- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:33 05:50 12:21 15:48 18:46 20:03

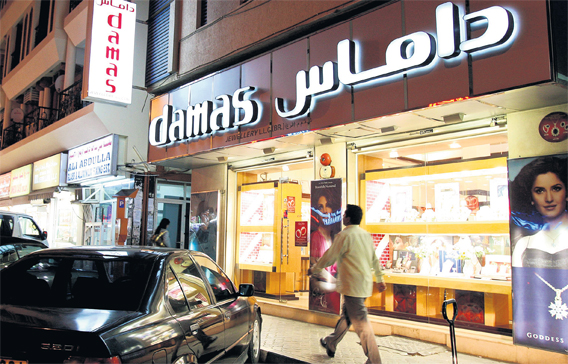

A Damas jewellery store in Satwa, Dubai. Regulators have said the Abdullah Brothers owe the company $99.4m cash. (DENNIS B MALLARI)

The Abdullah Brothers, represented by Afridi & Angell, said they were not able to pay the purchase price to Amwal Al Khaleej due to "unforeseen factors" because of which they agreed to return the shares "at the earliest opportunity".

However, following the initial public offering (IPO), a mandatory one-year "lock-in" period was put in place forbidding the Abdullah Brothers from transfering shares in Damas International Limited (DIL).

"Until the expiry of this lock-in period on July 8, 2009, it was not possible to return the shares to the claimant," the defendants have argued. They said Amwal agreed the shares would be returned on expiry of the lock-in period "without further compensation".

This agreement, formalised in the second Sales and Purchase Agreement (SPA) dated Nov 30, 2008 was entered into by Amwal and Tawhid Abdullah. The defence claims that the second SPA superseded and replaced the original SPA dated June 16, 2008.

However, Tawhid no longer has access to the second SPA but believes Amwal has a copy. The defence party nevertheless pointed out that they have the right to amend this defence once a copy of the second SPA is disclosed by Amwal.

"Under the terms of the second SPA, the claimant agreed that the liability of the second and fourth defendants under the original SPA would be assigned in full to the third defendant and that no claims regarding the original SPA would be made by the claimant against the second and fourth defendants," the defendants said in a court paper.

The third defendant who is claimed to bear all the liabilities is Tawhid, who previously resigned as the managing director of the company, and who took most of the company's decisions. The second defendant is Tawfique, Damas' Strategy and Human Resources head while the fourth defendant is Tamjid, who heads the diamond division and retail network.

In lieu of this, Tawhid denies he is in breach of the original SPA, as alleged, because the obligation to transfer the shares would only arise on July 8, at the earliest.

Tawhid accepts that the shares have yet to be transferred and is taking steps to affect the transfer "as soon as possible" but the return of shares has been delayed due to other disputes between Amwal and the Abdullah Brothers concerning "other investments".

Amwal and Tawhid had been seeking to negotiate a "global resolution" to all of these outstanding matters, "but these negotiations have not proven successful", according to court papers.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.