- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:31 05:49 12:21 15:48 18:47 20:05

The pace of increase in rentals in Dubai has slowed down substantially over the last one year, making it far cheaper to rent a luxury property here compared with global cities such as London, New York and Hong Kong.

Rents for luxury properties in the emirate fell 0.6 per cent in the first three months of 2015, according to UK-based Knight Frank.

“The fall is in line with trends in the UAE’s wider non-oil economy, which grew at a notably weaker pace in the first quarter of 2015.

“This is likely to have hit confidence, and thus, tenant demand for luxury residential properties in the emirate,” the consultancy said in its Q1 2015 Prime Global Rental Index report.

In the past two years, the emirate witnessed double-digit increases in luxury property rents, topping the list quite often.

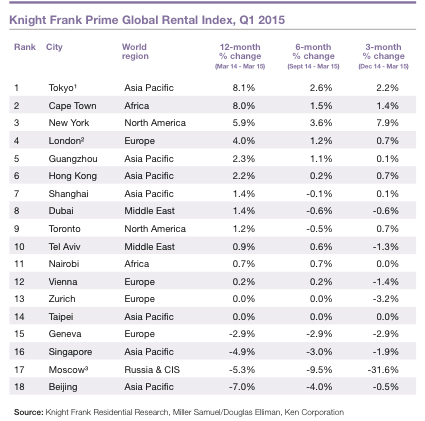

The annual rental growth stood at mere 1.4 per cent (March 2014 to March 2015), putting Dubai 8th on the list of 18 cities.

Earlier this week, Numbeo, one of the world's largest database of user-contributed data about cities and countries worldwide, ranked Dubai’s as the 14th most expensive city on its rent index, though its Cost of Living Index gave the emirate 212 position out of the 517 cities it ranks.

In January 2015, Knight Frank said residential rents were likely to fall by five per cent, while property prices would decline by 5 to 10 per cent in 2015.

JLL, a real estate consultancy, also predicted in the same month that Dubai residents could expect rental declines of five per cent this year, with landlords even offering rent-free periods to hold on to tenants.

Tokyo tops the list

According to the global rent index, Tokyo leads the annual rankings for the second consecutive quarter with prime rents up 8.1 per cent annually followed by Cape Town, registering a 8 per cent rise and New York with 5.9 per cent increase.

London and Guangzhou recorded gains of 4 per cent and 2.3 per cent, respectively, making it to the top five.

The index rose by 1.3 per cent in the year to March.

“A year ago, prime rents globally were rising on average by 3.5 per cent per annum but the global average has now slipped to 1.3 per cent,” Kate Everett-Allen, Partner, Residential Research, Knight Frank wrote in the report.

The consultancy states the health of the global economy will determine the future direction of the index with the immediate concern being the Greek crisis.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.