- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

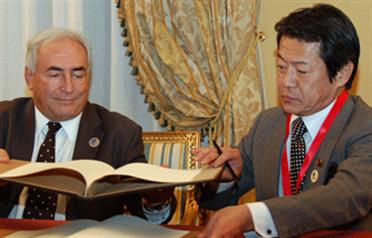

Japan's Finance Minister Shoichi Nakagawa (R) and International Monetary Fund Managing Director Dominique Strauss-Kahn exchange documents after signing a loan agreement during a meeting of G7 finance ministers in Rome. (REUTERS)

Several officials aired their concerns about short-term debt payments this year at a meeting of G7 finance ministers and central bankers on Saturday.

"There will be a lot of maturing short term debt in 2009 and it's not clear there will be rollovers," International Monetary Fund Managing Director Dominique Strauss-Kahn said after the meeting.

"Fewer resources from current account surpluses, increasing need to renew short-term credit; the financing gap for emerging market countries is going to become very large in 2009."

The dramatic slowdown in the world economy and falling commodities prices has hit emerging market exports and investment flows have dried up due to the financial crisis.

European Central Bank Governing Council member Christian Noyer, who is also governor of the Bank of France, said several officials at the meeting had spoken of their concern.

"There is really a lack of financing even for very well managed (emerging) countries," he said.

"An extra factor is the slowdown in global trade."

Hungary, Iceland and Pakistan are among the countries which have fallen victim to the crisis in recent months, forcing them to tap into IMF funds.

The IMF is expecting more countries to come knocking at it door and that is why Strauss-Kahn is trying to double its resources to $500 billion for short-term needs.

"If there are difficulties it will have an impact in developed countries and it also raises the question in a more concrete way of the fund," said Strauss-Kahn.

"Because at the end of the day, you can hope to restart private credits, push banks to stick to their commitments etc, etc, but it's the fund that is the lender of last resort."

Japan led the way on Friday, signing a loan of $100 billion for IMF coffers.

Other countries are expected to follow suit. The G7 underlined their commitment to new cash.

European countries have agreed that they will provide new money but they are waiting to see how much China, which is seeking a greater voice at the IMF, is prepared to contribute from its huge surplus.

This will be discussed at the March and April meetings of the Group of Twenty, which includes the G7 and large emerging market nations such as China.

Strauss-Kahn said he was also hoping to increase financing for poor countries in order to bring down the interest rate on its concessional lending programme.

"It is shocking than we can find billions for some developing countries with balance of payments problems and not be able to find a few millions for poor countries, notably in Africa," he said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.