- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

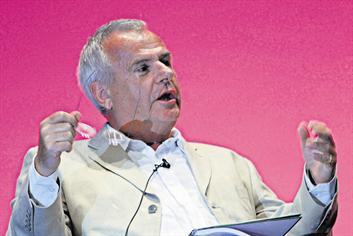

City Minister Paul Myners (SUPPLIED)

The British banking system was under severe strain before the government stepped in and announced its first bail-out last October, a minister said.

"We were very close on Friday, October 10," City Minister Paul Myners was quoted on The Times website as saying.

"There were two or three hours when things felt very bad, nervous and fragile. Major depositors were trying to withdraw – and willing to pay penalties for early withdrawal – from a number of large banks."

The following Monday, the government unveiled a £500 billion (Dh2.5 trillion) rescue package to shore up confidence and strengthen bank capital reserves.

Myners accused banks of having been mismanaged and their bosses having been overpaid, though he did not name any.

"I have met more masters of the universe than I would like to, people who were grossly overrewarded and did not recognise that. Some of that is pretty unpalatable," he said.

"They are people who have no sense of the broader society around them. There is quite a lot of annoyance and much of that is justified.

"Let us be quite clear: There has been mismanagement of our banks."

Chancellor Alistair Darling, in an interview with BBC's Newsnight, also criticised the banks.

"I think the thing we recognise that is pretty clear is that the root cause of this problem is a failure in the banking system.

"That is why we set so much store on trying to firstly stop banks from collapsing, then secondly getting lending going again to homeowners and businesses."

He said the speed at which problems that started in the US sub-prime market spread across the world had taken many people aback. But he said it was "quite pointless" to point the finger at individuals at the moment.

Darling said the solution lay in Britain and other countries managing to get lending going again and ensuring money is put in the economy to support businesses. Asked if he knew the extent of the liabilities the taxpayer was taking on with the banks, Darling said: "Firstly, in the nature of what we are doing, every stage, I have made an announcement – whether it's the bailing out of the banking system to keep it going last October through to the announcements I made at the beginning of this week – I set out clearly what the government's exposure is there.

"The second point… certainly with the banks we now have major shareholdings in, we are getting a far greater clarity of that [liabilities]."

The comments came on the same day official figures showed Britain had entered recession and looked set to see its economy contract further. "We are facing the biggest downturn and biggest set of challenges in generations," he said.

"What has happened in the past 12 months is that the intensity, the speed at which this has happened, and the intensity in terms of the depth clearly the conditions have deteriorated, we are affected."

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.