- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

(SASAN SAIDI)

Dubai will utilise proceeds from the $20 billion (Dh73.4bn) sovereign bond issue to help government-linked entities meet their financial commitments and is working out a mechanism for disbursement of the fund, according to a top government official yesterday.

"We understand that some entities might face difficulties in refinancing because of the global credit crisis. The times are challenging throughout the world and now it is up to us. And by protecting our major players, we are automatically protecting our economy," said Nasser Al Shaikh, Director-General, Dubai Department of Finance.

"While Dubai does not itself face any challenges in meeting its financial obligations or fiscal programmes, we have a clear understanding of the financial commitments of affiliated entities whether they are fully or partially-owned or affiliated in any way with the Dubai Government."

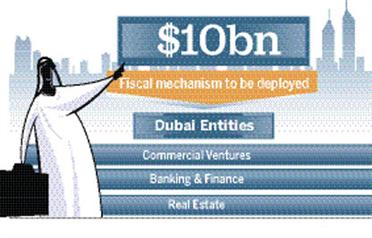

Last week, Dubai launched a $20bn bond programme as part of its long-term financing strategy. The first tranche, valued at $10bn, has been fully subscribed by the UAE Central Bank. The unsecured bond will pay a fixed yield of four per cent per annum and has a five-year maturity.

The support to the entities will come in the form of lending at a price at least equal to the four per cent Dubai is paying on the bonds, and be repaid once the financial climate improves. Among the first beneficiaries of the support fund will be real estate companies.

According to Al Shaikh, the remaining portion of the sovereign bond issue will be raised as and when required.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.