- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

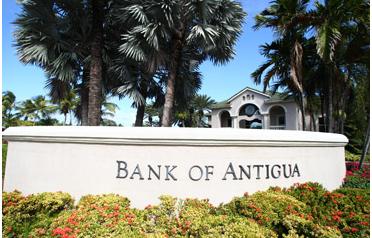

The Bank of Antigua faced hundreds of customers queuing to withdraw their funds after the US Securities and Exchange Commissions charged the owner Sir Allen Stanford with an $8-billion investment fraud. (GETTY IMAGES)

Peru, Panama, Ecuador, Venezuela and Colombia have also taken action against his banks, and analysts warn that the fallen impresario could soon face criminal charges if the fraud allegations laid out by securities regulators prove true.

US authorities this week accused Stanford of lying to investors about the safety and real returns of $8 billion (Dh29 billion) in "certificates of deposits" and $1.2 billion in mutual funds.

The global reach of the billionaire's banking operations has complicated the return of an estimated $50 billion in assets belonging to an estimated 50,000 clients in 140 countries.

Panicked investors who lined up outside Stanford-linked banks from Texas to Antigua this week were turned away empty handed.

The US Securities and Exchange Commission charged Stanford on Tuesday with perpetrating "a fraud of shocking magnitude that has spread its tentacles throughout the world."

"While the US has many treaties in place (governing the retrieval of assets) I can see other countries like Peru wanting to protect their citizens," said Lilly Ann Sanchez, a former prosecutor and securities enforcement officer who now works for the Florida firm Fowler White Burnett.

"Once it goes into the Texas receivership, Peru then falls in line with a bunch of other creditors."

With many of Stanford's operations now in receivership it could be weeks or even months before they find out if they will be able to recover their savings and access the funds.

The US receiver who has taken control of the US-based assets of the Stanford Financial Group issued a notice to investors Friday that they will not be able to withdraw funds or make payments out of their accounts "for the foreseeable future."

"Transfers out of these accounts are frozen until the receiver is able to verify there are no legal or equitable claims against those accounts," Ralph Janvey wrote in a note to customers.

Antigua announced plans to take over Stanford's Bank of Antigua and seize the assets of his Antigua-based offshore investment banks, and within hours employees locked the doors and left.

Meanwhile, Venezuela on Friday barred the directors of Stanford Bank Venezuela from leaving the country a day after government seized the bank and announced plans to sell its assets.

As Venezuelans rushed to withdraw money, financial authorities reported Friday that some $26.5 million were withdrawn from the bank, which at the close of 2008 had assets worth $41 million.

The broad-shouldered billionaire was tracked down in Fredericksburg, Virginia by FBI agents on Thursday who served him with documents related to the SEC's civil case but was not arrested.

On Friday, the SEC said Stanford has surrendered his passport.

"The SEC charges, if accurate, certainly would be the basis for a parallel criminal charging document," said Jacob Frenkel, a former federal prosecutor and SEC enforcement lawyer who now works for the Pennsylvania firm Shulman Rogers.

While prosecutors typically launch criminal charges in tandem with civil fraud proceedings, Frenkel said the SEC will step forward first if there is a need to seize assets before sufficient evidence is gathered for a criminal case.

The SEC is also under intense pressure amid intense criticism over its apparent failure to uncover the alleged $50-billion investment scam run by mastermind Bernard Madoff and has also been accused of dropping the ball on the Stanford case.

"It looks like they may have had opportunities to find this earlier," said former SEC enforcement lawyer Tom Gorman, who now works at the firm Porter and Wright in Washington.

Coming with the current turmoil in the financial markets, which have erased the savings of millions of Americans, these high-profile fraud cases are going to spur calls for greater regulation and a crackdown on white-collar crime, he said.

"You're going to see a lot more active enforcement division, a lot more investigations and probably a lot more charges," Gorman told AFP.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.