- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:26 05:44 12:20 15:47 18:50 20:08

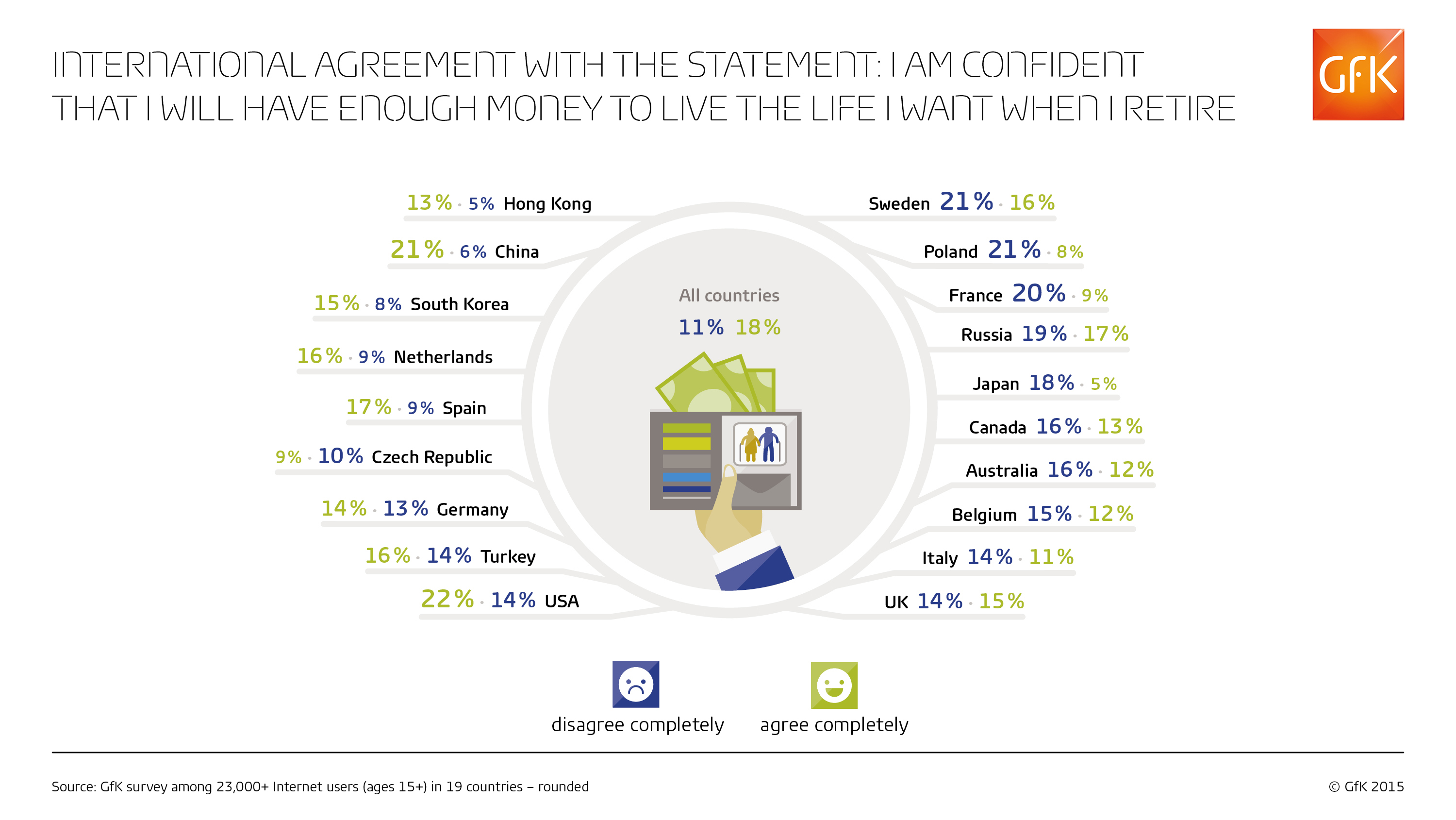

Internationally, close to three in ten (28 per cent) lack confidence that they will be able to afford the life they want during retirement, including one in ten (11 per cent) who have no confidence in this at all.

On the other hand, 42 per cent believe they will have enough money for the life they want, including 18 per cent who are completely confident.

These are findings from a GfK survey, conducted online this summer, that asked over 23,000 people in 19 countries how strongly they agree or disagree with the statement "I am confident that I will have enough money to live the life I want when I retire."

These are findings from a GfK survey, conducted online this summer, that asked over 23,000 people in 19 countries how strongly they agree or disagree with the statement "I am confident that I will have enough money to live the life I want when I retire."

The results show that men and women hold very similar levels of confidence. But when one looks at the separate age groups, it's a different story. The older age groups show the highest per centages who say they have little or no confidence in being able to afford the life they want in retirement. The 50-59 and 40-49 age groups both have over a third (35 per cent) in this category, followed by the 30-39 year olds with 29 per cent. Even among the 20-29 year olds - an age group where retirement is a long way off and with plenty of time to prepare for it - nearly a quarter (23 per cent) lack confidence in being able to afford the life they want upon retirement.

Looking at those people who claim confidence in their ability to afford a good life come retirement, the highest levels are found among the 20-29 year olds, where nearly a half (48 per cent) agree either somewhat or completely. This drops slightly to 45 per cent for those aged 30-39 - and then drops considerably to just over a third (36 per cent) among 40-49 and 50-59 year-olds.

Alexander Zeh, GfK's global lead for financial services research, said: "These findings present financial organizations - and others -with valuable insight on the size and type of opportunity within each age group. For example, the quarter of 20-29 year olds who show early concern about their financial comfort in old age are an ideal audience for pension plan marketing that focuses on the benefits of starting contributions at an early age. And the 15 per cent of over 60s who say they are completely confident in their retirement finances are likely to be receptive to products and services aimed at making retirement fun - be it holiday and travel, dining out, in-home comforts or that special car they'd always wanted."

Americans and Chinese lead for good retirement

Looking at individual countries, USA, China, Russia and Spain are the most confident in having enough money to live the life they want, when they retire. This

is led by the USA at 22 per cent, followed by China at 21 per cent and then Russia and Spain level at 17 per cent.

Sweden, Poland and France, by contrast, mark themselves the most as completely lacking confidence. Sweden and Poland both have 21 per cent disagreeing completely with the statement of confidence, followed by France at 20 per cent. Interestingly, Russia - who is in the top three people in complete agreement - also comes fourth for people saying they disagree completely (19 per cent), pointing to strong polarization in this market.

Alexander Zeh said: "Countries that provide government-funded pensions - as many of the European countries do - actually have lower levels of confidence than countries such as the USA, where there has been no government-funded pension plan. This suggests that people in Europe have finally become aware that the aging population means that public pensions can no longer be relied upon to support them comfortably in retirement. Conversely, people in the likes of America have grown up knowing that they have to fund their own retirement from the start, and so are in a better mind-set than their newly awakened European counterparts."

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.