- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:26 05:44 12:20 15:47 18:50 20:08

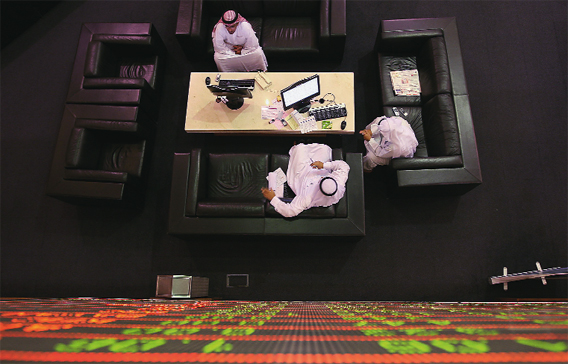

Market sees positive buying albeit in low volumes. Air Arabia, Aramex seen as promising stocks . (EB FILE)

Foreign investors have turned neutral towards banking stocks and are offloading realty and other selected scrips in response to the uncertainty that has loomed over the UAE's bourses for the past three months.

Encouraging dividends from banks and expectations of some clear direction on Dubai World's restructuring plan in March or April could explain why foreign investors are holding on to their investments in banking stocks.

Banking stocks have witnessed stable trading, though on thin volumes, from overseas players. Foreign holdings in Ajman Bank went up marginally to 4.38 per cent last Thursday from 4.08 per cent on November 1, while the figure for Mashreq was flat at 1.62 per cent. Emirates NBD recorded a minuscule drop in foreign holdings as it slipped to 1.67 per cent on Thursday from 1.69 per cent on November 1.

"Foreign investors are neutral on banking stocks and bearish on realty and other selected companies," Hassan El Salah, Deputy Head of Institutional Sales Trading at Al Ramz Securities, told Emirates Business.

"Market players are waiting to see details of provisions made by the banks. Once they are clear to the market then foreign investors and other major players will take a fresh look at their decisions. Market players are bearish on realty stocks as the lack of clarity about Dubai World's restructuring plan is affecting sentiment."

The impact of Dubai World's restructuring plan has already been factored in by the market. The expectation is that any sort of clarity is likely to boost stock prices, and this is the prime reason why foreign investors are neutral on this segment.

"Many funds exited from most of their positions. Turnover is minimal as we see extremely low trading. Everybody is waiting for the end of March and beginning of April when Dubai World will come out with its plan for creditors and this will help improve market sentiment. Interest in trading has also fallen among local investors and this has created an environment of uncertainty."

Interestingly, foreign investors' holdings in logistics major Aramex increased to 33.22 per cent on Thursday from 31.76 per cent compared with the first session of 2010. Foreign investors offloaded Aramex marginally in mid-February against 33.86 per cent on January 3. Foreign holdings in Air Arabia slipped marginally to 24.78 per cent from 28.27 per cent on November 1.

Robert McKinnon, Chief Investment Officer at ASAS Capital, said: "Air Arabia and Aramex have positive cash flows and look promising."

However, foreign investors reduced their positions in market heavyweights such as Arabtec, Drake & Scull International, Union Properties and Shuaa Capital between last November and now.

"I don't think buying by foreign investors is returning. Over the last year the corporate governance of individual companies and other fundamental factors have gained importance and this will be the key for foreign investors," said McKinnon.

The uncertainty has made many stocks attractive as they are available at low prices. But buyers are still cautious and waiting for entry points rather than chasing the market higher.

Contrary to expectations, this failed to produce heavy position-taking in these stocks as the market was directionless and moving in a sideways trading channel.

Julian Bruce, Director of Institutional Equity Sales at EFG-Hermes, said: "It's difficult to see the classification of foreign investors' investments. Quite often a lot of GCC funds account for foreign investments as well. It's difficult to say that foreign investors are negative on the market as everyone is cautious on the UAE markets, which have been weak for quite some time."

Foreign investors are looking at some attractive valuations against a backdrop of uncertainty about the strength of the global economic recovery.

After being net sellers on the Dubai Financial Market during December and January, foreign investors became net buyers in February, particularly from the third week onwards.

Net selling by foreign investors amounted to Dh34.49 million in he first week of the month and eased to Dh11.78m in the second week.

From the third week onwards, these investors became net buyers as the bourse witnessed figures of Dh27.60m and Dh34.71m respectively in the last two weeks of February.

This has reduced the overall selling spree and resulted in positive buying, albeit on low volumes. El Salah said: "Foreign trading was minimal during the past three weeks. The local markets were trading sideways as they waited for a clear directional break."

And Bruce added: "If you look at the daily flow you see an inflow of foreign investment one day and an outflow the next. We can't determine the trend in the market amid low volumes and volatility."

The DFM General Index moved in tandem with the net foreign investment flow.

The index declined 7.1 per cent in December on net foreign investors selling of Dh69.69m.

When their net selling soared to Dh310.35m in January the index tanked 11.8 per cent.

February witnessed positive net investment of Dh16.05m and the index's fall also declined proportionately to 0.5 per cent.

Keep up with the latest business news from the region with the Emirates Business 24|7 daily newsletter. To subscribe to the newsletter, please click here.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.