- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:32 05:49 12:21 15:48 18:47 20:04

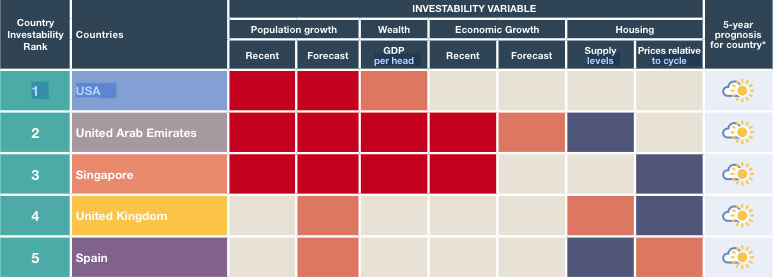

The UAE has been named the second hottest market for global residential property investors ahead of Singapore, the United Kingdom and Hong Kong, according to Savills, a UK-based real estate advisor.

“The UAE’s domestic wealth creation and growing population and regional demand make it a wise investment choice,” the consultancy said in its latest “World Residential Markets” report, which analyzes economic and demographic trends in 14 countries to forecast how much prices in popular cities will rise over the next five years.

“The UAE stands out as a ‘safe haven’ for both local and international investors in the Middle East, attracting businesses and capital from across the region and into the region,” Savills said, adding, “The economic growth is currently strong, growing 5 per cent per annum since 2011.”

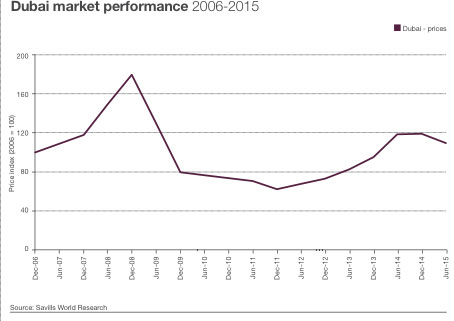

The report further disclosed that the first half of 2015 saw prices fall by 7.7 per cent and a lower transaction volume in Dubai amid a wave of new supply and decline in speculative investment.

“Dubai is the most internationally invested city for residential real estate in the Middle East and much of Dubai’s success is down to its multi-layered appeal as a business and leisure destination for a range of European and Middle Eastern markets,” the consultancy said.

Although residential values had fallen by 60 per cent between 2008 and 2011, it was in 2013 that the market recovered strongly, with Savills putting the increase to 39 per cent compared with the former highs. But in order to curb the market volatility, cooling measures were introduced in the second half of 2013, including mortgage caps across the UAE and Dubai doubling registration fee to 4 per cent from 2 per cent of the sales value.

“What makes Dubai’s long-term prospects stronger than many other centres in the region is its reputation as a global centre of business. This has been underpinned by the city’s hosting of the World Expo in 2020. Strides are being made in improving the city’s infrastructure with the tram opening in 2014,” the consultancy stated.

The US leads the pack, with four cities Los Angeles, Miami, New York and San Francisco (likely to see the strongest mid-term growth). On the third place is Singapore followed the United Kingdom and Spain. Caribbean, Australia, Portugal, Italy, France, China, Hong Kong, South Africa and Switzerland take the sixth to 14th slot.

Cities such as London, Singapore and Hong Kong are expected to restrict growth relative to other cities over the next five years.

On the other hand, Shanghai, expecting population growth, has witnessed a long period of asset price inflation and will witness a period of rental growth before investors are attracted back into the market, the report said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.