- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

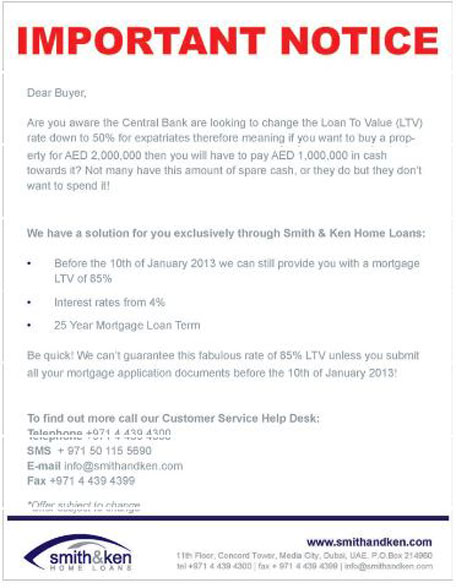

The emailed promotion notice received by Emirates 24|7.

A week after the UAE Central Bank sent shockwaves across the country’s banks by announcing to cap mortgage lending for expatriates at 50 per cent of a property’s value, it is emerging that some brokerages continue to offer old loan-to-value ratios to customers, albeit only for this week.

One such offer emailed promotion message was received by Emirates 24/7 on January 6, 2013.

Dubai-based real estate brokers Smith & Ken, through their mortgage division Smith & Ken Home Loans, claim to have a solution to their potential customers’ woes of not having adequate funds to cough up the 50 per cent down payment that new Central Bank guidelines mandate.

The message, titled ‘IMPORTANT NOTICE’ reads: “Dear Buyer, Are you aware the Central Bank are looking to change the Loan to Value (LTV) rate down to 50% for expatriates therefore meaning if you want to buy a property for AED 2,000,000 then you will have to pay AED 1,000,000 in cash towards it? Not many have this amount of spare cash, or they do but they don’t want to spend it!”

While that may indeed be the case, the Smith & Ken promotion offers customers 85 per cent LTVs if they act within this week.

The message lists the deal’s benefits and how to go about it.

“We have a solution for you exclusively through Smith & Ken Home Loans:

• Before the 10th of January 2013 we can still provide you with a mortgage LTV of 85%

• Interest rates from 4%

• 25 Year Mortgage Loan Term”

“Be quick! We can’t guarantee this fabulous rate of 85% LTV unless you submit all your mortgage application documents before the 10th of January 2013!”, the message concludes.

Benjamin J. Smith, CEO of Smith & Ken, told this website that, according to the ongoing discussions his home loans division has had with some of the UAE’s banks, the Central Bank mandate will become effective January 10, 2013.

“While some banks have, with immediate effect, frozen accepting any new applications, some of the other banks that we are dealing with have told us that they will continue accepting applications until the 10th [of January], and that such applications will be evaluated based on the old LTVs,” Smith told Emirates 24|7.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.