- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:32 05:49 12:21 15:48 18:47 20:04

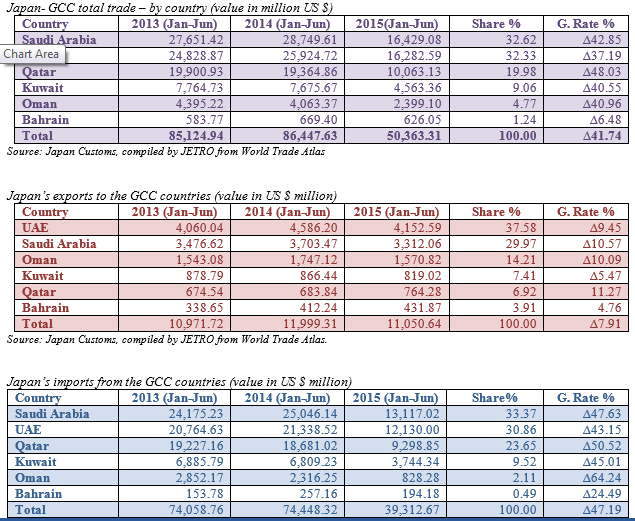

The value of Japan’s exports to the GCC dropped by nearly 8 per cent to $11.05 billion from $12 billion.

Since the volume of exports remained almost the same, this decline in export value is attributed to the depreciation in the Japanese yen against the US dollars. Japan’s currency depreciated by an average 16.9 per cent during the first six months of 2015, comparing with the same period in the previous year, making GCC countries pay less in US dollars for their imports from Japan.

As a result of the fall in the price of mineral fuels, Japan’s trade deficit with the GCC countries declined by 54.7 per cent to $28.26 billion during the first six months of 2015, compared with $62.46 billion during the same period in the previous year.

Japan’s deficit with the world as a whole was also brought down during this period from $74.2 billion to $14.6 billion, mainly due to the impact of declining fuel oil prices, and partly due to reduced imports from major trading partners of Japan like China, Australia, South Korea and Malaysia.

Japan’s major exports to GCC

The value of Japan’s exports to the GCC countries shrank by 7.9 per cent to $11.05 billion during the first half of 2015, compared with $12 billion during the same period in the previous year.

However, the export volume remained stable. GCC, as a single block is in the 7th position in size as an export market for Japan, comparing with Japan’s other export markets. Others ahead of the GCC are countries like USA, China, South Korea, Taiwan, Hong Kong and Thailand in the order of market size. Country-wise, UAE stood at the 18th position and Saudi Arabia at the 21st position.

The largest component of Japan’s export to the GCC is motor vehicles, valuing at $6.55 billion and covering 59.3 per cent of the total exports. UAE topped among the GCC countries taking nearly 34 per cent of Japan’s motor vehicle exports to the GCC. Saudi Arabia stood second with a share of 24.5 per cent.

Other major exports were general machinery, electrical machinery, iron and steel, tyres, optical goods, plastic products, textiles, chemicals and beverages. Among general machinery, export of steam turbines rose by 140 per cent to $140.41 million from 58.5 million in the previous first half. Similarly, export of printing machinery showed a surge in export by 43.4 per cent to $71.53 million from 49.89 million. However, most other categories of general machinery showed various degrees of declines in their export value.

Export of electrical machinery showed a moderate increase of 5.13 per cent in value to $567.21 million, compared with $539.53 million in the previous first half. Notable among the increased exports were electrical appliances for switches that grew by over 100 per cent and electrical motors and parts that grew by 642.9 per cent.

Strong surge in the export of structural iron and steel to the UAE, Saudi Arabia and Kuwait raised this commodity’s exports to the GCC block by 18.6 per cent to $342.47 million from 288.87 million.

However, considerable fall in the export of iron and steel products to the UAE and Saudi Arabia had weighted down the increase in their exports to Qatar, Oman and Kuwait. Increase in exports of iron and steel to Qatar was phenomenal at 853.7 per cent to $115.51 million from $13.53 million. Overall, the iron and steel products exports to the GCC was valued at $473.62 million during the first half of 2015, compared with $751.86 million during the same period in 2014, making an overall decline by 37 per cent.

Japan’s mineral fuels exports to the UAE and Oman increased considerably; making the overall exports of this commodity to the GCC grew by 187 per cent to $64.08 million, in the place of 22.34 million during the first half of 2014.

Japan’s major imports from GCC

The value of Japan’s imports from the GCC dropped by 47.2 per cent to $39.31 billion during the first six months of 2015, mainly due to the fall in the price of crude oils and other mineral fuels. Mineral fuels constitute 97.4 per cent of Japan’s imports from the GCC countries. More than 75 per cent Japan’s total fuel oil requirements are being met by the GCC block. Aluminium formed the 2nd major imports, covering around 1.5 per cent of the total imports from the GCC. Remaining minor components of imports were organic chemicals, copper scraps, plastics, precious stones and metals, fertilizers, beverages etc.

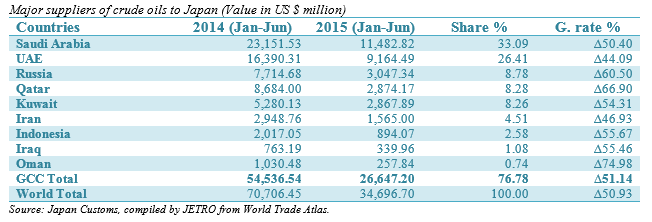

The average price of crude oils fell by 47.9 per cent during the first half of 2015 to $57.63 per barrel, compared with $110.57 during the same period in 2014. Japan imported a total of 462.4 million barrels of crude oil during first half 2015, 6.3 per cent less, compared with the volume of import during the first half of 2014.

Saudi Arabia topped the list of crude oil suppliers to Japan, contributing 33 per cent of Japan’s requirements, while UAE stood at a close 2nd position with a share of 26.4 per cent.

The 3rd largest supplier is Russia with a far lower share of 8.8 per cent. Qatar and Kuwait among the GCC countries were in the 4th and 5th position with shares of 8.28 per cent and 8.26 per cent respectively.

Petroleum gas imports were amounted to $9.2 billion during the 1st half of 2015, compared with $15.5 billion during the same period in 2014. The average price of petroleum gases fell by 35.5 per cent to $572.84 per ton from $888.52, contributing to the decline in the total trade value. Japan imported nearly 16 million tons of petroleum gases during this period, compared with 17.5 million tons during the same period in 2014, registering a fall of 8.5 per cent.

With regards to petroleum products, such as light oils etc., in spite of a major increase in the volume of import, the import value decline considerably in the backdrop of the slide in their prices. While the volume of imports rose 30.5 per cent to 40.75 million barrels, import value decreased by 25 per cent to $2.48 billion. The price fall was to the tune of 42.5 per cent to $60.92 per barrel during the first half of 2015, compared with $105.95 per barrel during the corresponding period in 2014.

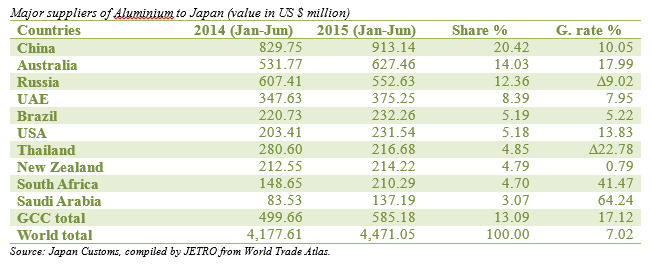

UAE heads list of Aluminium suppliers to Japan

Japan’s aluminium import from the GCC countries rose by 17.1 per cent during the first half of 2015 to $585.18 million, compared with $499.67 million during the same period in 2014.

UAE was the top supplier of aluminium to Japan among the GCC countries, exporting $375.25 million worth of aluminium to Japan, covering 8.39 per cent of Japan’s total import of aluminium during the first half of 2014. Another major supplier of aluminium to Japan is Saudi Arabia that raised her exports to Japan by 64.24 per cent during the first half of 2015.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.