- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:27 05:45 12:20 15:47 18:49 20:07

Gold extended losses below its highest level in a year on Monday as the dollar and equities strengthened, but the metal remained underpinned above $1,200 an ounce as caution in financial markets prompted investors to channel money into bullion.

Spot gold fell more than 1 per cent to $1,217 an ounce by 8.40am UAE time. It declined 0.3 per cent on Friday.

Gold rates for Saturday, Feb 20, 2016

The metal jumped to a one-year high earlier this month on turmoil in the stock markets and concerns over the global economy, but posted small losses last week on profit-taking and as equities consolidated.

Bullion remains one of the best performing assets of the year with gains of 15 per cent as global uncertainties linger and fund inflows support the rally.

Top consumer China has been on the offer since its return from a week-long holiday last Monday, a sign they do not expect prices to go much higher and cannot be counted on to support the market with post-Lunar New Year demand set to falter.

Bullion was also hurt by the strength in the dollar, which was supported by Friday data that showed underlying US consumer price inflation accelerated in January by the most in nearly 4-1/2 years.

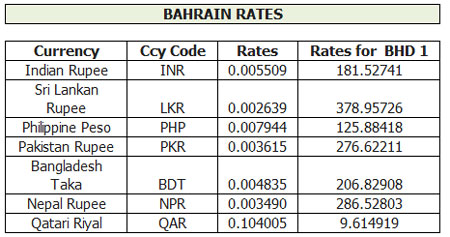

DD/TT RATES AT - 09.45 PM - 20 Feb

.jpg)

.jpg)

.jpg)

The dollar has recovered from multi-month lows hit last week against the euro and the yen.

Despite the recent losses, gold has risen 13.1 per cent in 2016, making it the best performing asset this year.

Investors will be eyeing the minutes of the Federal Reserve's January 26-27 meeting to be released later on Wednesday to gauge the US central bank's view of the economy and its outlook on interest rates.

Speculation has increased in recent days that the Fed might resort to negative interest rates to stimulate the economy after Fed Chair Janet Yellen said last week it was an option that would not be taken “off the table.”

Lower or negative rates would boost demand for non-interest-paying gold.

However, Boston Fed President Eric Rosengren said on Tuesday it would take a grimmer economic picture to prompt the central bank to cut rates.

The Fed raised interest rates in December for the first time in nearly a decade.

Weekly Gold Rates

Get retail Gold and Forex rates with Emirates 24|7

Rates will be updated twice daily

Emirates 24|7 brings you the daily Dubai gold rate (22k, 24k, 21k and 18k), as well as currency exchange rates, including the Indian rupee, Pakistani rupee, Philippine peso, Sri Lankan rupee, sterling pound, euro and may more against the UAE dirham (US dollar).

The rates for 24 carat, 22 carat, 21 carat, 18 carat and Ten Tola (TT) Bar (11.6638038 gram) will be updated four times a day to keep them fresh and relevant for buyers of gold bars and gold jewellery in the UAE.

The update times for Retail Gold Rate in Dubai will be at 9.30am, 2.30pm, 5pm and 8pm (unless there is drastic fall or rise in the international rate).

On Saturdays, the gold rates will be updated at 9.30am and this rate will stay static through Saturday and Sunday until the international market reopens on Monday.

Please note that the retailers add making charges separately to the quoted rate of gold.

The Retail Gold Rate in Dubai is being supplied by the Dubai Gold and Jewellery Group.

Foreign Exchange Rates

The Foreign Exchange Rates of major currencies will be updated twice each working day at around 8:30am and 3:30pm.

These will cover both the Remittance Rates [for sending money] and the Currency Notes Rates [for buying and selling of currency notes].

The Foreign Exchange Rates are being supplied by UAE Exchange.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.