- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:19 05:39 12:19 15:45 18:53 20:13

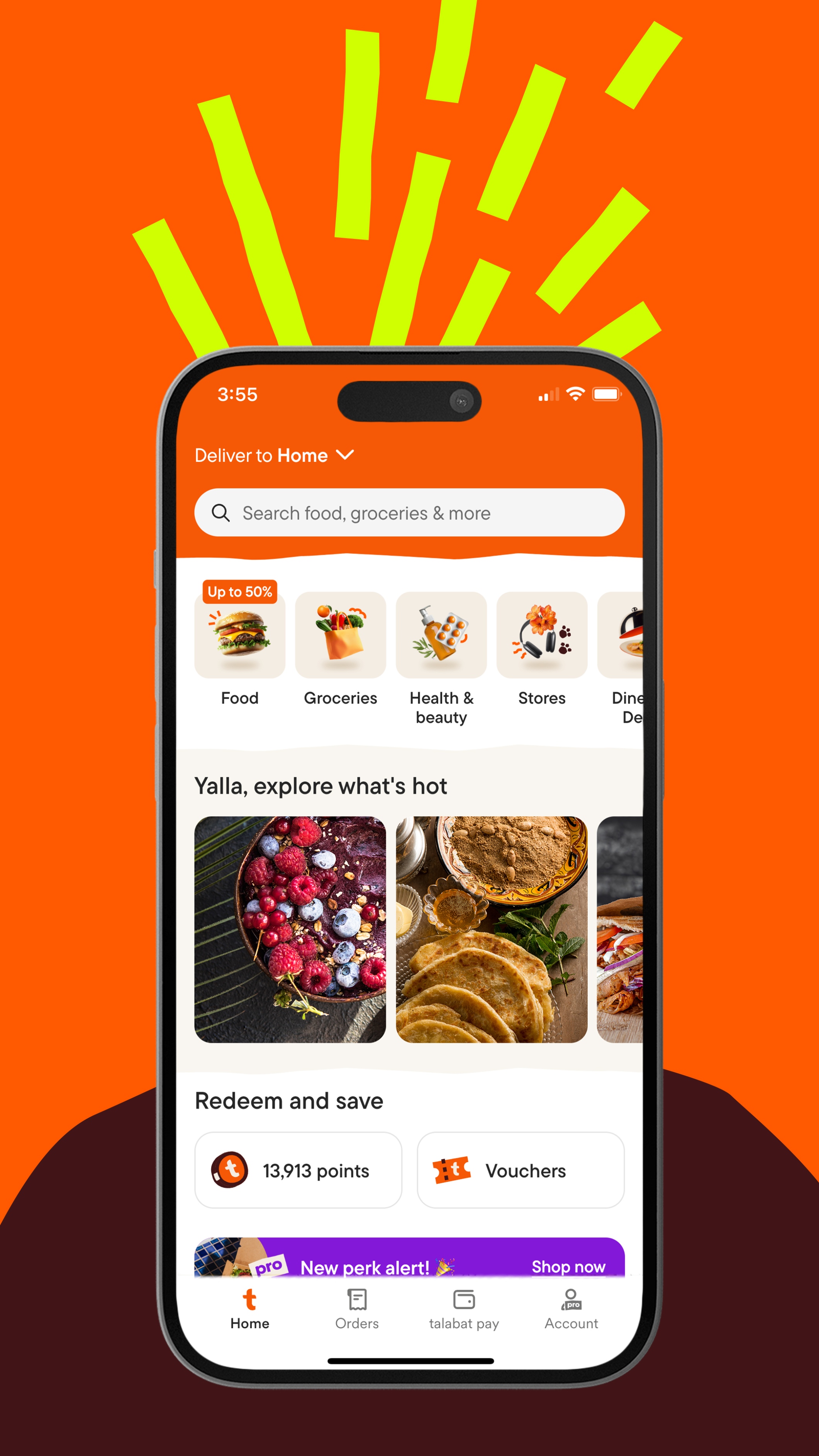

Talabat Holding PLC, the MENA region's leading on-demand food, grocery, and retail delivery marketplace, has announced its intention to float on the Dubai Financial Market (DFM) through an initial public offering (IPO). The company will make available 3.49 billion shares, representing 15% of its total capital, with all shares being offered by sole shareholder Delivery Hero MENA Holding GmbH, a subsidiary of Germany’s Delivery Hero SE.

The IPO listing on DFM is anticipated to occur on or around 10 December 2024.

Talabat's share capital is AED 931.5 million, divided into over 23 billion shares. Following the IPO, the company plans to distribute a minimum dividend of AED 367.25 million in April 2025, with further payments totaling AED 1.469 billion in 2025 and 2026. Talabat's dividend policy targets a payout of 90% of net income, balancing returns to shareholders with reinvestment for growth.

Chairperson Pieter-Jan Vandepitte expressed enthusiasm for the milestone, highlighting Talabat's strategic position and growth driven by Delivery Hero’s expertise since 2015. CEO Tomaso Rodriguez reflected on Talabat’s transformation since its inception in Kuwait in 2004, now serving over six million monthly customers with a strong financial profile and a GMV of USD 6.1 billion in 2023.

Operating in eight MENA countries, Talabat connects over six million active users, 65,000 partner restaurants, and 119,000 riders, offering both food and retail delivery. Through its tech-powered logistics, Talabat optimizes customer experience across its diverse delivery services, from groceries to household items.

This IPO marks a new chapter for Talabat as it solidifies its leadership in the MENA market and opens investment opportunities for regional and international stakeholders.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.