- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

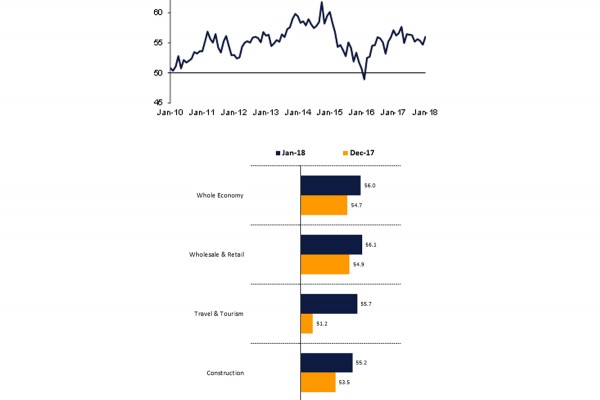

Data for the opening month of 2018 signalled a pick-up in growth in Dubai’s non-oil private sector. The seasonally adjusted Emirates NBD Dubai Economy Tracker Index – a composite indicator designed to give an accurate overview of operating conditions in the non-oil private sector economy – rose to 56.0 in January, from December’s 14-month low of 54.7. The latest reading indicated the strongest rate of improvement for five months.

By sector, wholesale & retail (index at 56.1) was the best performing category, followed by travel & tourism (55.7) and construction (55.2) respectively. All three categories registered stronger growth than in December.

A reading of below 50.0 indicates that the non-oil private sector economy is generally declining; above 50.0, that it is generally expanding. A reading of 50.0 signals no change.

The survey covers the Dubai non-oil private sector economy, with additional sector data published for travel & tourism, wholesale & retail and construction.

Commenting on the Emirates NBD Dubai Economy Tracker, Khatija Haque, Head of MENA Research at Emirates NBD, said, "The rise in the Dubai Economy Tracker Index signals a strong start to 2018, despite the introduction of VAT putting upward pressure on both input and output prices. The construction sector had a particularly strong month in January, and this supports our view that construction will be a key driver of Dubai’s growth this year."

Non-oil private sector companies operating in Dubai reported the fastest growth in business activity since July 2017. Moreover, the rate of expansion was stronger than the long-run series average (since January 2010). At the sector level, construction companies noted the steepest increase in output during the latest survey period, followed closely by wholesale & retail.

Job creation in the non-oil private sector was registered for the eleventh consecutive month in January. Moreover, the rate of growth strengthened to the sharpest since November 2015.

Matching the sequence registered for total activity, the volume of new business rose for the twenty-third successive month in January. Unlike the trend for output, however, the rate of growth eased further to the weakest since October 2016.

Despite the ongoing moderation in new business growth, business activity expectations remained strongly positive overall during January. The degree of confidence improved for the second month running and was the highest since December 2016. Sentiment was strongest in the construction sector.

January data signalled a sharp increase in average cost burdens in the Dubai non-oil private sector economy, widely linked by firms to the introduction of VAT. The rate of input price inflation accelerated markedly to the highest since October 2011. The latest increase extended the current sequence of cost inflation to 23 months. All three sectors monitored registered sharp rates of input price inflation in the latest period.

Selling prices in Dubai’s non-oil private sector rose at the fastest pace in three years in January, again linked to VAT. There was a record increase in charges in the wholesale & retail sector. Charge inflation in construction almost matched December’s record high. In contrast, output prices in the travel & tourism sector were largely unchanged in January compared with one month earlier.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.