- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

The author Richard Foulkes is a Client Partner at Pedersen & Partners based in Dubai.

Professionals operating in the Middle East market are often attracted by the increasing opportunities in the region to work with family offices – a trend that is likely to develop substantially.

One of the key reasons for this trend is the challenge of inter-generational asset transfer, as families wish to manage their wealth within a more formal corporate structure. Typically, as a family expands, there is a risk that its capital will quickly be diluted unless a sensible wealth preservation strategy and governance structure is put in place. The majority of new family offices are being set up in Saudi Arabia, where both industrial and sovereign families are realizing the necessity of ensuring that a strong framework exists to secure the family’s prosperity for future generations. In these families, a significant concentration of assets – 80% to 95% – is linked to the primary family business, and must therefore be attended to.

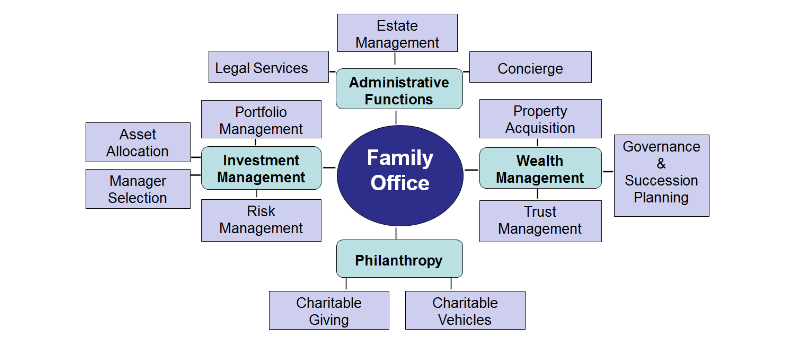

Family offices carry out a range of business activities, enabling them to expand their service provision within a very wide scope, including investments, procurement services, fund selection and asset allocation. However, a family office must adjust its operations and structure based on its clients’ expectations and realities. The family office must be large enough to tackle the complexity of the managed assets, while ensuring the diversification of portfolios in order to manage the risks and costs associated with operating the entity itself. The best advisors do not sell their services cheaply!

INSEAD Business School; "The Institutionalization of Asian Family Offices"

INSEAD Business School; "The Institutionalization of Asian Family Offices"

The 2015 PwC Billionaires Report2 states that worldwide: “Family offices are becoming more vertically integrated, and are shopping for a wider range of advice.” Based on the family’s needs and wants, a family office might determine whether investments can or should be handled in-house, or if they should be outsourced.

In the Middle East, many family offices prefer to keep all the eggs in the office basket by hiring a top-of-the-line investment expert, who serves as a messenger and can establish the right connections.

A stellar investment officer within a family office will navigate the turbulent waters of possible investment opportunities, while restraining the sometimes contradictory investment directions coming from members of the family. It frequently takes a great deal of diplomacy to convince the leader of the family to approve a sound investment decision, while appeasing the desire to apply the same practices that produced the original wealth.

The heads of the family will agree to the need to reduce risk and exposure, and generally understand the wider situation, but are resistant to actually taking action. Some of this reluctance stems from past cases where families opened their pockets to supposedly professional investors who abused the funds, and this in turn generated significant mistrust. The families need to diversify their portfolios, but are cautious after sour experiences in the past.

Given the option, some families – particularly the first and second generations – would prefer to invest in their own business and acquire similar assets, because they understand the fundamentals. Typically, the third generation has less of an emotional commitment to the family fortune, and is more used to a Western style of family investment.

The adoption of a detailed investment strategy, where all of the parties involved agree to specific steps, will allow for the smooth transition of capital, a diversified portfolio and a secure move towards reaching short-term and long-term investment goals.

Before establishing a family office, it is important to understand the potential structural variations that exist. Each new family office will have its own objectives. A high net worth family may wish to create a discreet platform to simply manage the allocation of assets across public and alternative investments with third-party funds.

However, there are families who would like to set up a more prominent private equity or corporate structure, requiring a substantially different team and set of investment skills. Moreover, many affluent Middle Eastern families have their wealth concentrated in a single asset class (such as real estate) or a single corporation.

Where families are looking to reduce their exposure from a single asset class and diversify, effectively liquidating part of the primary asset is often the biggest challenge.

At the same time, an important asset management trend among family offices in the Middle East is the very small amount of capital that flows between personal and corporate assets. This is partly due to the easier credit terms that are now available from lending institutions, due to the improved performance of regional businesses.

The appeal of working for a family office in the Middle East and liaising with external asset managers and investment professionals remains high, although talking with the incumbent investors of a family office sometimes paints quite a different picture. Family office professionals cite high risk-taking by the owners and poor governance as reasons for considering a move back to the corporate world. Even with elite investment professionals on board, trust must be built up over several years.

The risks in working with a family office often attach specifically to individual family members. When considering a move away from an established institution, this should be one of the primary areas for due diligence.

Professionals from Western-style firms can experience frustration if they try to move too quickly. If they then get frustrated because the family is too cautious about investing, a vicious circle can develop. Essentially, it must be understood that the families have an emotional commitment to their capital because they accumulated it themselves.

The appeal of a family office to professionals working for institutional firms in the Middle East can perhaps be partly ascribed to the relatively tough economic period experienced after the global financial crisis. Eradicating the need to continually raise capital deal-by-deal or for a new fund takes away much of an investor’s anxiety.

However, family offices must also take into consideration that the life cycle of the entity will rarely exceed one or maybe two generations of the family. When generational managerial handover occurs in a family business, the family office could face a volatile “flight plan” and will need to cater to the newer generation of high net worth individuals. These circumstances might not be optimal for the two- to three-generational span of a family office.

Although there are always many factors to consider when contemplating a career change, when considering a move to a family office, a finance professional’s focus should be on how well the investment team’s goals and objectives align with those of the individual family members within an agreed governance framework.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.