- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

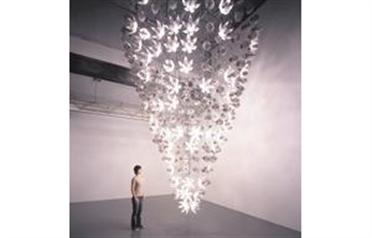

One of the art pieces to be displayed at Art Dubai. (FILE)

As share prices and prices of real estate crash globally shaking everyone's faith in conventional investment avenues, investors are now looking at unconventional assets such as paintings, antiques and collectibles to invest in.

Experts say due to economic crunch prices have softened in the contemporary art market, and therefore this is the best time to buy.

Emirates Business spoke to auction houses, fair organisers, dealers and interior designers to find out more about why it is a good idea to invest in art now and the rules for investing.

John Martin, director and co-founder of Art Dubai said: "The financial crisis has affected the entire world and the art market is no different. However, it is resilient and some artists are still commanding good prices. But the galleries will now have to be more realistic in their expectation. The past three years saw a lot of speculation in the art market both globally and in the Middle East. But now, due to the crisis, there are not a lot of speculators in the market and the prices of overpriced pieces will come down. With speculators gone this is the right time for serious art buyers to invest."

Patrick Gallagher, founder, Decoratives & Design, Inc said: "Like the rest of the world's financial markets, prices at auctions have declined at recent sales. The reason for this is that auction houses placed reserves that were too high on the pieces well before the world markets fell. Several estimates and reserves were subsequently lowered; however many pieces had to be brought in (not sold). Speculation has gone out of the market. Buying and selling only to make a profit are pretty much gone now. Dealers are kinder and more eager to make a deal. So this is the best time for those who want to build serious collections for personal use and as investments for the future."

Talking about the Middle East art market, Michael Jeha, Managing Director, Christie's Middle East said: "Christie's has seen incredible growth in the UAE since we opened our office in 2005 and held our first auction the following year. In that time we have sold approximately $116 million (Dh426m) worth of art and seen the Middle Eastern spend in our sales internationally increase by 400 per cent. Though there is still an astonishing appetite for art in the Middle East and the art market in the region has flourished in recent years, it is not immune to the effects of the economic downturn the world is experiencing. Prices and expectations will readjust to some extent, but we are very confident about the long-term sustainability of the Middle Eastern art market and its ability to withstand the current global challenges."

Experts also believe that the involvement of fewer regulations in the art world, compared to investment in securities and real estate, is prompting more investors to build up asset portfolios of fine art and antiques.

Anne Haughton, international art fair organiser and dealer who will participate in the Art Antiques Design Dubai, said: "Undoubtedly, we are seeing a widespread interest in purchasing top quality antiques and art as valuable investments."

So what are the thumb rules for investing in art?

Giving advise for first-time buyers, Jeha said: "Do not be afraid to seek expert advice; make informed decisions; try to see as much art in person as possible. Discuss the piece you want to buy first with specialists at auction houses, gallerists, established art collectors, etc. Find out about the piece, such as its condition, provenance, etc. Then visit art and auction websites for the latest international market prices and to see comparable works.

"There is no substitute for seeing works in the flesh, so try and visit as many exhibitions as possible at galleries, museums, art fairs. Attending educational seminars and lectures on art can also be a great tool for learning, as well as reading up on exhibition catalogues produced by galleries. Art publications can also be an important source for knowledge."

Art experts say works of art of outstanding quality, condition and rarity will always hold their value. Categories that are considered to yield substantial financial gains include Old Master or Impressionist paintings, 18th century furniture, and the finest 18th and 19th century porcelains among others. Prices at the top end of these categories can run into millions of dollars.

They also say that first and foremost buy what you love.

Jeha said: "Buying art should be an enriching experience and something that expresses your personality and individuality. Art should not be bought purely as an investment but, by seeking advice, only buying what you love and setting a limit before you buy, it can be thoroughly rewarding.

"Also, try to buy quality, no matter what the category and what the artist – it can often be better to buy a very good example by a lesse- known artist, then an very average work by a very established artist."

Haughton agreed: "Always buy the best in its category as that is what always retains its value. Also acknowledged art connoisseurs still advocate the practice of buying art for love rather than solely for investment purposes as the best approach for any art buyer. Provenance matters, especially in antiques as in the antique world you can track back how many times a piece has changed hands. So ensure you can track back on the paper trail. However in the contemporary art world it is difficult to track a piece. So find a dealer you can trust and buy from them."

Gallagher said: "There are several ways to build a collection. You may wish to acquire an encyclopedic collection, spanning different genres over history. Or focus on a more in-depth artist or period or style. Or you may wish to collect a more eclectic assemblage of art."

Haughton said: "The best portfolios are the ones in which there is a little of each category. The old masters always hold their prices, so do antiques. Islamic art is also a very good choice as it has always been revered and brings in top prices. It is a very good investment."

Jeha said: "Islamic art covers a huge area but beautiful objects are always going to attract connoisseurs. In London last October Christie's sold a rare Fatimid carved rock crystal ewer made in Egypt in the last quarter of 10th or first quarter of 11th century. It sold to The Keir Collection for $5.5m."

Experts warn no matter which way your collecting takes you, it is wise to utilise the services of accredited art advisors. They can give you access to reputable dealers, experienced auction house and will guide you through the sometimes arcane and byzantine art world. This access is particularly critical in the contemporary art market where their expertise in matters of condition and provenance are invaluable.

Gallagher warned: "It is important to note the art advisor is working for you rather than the seller." He summed up: "Art can be a strong and prominent part of an investment portfolio. It is portable, can be transferred to the next generation and it should retain its value if top quality art is purchased."

Check list

What first time investors need to do…

Read art magazines, newspaper art sections, visit art galleries and museums to educate yourself.

If there are particular artists whose work you would like to buy, research first. Find out what shows they have been in, and if there have been any reviews of their work. Check how the artist has fared at the reviews. This will tell you if his works will increase in price and prestige over the years.

If you are starting small and wish to invest in upcoming artists, find out where the emerging artists are showing and do a lot of research to find out the potential winners before you invest.

If you love antiques, then beware of antiquities dealers who don't have clear title to what they're selling.

Also look out for forgeries and faked signatures.

Be wary of buying posters being sold as original prints.

Don't get carried away by the momentary hype surrounding an artist or an art work and pay inflated prices.

Also look out for forgeries and faked signatures.

Thumb rules

Key guidelines for buying art.

Buy the best you can afford: The best work by artists appreciates in value more than mediocre work. So if you are buying paintings, antiques or collectibles, the thumb rule is to buy the best as even in a down market, prices hold-up better for the top examples of any type of art.

Buy art with provenance: A paper trail hikes the value of your artwork and adds to its provenance.

Buy signed objects: For resale value, the signature must be there.

Buy items in mint condition and keep them that way: Though you can have a piece restored, it will never be as desirable as something that was never damaged in the first place. For the same reason keep items in perfect condition too as your investment goes up.

Do not buy the flavour of the month: Whatever is terminally fashionable is not a viable long-term investment as trends change.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.