- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:32 05:49 12:21 15:48 18:47 20:04

The pace of rental growth in Dubai may slow down in 2014, but rents will rise even though nearly 25,000 new housing units are likely to enter the market, according to a global real estate consultancy.

“As rent values and sale prices continue to rise in Dubai’s established communities, tenants are likely to relocate to more affordable areas within Dubai, with some moving to the neighbouring Northern Emirates,” the global real estate consultancy said in its Q1 2014 report on Dubai real estate market.

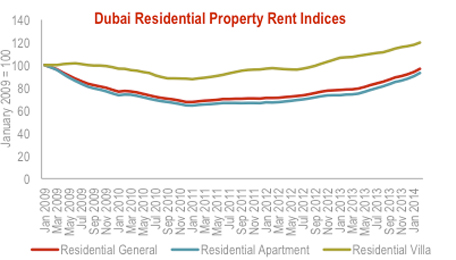

In the report, JLL quoted Reidin’s general rent index, which has risen 23 per cent year-on-year and 7 per cent quarter-on-quarter. Apartment rental index jumped 26 per cent y-o-y, while the villa rental index was up 12 per cent y-o-y.

“At this rate, rental prices remain lower than peak levels with more room for growth over the year, albeit at a slower rate,” JLL said.

Rental values jumped the most in Sports City, which saw a 41 per cent increase y-o-y, International City (35 per cent) and Discovery Gardens (33 per cent) compared to Downtown Dubai and Dubai Marina, which rose by 24 per cent and 21 per cent, respectively.

Citi, a top global bank, has said that the current pace of population growth in Dubai can easily absorb on average 25,000 new units per year, indicating there is enough space for new project launches.

“Vacancy rates in the residential markets peaked in 2010 and have been coming down steadily ever since. What’s more, we believe there is scope for the market to absorb further development given the current rate of population growth (estimated at around seven per cent),” Farouk Soussa, Middle East economist, Citi, said last month.

Dubai, however, has introduced measures such as a rent slab to control increases for existing tenants, with the slab allowing 5 to 20 per cent hike per annum.

1,800 new units delivered

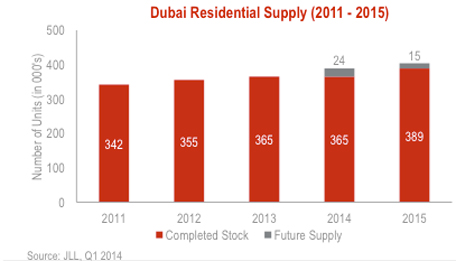

According to JLL, the total residential stock in areas monitored by the consultancy, stood at 365,000 units in the first quarter. Around 1,800 residential units, mostly apartments, were handed over with an additional 24,000 units expected to be handed over in 2014.

JLL estimates that around 39,000 residential units are scheduled to enter the market over the next two years, which will represent a 9 per cent increase on the existing stock.

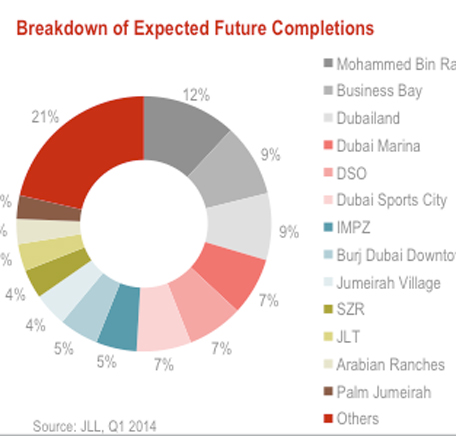

Most of the upcoming residential supply will continue to be located in areas to the South and East of Dubai with the largest proportion being delivered in Mohammed Bin Rashid City, Business Bay and Dubailand, supported by the growth of surrounding infrastructure particularly Al Maktoum International Airport.

Prices up 30%

On the sales side, Reidin general residential sale index rose by 30 per cent y-o-y as of February 2014, with apartments outperforming the villa sector.

The villa sale price index and apartment sale price index increased by 20 per cent and 33 per cent y-o-y respectively.

“While figures for most locations remain shy of their 2008 highs, some areas around Dubai have recorded peak levels,” JLL said.

The consultancy has already ruled out a price “correction” in the residential market and dismissed the speculative bubble theory, indicating to the strong economic fundamentals of Dubai and the UAE.

Earlier this year, Knight Frank, a UK-based consultancy, said property prices in Dubai would continue to rise at a much higher rate than rest of the world, registering a double-digit growth.

“Dubai will see prices jump by 10 to 15 per cent in 2014 driven mostly by Expo 2020 development, buyer incentives and a relaxation of cooling measures,” Liam Bailey, Global Head of Residential Research, said.

Sound and balanced upswing

A Citibank report also stated that Dubai was experiencing a sound and balanced cyclical economic upswing with the real estate growth not being reminiscent of 2008.

“In mid-2008, the Dubai economy was being increasingly driven by construction activity, with developers building projects based on off-plan sales model. It’s good news that we are probably quite far from that stage now,” the global bank said.

It added that the drop in construction activity in the past few years had given the emirate economic revival time to reduce significantly residential supply overhang problem.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.