- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

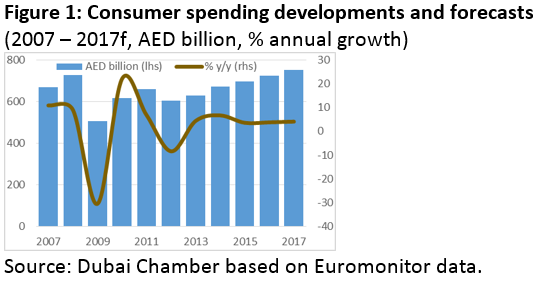

Retailing in the UAE is expected to reach Dh200 billion by 2017, growing by a 5 per cent on average each year, according to an analysis by the Dubai Chamber of Commerce and Industry. Consumer spending is also expected to continue rising in the medium-term, with growth rates projected to stabilise at about 4 per cent on average per year leading to a total spending of more than Dh750 billion by 2017 across many categories, the analysis adds.

The Dubai Chamber analysis, based on data from Euromonitor, information from an ATKearney Research study and other sources, points out that consumer confidence in the UAE has not been negatively impacted by expectations of decelerating economic growth in the region. Data for retail sales and consumer spending indicates that the retail sector is growing faster than the UAE economy as a whole, it says.

The findings of the analysis are significant considering that Dubai is hosting the 10th edition of the World Retail Congress from April 12 to 14, 2016. This is the first time the event is being held outside of Europe.

“The UAE stands out as one of the leading retail centres in the region. Retail is an important pillar of Dubai’s economic diversification strategy, and the Dubai Chamber has launched the analysis on the retail sector as part of its continued efforts to support the business community with the latest statistics and trends to encourage sustained economic growth. The analysis will not only boost the sentiments of the retail sector in the region, but also help raise investor confidence in the market,” said Hamad Buamim, President and CEO of Dubai Chamber.

Retail and wholesale trade in the UAE is an important sector, accounting for more than 11 per cent of the country’s Gross Domestic Product (GDP) and close to 30 per cent of Dubai’s GDP. The Dubai Chamber analysis points out that even if it approaches saturation, the retail market in the UAE is on a growth path as Dubai cements its position in the region as a retail hub. In particular, retail space has increased by 7 per cent during 2014 to reach 1.6 million square metres. Retail sales in the UAE reached Dh173 billion in 2014, growing by more than 6 per cent compared to 2013. This translates to more than Dh20,000 retail sales per capita in a year. Furthermore, there are projects underway to expand existing malls and plans for constructing new malls and further entertainment offerings, the analysis states.

Households in the UAE spent Dh673 billion in 2014, with consumption growing by 6.7 per cent per year in real terms. In nominal terms, spending growth was higher, at 9.2 per cent year-on-year. Those figures indicate a normalisation in consumption patterns, compared to large shifts occurring in previous years. In 2009 and 2012 consumer spending had even registered negative growth. Spending per capita increased by 5.7 per cent to reach more than Dh79,000 in 2014. This means that each person spends on average more than Dh6,500 a month.

Consumers in the UAE spend most of their income on housing, with expenditure on housing reaching Dh278 billion in 2014; more than 41 per cent of total consumer spending. This is comparable to almost 25 per cent of the country’s GDP. Food and beverage is the second most significant consumer spending category, with a 14 per cent share, followed by transport spending at 9 per cent. Communications has a share of 7.8 per cent, and apparel and footwear has a share of 7.4 per cent, while all other items account for less than 5 per cent of private expenditure.

One area in particular which offers many opportunities is luxury retail in the UAE. There is growth of wealthy and ultra-rich consumers, the main potential customers of the luxury segment. All in all, consumption is going up and retailing in the UAE is a major sector, which is supportive of economic growth and offers a lot of business opportunities, the analysis states.

The analysis points out that the UAE is ranked 7th in the 2015 Global Retail Development index (GRDI), which ranks the top 30 developing countries for retail investment. The index gives the UAE the second best rating in the Middle East and North Africa (Mena) region, after Qatar, which comes 4th. Saudi Arabia is ranked 17th, while Oman and Kuwait are 26th and 27th, respectively. Although there is slowing global economic growth and some political and economic turbulence in the developing world, global retailers continue to expand in this part of the world, it says. China is on top of the GRDI list, followed by Uruguay in second place.

In 2015, global retail sales value is set to grow by 6.4 per cent, to reach $18.4 trillion (Dh67.6 trillion), compared to the $17.3 trillion (Dh63.5 trillion) registered in 2014. Sales volume has been also increasing, by 2.6 per cent on average per year since 2011. Asia and Australasia is expected to remain the most important region as measured by retail sales generation, with sales set to approach $8 trillion (Dh29 trillion) in 2015. North America and Western Europe follow with $4.3 trillion (Dh15.8 trillion) and $3.1 trillion (Dh11.4 trillion), respectively. On the other end comes Middle East and Sub-Saharan Africa, with just $0.6 trillion (Dh2.2 trillion) in sales. However, the Middle East and Africa region is expected to register strong growth. It would show the second fastest growth during 2016, at 3.9 per cent, following Asia and Australasia, which would post an increase of 4.8 per cent.

The analysis states that the retail market in the Middle East has been resilient to the falling oil prices so far. The market is growing, with a lot of retail space available and several major projects underway, especially in the Gulf Cooperation Council (GCC) countries. Existing retailers are expanding, while new local and international players are entering the market. Retail sales in the GCC region are growing fast, driven by common positive trends, including economic growth, ongoing diversification, and a growing population – especially amongst high-worth individuals. The sector is also benefiting from the development of the area as a tourist hub, the Dubai Chamber analysis explains.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.