency in one of the most closely watched tax evasion cases in German history.

"The voluntary disclosure is not valid with the documents that were presented alone," said the judge. He said the confession was riddled with mistakes and that Hoeness had failed to submit other documents requested by tax inspectors on time.

The 62-year-old Hoeness, who also owns a Bavarian sausage factory, bowed his head and stared at the floor when the verdict was delivered, his face turning red as he struggled to retain his composure. He left the court in silence, avoiding reporters.

The case hinged on the question of whether Hoeness, who as a player helped West Germany win the 1974 World Cup, cooperated fully with his voluntary disclosure. His case shocked the nation and prompted thousands of tax dodgers to turn themselves in.

Hoeness's defence lawyers immediately announced they would appeal to the Federal Court of Justice.

"The high court will decide if his voluntary disclosure was valid, or partially valid or botched," said lawyer Hanns Feigen. "That's the interesting point. The key point is the way a taxpayer is being treated - as if he hadn't turned himself in."

The maximum sentence for tax evasion is 10 years and the prosecutors, citing Hoeness's cooperation, had sought a 5-1/2 year sentence.

Hoeness was first charged with evading 3.5 million euros in taxes. But when the trial began on Monday he stunned the court by admitting he had actually evaded five times that amount - or 18.5 million euros.

That figure was raised further to 27.2 million euros on the second day of the trial based on testimony by a tax inspector. Hoeness's defence team acknowledged the higher figure.

PLEA FOR LENIENCY

Hoeness, whose team won last year's Champions League and dominates the German Bundesliga, apologised to the court and pleaded for leniency. The club's earnings have soared under his stewardship, which has lasted 35 years in various posts. With more than 220,000 members, it is one of the world's biggest soccer clubs.

"I deeply regret my wrongdoing," he said on Monday. "I'm doing everything I can to put this unhappy chapter behind me."

Tax evasion is a serious crime in Germany. Peter Graf, the late father of tennis champion Steffi Graf, was sentenced in 1997 to three years and nine months for evading 12.3 million marks (6.3 million euros). He was released after 25 months.

Michael Meister, deputy finance minister, said the verdict would be a lesson to other taxpayers. "It shows that it is not worth it to evade taxes," he told Rheinische Post newspaper.

Hoeness, once one of Germany's most admired soccer executives, alerted tax authorities in January 2013 about his bank account and undeclared income. He said the Swiss account was a personal account created for financial market trades.

Some 55,000 tax evaders have turned themselves in over the last four years and paid a total of about 3.5 billion euros in back taxes, according to the taxpayers association. The number of voluntary disclosures rose four-fold in 2013 from 2012.

"First of all, I feel great personal empathy because a prison sentence is a serious imposition on anybody, including Uli Hoeness," said Bavarian state premier Horst Seehofer, leader of Chancellor Angela Merkel's Bavarian sister party.

"On the other hand, I as a politician and state premier have to accept the result of a trial conducted according to the rule of law," Seehofer added.

Hoeness had been a friend of Merkel and a popular TV talk show guest. He spoke out for higher taxes and railed against tax evasion. His case has led to calls to change German laws that allow tax evaders to avoid prosecution if they turn themselves in before an investigation starts.

It is unclear if Hoeness can remain chairman of Bayern Munich's supervisory board. The club said its boards would deliberate the matter but would not decide immediately.

FC Bayern Munich AG is privately owned. Major German companies Adidas AG (ADSGn.DE), Allianz (ALVG.DE) and Audi AG (VOWG_p.DE), all of which are based in Bavaria, each have an 8.3 percent stake in the club. Deutsche Telekom AG (DTEGn.DE) is the club's main advertising sponsor.

Members of the supervisory board include Adidas chief executive Herbert Hainer, Audi CEO Rupert Stadler, Volkswagen CEO Martin Winterkorn and Deutsche Telekom CEO Tim Hoettges.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.