- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:24 05:43 12:19 15:46 18:51 20:09

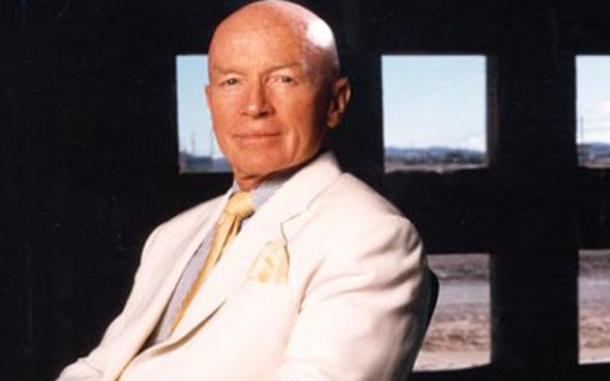

Dr. Mark Mobius (SUPPLIED)

Despite recent tensions in the Korean peninsula, which triggered anxiety in global markets, South Korea has continued to grow its economy, and we continue to find opportunities in the region.

Since we like to get a first-hand view of the operations of prospective investments - our so-called “kick the tires” approach - we took a closer look at various factories around Pusan, South Korea’s second-largest city after Seoul, during a recent trip to South Korea.

Our first visit was to see the operations of a company that, to us, represents the new generation of high-quality, high-tech metal products manufacturers that contribute to South Korea’s industrial and export strength.

After a lean 2009, new orders were beginning to arrive from U.S. aerospace companies, Chinese railways and Indian power plants.

The firm makes exceptionally large machines, each costing as much as US$ 1 million per unit. This type of firm continues to domestically develop new types of machinery tools that can replace imported machinery tools at lower prices.

We were impressed by its capabilities in building large precision machinery tools such as computer numerical control (CNC) gear hobbing machines, which are required to make products such as mega-ton gears, and CNC high frequency machines for wind power components.

At another Pusan plant visit, officials reported continued growth in new orders for industrial fittings.

This was our third visit to the factory, and as before, the factory yard was full of finished industrial fittings awaiting shipment.

About 60 per cent of the firm’s components are made for petrochemical plants, 17 per cent for ships and drilling rig parts, and the rest for electric power plants.

To celebrate a milestone anniversary of its founding, the firm was attempting to achieve an aggressive revenue target by expanding its international presence. To tap that market it had to be close to its clients, major international engineering firms, so it opened a U.S. branch.

We discovered that the firm was placing more emphasis on customers who were constructing power plants, particularly nuclear power plants, which is a potentially larger market than petrochemical plant construction and a market in which the company could meet the industry’s demanding specifications.

The third plant we visited was also experiencing an increase in new orders.

We learned that the firm had just been granted the ability to supply components for nuclear power plants.

For its raw materials, it currently purchases steel ingots from domestic suppliers and imports steel slabs from Brazil and Russia. In order to increase margins, however, it plans to build an electric arc steel production facility, which management expected to reduce manufacturing costs by 20 per cent.

As always, visiting the heart of the action gave us a real sense of how businesses were performing, and we were encouraged to see an increase in new orders for the manufacturers we visited in Pusan.

We believe their strategy to specialize in niche products and markets will help them capitalize on their strengths.

The writer is Executive Chairman, Templeton Asset Management Ltd

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.