- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:18 05:40 12:28 15:52 19:10 20:33

The Federal Tax Authority, FTA, has determined three main categories of "eligible goods" for calculating Value Added Tax, VAT, on the basis of the profit margin scheme.

These are second-hand goods, meaning tangible movable property that is suitable for further use as it is or after repair; antiques, i.e. goods that are over 50 years old; and collectors’ items, such as stamps, coins, currency and other pieces of scientific, historical or archaeological interest.

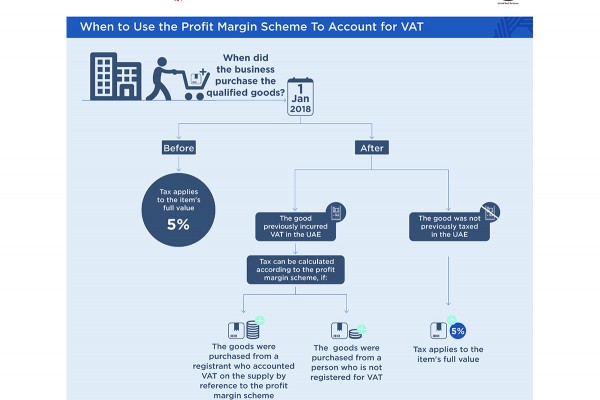

The authority asserted that only those goods, which had been subject to VAT before the supply in question, may be subject to the profit margin scheme. The profit margin is defined as the difference between the buying and selling price of an item and is inclusive of taxes.

The announcement was made in a "Public Clarification" about eligible goods under the profit margin scheme, as per Federal Decree-Law No. (8) on VAT. The FTA offers the clarifications service through its website.

The Director-General of FTA, Khalid Ali Al Bustani, asserted that the new service was launched as part of the authority’s efforts to empower businesses and the general public, and educate them about their rights, obligations and the UAE tax system.

"As part of its comprehensive awareness campaign targeting all segments of society, the FTA published a series of guides that cover all legislative and executive aspects of the UAE tax system, as well as e-learning programmes and infographics," he said, noting that these efforts reflect the FTA’s commitment to transparency and accuracy in implementing tax procedures.

He called on businesses and experts to take advantage of the Public Clarifications service on the authority’s website, which complements the other guides and publications, and help further raise awareness of the UAE tax system and related procedures and laws.

In a press statement issued on Wednesday, the FTA called on registered businesses to carefully verify eligible goods for the profit margin scheme, reiterating that only those goods which have previously been subject to VAT before the supply in question, may be subject to the scheme.

As a result, stock on hand of used goods that were acquired prior to the effective date of Federal Decree-Law No. (8) on VAT, or goods that have not previously been subject to VAT for other reasons, are not eligible to be sold under the profit margin scheme. VAT is, therefore, due on the full selling price of these goods.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.