- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:25 05:43 12:19 15:46 18:50 20:09

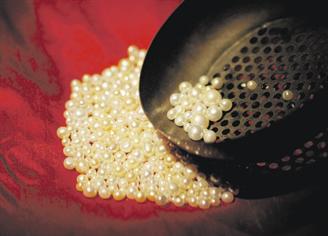

There are various types of pearls that vary in value and rarity. (FILE)

Pearl trade was one of the mainstays of the economy of the Middle East before the region discovered oil or the black gold. For thousands of years, some of the finest pearls in the world were harvested from the warm waters of the Arabian Gulf. The pearl became a symbol of power and love and everyone from royalty to wealthy merchants eagerly sought those of the highest quality – the Arabian Pearl.

In particular, Dubai was the pearl trading hub in the region as most pearls found in the waters of the Gulf were traded through Dubai. However, over the years pearl trading took a backseat to the oil bonanza. Now as Dubai looks to diversify its economy further to prepare for the future as oil is not going to last for ever, it is looking back to its past.

The emirate is holding the first World Pearl Forum at the Atlantis hotel, on February 17 and 18. Emirates Business spoke to Dubai Multi Commodities Centre and some participating companies on the eve of the forum to find out more about it, the global pearl industry and the impact of the economic slowdown on it.

Gaiti Rabbani, Executive Director, Coloured Stones and Pearls, Dubai Multi Commodities Centre, said: "The World Pearl Forum 2009, an initiative of the Dubai Pearl Exchange (DPE) is set to be the global pearl community's brightest and biggest gathering to discuss industry challenges, debate hot topics, share best practice and highlight opportunities."

As many as 200 registered delegates representing pearl retailers, wholesalers and manufacturers from various countries and sectors around the world are expected to attend the forum. Countries such as Australia, the Philippines, Tahiti, Japan, China, India, the US and several from Europe and the Middle East have already shown interest.

The programme features 19 of the world's leading pearl representatives across certification, education, producers, brands and designers. Rabbani said: "These include Nicholas Paspaley, Executive Chairman, Paspaley; Robert Wan, Chairman, Robert Wan Tahiti; Justin Hunter, Founder of J Hunter Pearls Fiji; Dr Jack Ogden, Chief Executive, Gemmological Association of Great Britain; and Kenneth Scarratt, Director of Research, GIA Thailand."

Talking about the reasons for holding the summit, Rabbani said: "The pearl business in the region is yet to reach its full potential. For thousands of years, some of the finest pearls in the world were harvested from the Arabian Gulf. In fact, pearling and the pearl trade were the mainstay of the economy before the advent of oil in the UAE. Through the initiatives of DMCC and the Dubai Pearl Exchange, Dubai is set to become a leading pearl capital of the world once again, not only for retail buyers but also for the trade.

"This forum is a part of a long-term strategy to guide the future of the pearling industry. As such, the primary objective of the forum is to foster lasting professional relationships with international and regional players in the pearl industry that will ultimately lead to new business opportunities among participants.

"Currently, the global pearl industry is rather fragmented and naturally divided into specific geographic regions where pearls are produced alongside key trading centres such as Hong Kong and Japan. In the absence of a global industry body that synergises pearl production and trade related initiatives on an international level, the Dubai Pearl Exchange has taken the initiative to create a forum for the global pearl trade. This is one of the very first steps in re-asserting Dubai's role in the global pearl trade."

In order to boost the pearl industry, the Dubai Pearl Exchange is also establishing standards for retailers within the local market to ensure disclosure and instil consumer confidence in purchases. Through such an initiative, Dubai will in fact be the first market to introduce standards setting an example to other international markets.

At the moment pearls make their way into all markets worldwide via wholesaling centres such as Japan and Hong Kong. Experts say the phrase "pearling industry" is misleading because pearls include South Sea pearls, black pearls, Japanese Akoya pearls and Chinese freshwater pearls, which are as different from each other in appearance, value and rarity as the various gemstones and semi-precious stones. South Sea pearls are the largest, rarest and most valuable of these categories and make up about $1 billion (Dh3.6bn) of annual international jewellery sales. Japan and the US are the largest markets for South Sea pearls, although the majority of South Sea pearls that are imported into Japan are re-exported to other markets around the world. The US is by far the single largest consumer of all categories of jewellery. After the USA, the biggest markets are Asia Pacific, Europe and the Middle East.

Jacques Branellec, Managing Director, Jewelmer, said: "The pearl industry is a relatively young one, amounting to only a fraction of the diamond industry, which is rather large. However, pearling is definitely growing in terms of fashion and awareness. The Middle East gives us around 15 per cent of finished product sales."

Talking about the UAE's pearling industry Nicholas Paspaley, Executive Chairman, Paspaley Pearling, said: "We see the future of Dubai's pearling industry as a major hub of pearl trading for the Middle East and Europe, and as a retail shopping destination for international tourists. The Government of Dubai established the Dubai Pearl Exchange as a wholesale trading platform recently, and Dubai is now the host of the World Pearl Forum. The Pearls of Arabia project, which was announced last year, seems destined to become the world's premium pearl retail destination. Such initiatives certainly encourage and facilitate pearl trade in the region. Dubai looks set to become the pearl trading centre of the Middle East and one of the most important pearl trading centres in the world."

Robert Wan, Chairman, Robert Wan Tahiti, said: "The Dubai pearling industry has many accomplishments but there is always room for improvement and growth. It will come with time and experience, since Dubai and DMCC is still very new in this field."

Talking about the effect of the economic downturn, the experts said though the crisis had hit the pearl industry they were hopeful that the pearl forum will create more awareness and hence business and the fact that pearls are becoming a fashion statement will help their cause.

Rabbani said: "It is known that the luxury market, and as a result the pearl market, has seen effects of the current global economic downturn. However, a move towards more cost effective and classic options for gems and jewellery tends to result during times such as these. The growth of the cultured pearl industry and the reappearance of pearls on the fashion scene has made the water- based gem a preferred and more viable option for consumer markets seeking precious gems during the global credit crunch.

The World Pearl Forum falls at an ideal time in the industry cycle, presenting opportunities for international pearl businesses to consolidate, collaborate and jointly identify opportunities to grow their share within the jewellery market."

Paspaley said: "It is unlikely that any sector will be unaffected by the economic downturn, so the next year will certainly present some challenges. However, in the jewellery sector, South Sea pearls should be more resilient than other categories such as diamonds because the price of South Sea pearls has been very stable during the last few years in comparison with diamonds. If demand for South Sea Pearls does decrease during the next 12 months, it is likely that some producers will be driven out of business. The medium term result will be that production decreases which will keep prices stable."

Branellec said: "The crisis has affected the pearl business. There has been an impact in the wholesale level and a slow down at the retail level. Our clients are more cautious in their purchases and go for pearls of higher quality rather than focusing on price."

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.