- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:28 05:46 12:20 15:47 18:49 20:07

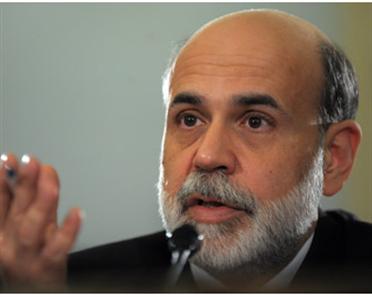

Federal Reserve Chairman Ben Bernanke (AFP)

Bernanke, in remarks delivered via satellite to an international monetary conference in Spain, said that the Fed’s powerful doses of rate reductions that started last September along with the government’s $168 billion (Dh618.24 billion) stimulus package, including rebates for people and tax breaks for businesses, should bring about “somewhat better economic conditions” in the second half of this year.

To help brace the US economy, the Fed in late April dropped its key rate to 2 per cent, a nearly four-year low, but hinted that could be the last reduction for a while. Bernanke drove that point home again on Tuesday.

“For now policy seems well positioned to promote moderate growth and price stability over time,” he said.

The Fed’s juggling act has gotten harder. It is trying to right a wobbly economy without aggravating inflation.

Many economists believe the Fed will hold rates steady at its next meeting on June 24-25 and probably through much, if not all, of this year. A few believe that inflation could flare up and force the Fed to begin boosting rates near the end of this year.

Bernanke, however, suggested that leaving rates at their current levels should be sufficient to accomplish the Fed’s twin goals of nurturing economic growth while preventing inflation from taking off.

Economic growth in the current quarter, he acknowledged, is “likely to be relatively weak.” Even as he reiterated the Fed’s hope for a pickup in growth in the second half of this year and into 2009, Bernanke said the economy continues to battle against a trio of negative forces – a housing slump, credit problems and fragile financial markets.

Until the slumping housing market and falling home prices show “clearer signs of stabilisation,” there will continue to be threats to the economic growth getting back to full throttle, he said. Moreover, recent increases in oil prices pose “additional downside risks to growth,” he said.

At the same time, if already lofty oil prices, now hovering past $127 (Dh467.36) a barrel, continue to rise, that could worsen inflation, Bernanke warned.

The Fed’s aggressive rate-cutting campaign has contributed to a lower value of the US dollar. That, in turn, has helped to push up the prices for imported goods flowing into the United States and fueled a rise in consumer prices. Bernanke called that development “unwelcome.” He said the Fed is “attentive to the implications of changes in the value of the dollar for inflation and inflation expectations.”

“Inflation has remained high,” he said. “The possibility that commodity prices will continue to rise is an important risk to the inflation forecast,” he said.

If consumers, investors and businesses believe inflation will continue to go up, they will change their behavior in ways that aggravate inflation, turning it into a self-fulfilling prophecy.

Were consumer prices to keep climbing over a sustained period, that might “lead the public to expect higher long-term inflation rates, an expectation that could ultimately become self-confirming,” Bernanke said.

The economy grew at a weak 0.9 per cent pace in the first three months of this year, slightly better than the prior quarter, but still considered subpar. The sluggishness comes as employers have cut jobs and consumers – clobbered by housing and credit troubles – are watching their spending much more closely.

“Consumer spending has thus far held up a bit better than expected, but households continue to face significant headwinds, including falling house prices, a softer job market, tighter credit and higher energy prices,” Bernanke said. Consumer spending is a major shaper of overall economic activity.

Businesses, too, are facing challenges, including rapidly escalating costs of raw materials and weaker demand from US consumers, Bernanke said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.