- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

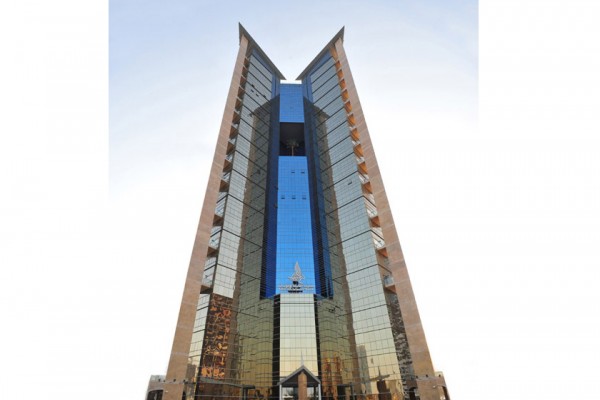

The Sharjah Islamic Bank, SIB, has announced its first quarter 2018 financial results with net profits of AED143.1 million, compared to AED139.1 million in the same period last year, indicating a three percent increase.

According to a press statement, total assets reached AED42.4 billion at the end of the first quarter of 2018, compared to AED38.3 billion at the end of 2017, representing an increase of 11 percent.

On the asset side of the balance sheet, customer financing saw a 1.1 percent increase, with AED22 billion at the end of the first quarter of 2018, compared to AED21.7 billion at the end of 2017. Also, investment in securities, which mainly represents investments in sovereign and investment grade-rated tradable Sukuk, increased significantly by 19 percent to reach AED6 billion, compared to AED5 billion at the end of 2017.

The SIB continues its strategy to maintain the liquid assets ratio above 22 percent of total assets, and reached AED10 billion, or 23.6 percent, at the end of 2016.

On the liability side, despite the tight liquidity during the year, the SIB successfully attracted more customer deposits during the year to reach AED25.5 billion, growing by AED3.2 billion or 14.1 percent compared to AED22.3 billion at the end of 2017.

As part of the SIB’s ongoing strategy to continue to diversify its funding sources, the bank has successfully issued a new five-year Sukuk of US$500 million during April 2018, as part of US$3 billion medium terms Sukuk-approved programme. The SIB currently has three outstanding Sukuk totalling US$1.5 billion.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.