- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:32 05:49 12:21 15:48 18:47 20:04

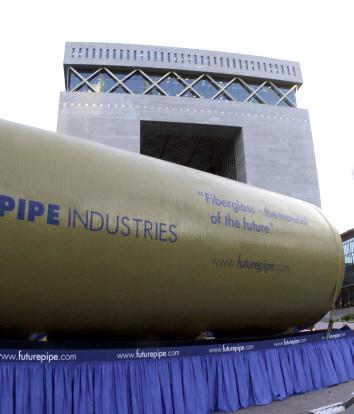

The IPO is cancelled (OSAMA ABUGHANIM)

Future Pipe Industries has cancelled its $487 million (Dh1.78 billion) initial public offering just days before it was due to list on the Dubai International Finance Exchange (DIFX).

In a carefully worded statement, the company said that "due to conditions in the equity capital market and recent events in the financial markets" it would not be proceeding with the IPO "at this time".

The shocking move comes just 32 days after Dubai-based Future Pipe announced its intention to sell 35 per cent of the company through an IPO, so the statement implies the decision has been taken following Depa's disappointing performance since listing on the DIFX just over a week ago. Meanwhile, a person close to the FPI deal said moribund trading on Dubai's flagship exchange also deterred international investors.

Future Pipe, which is owned by the Lebanese Makhzoumi family, would not comment further, so it is unclear whether the IPO has been permanently shelved or merely postponed.

Pricing for the IPO was due to be announced on Wednesday, while the retail offer closed on April 21.

Subscribers will now receive full refunds.

Future Pipe's decision is another setback for the beleaguered DIFX, which has so far failed to deliver on its promise to become a global exchange. Most analysts remain bullish on its long-term prospects, but a succession of bad headlines have lessened its lustre.

DP World's $5 billion November IPO was the largest ever completed in the Middle East and was heralded as the anchor listing to spark the dormant DIFX into action. However, DP World's shares have failed to live up to its billing and closed yesterday at $1.03, 21 per cent below its IPO price.

Interiors contractor Depa has suffered a similar fate, and ended yesterday 7.7 per cent below its debut mark.

"Future Pipe is a very good company so I am surprised that investors were not positive on the stock of the firm," said Robert McMillen, chairman of MAC Capital, a Dubai-based broker with licences to trade on all three UAE stock markets.

"Any good company executive would take the highest price the underwriters can get for them, so a lot is down to the involvement of the underwriters and how they structure the deal.

"Global markets are very depressed so I can understand the buoyancy of the UAE not being enough to support the FPI issue worldwide," he said.

McMillen was critical of the underwriters' inability to stimulate post-market trading in both DP World and Depa. "How can a firm that is 18 times oversubscribed not trade well in the secondary market? Something has gone wrong," he added.

However, McMillen stressed the IPO blues were not unique to the DIFX and warned companies across the globe are rethinking possible floatations in the present tough economic climate.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.