- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:32 05:49 12:21 15:48 18:47 20:04

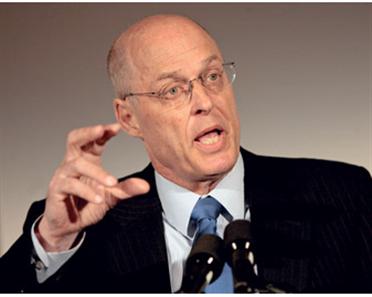

US Treasury Secretary Henry Paulson will discuss steps to stop money reaching terrorists. (GETTY IMAGES)

United States Treasury Secretary Henry Paulson will fly to the UAE and other Gulf states this week to reassure regional governments on their funds in the US following recent furore about the role of their investments.

During a trip, which will take him to the UAE, Saudi Arabia, Kuwait and Qatar, Paulson will also discuss measures taken by the US economic partners in the Gulf to stem the flow of funds to suspected terrorists.

Paulson is expected to outline the outcome of his talks during a speech in Abu Dhabi on Monday.

"Treasury Secretary Henry Paulson will travel to the Middle East this week to reiterate the United States commitment to open investment and discuss the economic benefits of nations around the world remaining open for investment," the US Department of Treasury said in a statement on Friday.

"The meetings will cover a broad range of regional and global economic and financial issues. He will also discuss continued efforts in the region to stem the flow of money to terrorist groups."

US diplomats said Paulson, who was scheduled to fly into the region on Friday, would also reassure Gulf nations over the investments of their sovereign wealth funds, most of which are based in the US and other Western countries. Other issues that are expected to be on the agenda are the dollar peg to Gulf currencies and the US financial crisis, which Paulson said in Washington this week was winding down as he sought to assuage investors' fears.

"I am sure Henry Paulson's talks will cover the recent furore in some Western countries about the so-called dubious role of SWFs there and the need for more control of these funds," a Riyadh-based US diplomat told Emirates Business.

"These statements have caused concern among the GCC countries and could push them to invest somewhere else. I believe Paulson will try to reassure their governments on this issue and tell them that the West will remain liberal and open for investments following the vital role those SWFs played in restoring calm to the financial markets in the US early this year by inject huge funds into some giant institutions that were on the verge of collapse."

The Abu Dhabi Investment Authority (Adia), believed to be the world's largest government investment fund, and other SWFs pumped in excess of $50 billion (Dh183.5bn) in January and February into ailing US financial giants after they reeled from the repercussions of the crippling US sub-prime crisis that has jolted many markets.

The UAE and Kuwait were the first Gulf countries to create SWFs in early 1970s to invest their oil savings in foreign markets, mainly in bank deposits, securities, bonds, real estate and other sectors.

Qatar and Oman decided to follow suit after a surge in oil prices four years ago, while Bahrain is managing a relatively small fund through the Ministry of Finance and Saudi Arabia is in the process of establishing a new local investment fund that could develop later into a SWF.

The surge in crude prices over the past few years has sharply boosted the assets of Gulf SFWs, with those of Adia peaking at nearly $875bn at the end of 2007, making it the world's largest wealth fund.

Its figures showed that Kuwait's SWF controlled around $215bn, while Qatar's fund was estimated at $60bn. EIB gave no figures for Oman, but said assets are still relatively small as the fund is in infant stages.

Paulson's trip also follows growing regional calls for switching investment to other markets because of what they describe as hostile Western campaigns.

"There have been increasing calls in the West for stronger control of these funds on the grounds they might use their massive resources for political rather than economic goals although many studies have shown all these investors have always managed their wealth responsibly and have never used their money to achieve any political or non-economic gains," said Abdullah Al Quwaiz, a Saudi economist who had been GCC Assistant Secretary General for Economic Affairs.

"It seems that these calls will only push Gulf funds to switch their operations to sisterly and friendly countries… this will contribute to strengthening economic and social relations, accelerate growth in those countries and could at the same time achieve what all political factions and military coups have failed to achieve."

Citing estimates by Morgan Stanley Bank, Quwaiz said the overseas assets of GCC investment funds could jump to $5.9 trillion at the end of 2012 and that part of them would head gradually to Arab, Islamic and other developing nations.

In a recent interview with the Oxford Business Group, a UAE official also indicated a shift to Asian markets could be possible.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.