- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

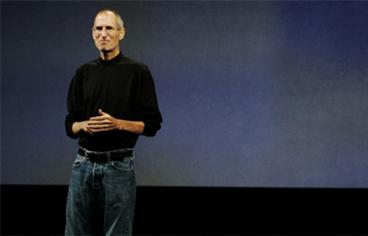

The Insead institute rates the crème de la crème of the global corporate world. The factors taken into account range from the performance of a company to the educational background of the chief executives. (AP)

With the focus on short-term corporate performance under fire, it is more important than ever to take a long view of business leadership. These chief executive officers may not all be household names, but here is an objective look at who delivered the top results over the long term.

A lot of people have blamed short-term thinking for causing our current economic troubles, which has set off a debate about what time window we should use to assess a CEO's performance. Today boards of directors, senior managers, and investors intensely want to know how CEOs handle the ups and downs of running businesses over an extended period. Many executive compensation plans define the "long term" as a three-year horizon, but the real test of a CEO's leadership has to be how the company does over his or her full tenure.

This article contains the first ranking that shows which CEOs of large public companies performed best over their entire time in office – or, for those still in the job, up until September 30, 2009.

To compile our results, we collected data on close to 2,000 CEOs worldwide.

It may come as no shock that Steve Jobs of Apple tops the list. However, our ranking does contain a few surprises. You'll see some relatively unknown faces at the top. The inverse is also true: Some obvious candidates in terms of reputation don't make the top 50. (To view the top 100 and access a list of the top 200, go to hbr.org/top-ceos). In fact, our list overlaps very little with lists of the most-admired or highest-paid CEOs.

When we analysed the data to see which factors increased the likelihood that an executive would rank high, we uncovered a few more surprises. Although one might expect context to have a big effect, we found a wide diversity of countries and industries represented among the top performers. The CEO's background did matter, however, as did the situation left behind by his or her predecessor. Our data highlight the great extent to which CEOs account for variations in company performance, beyond those due to industry, country, and economic swings.

That drives home how important it is to use objective, long-term measures to assess CEOs and to inform CEO searches and succession planning.

How did we judge performance?

To create our ranking, we identified the CEOs of all publicly traded companies that had made Standard & Poor's Global 1200 or BRIC 40 lists since 1997. Considering companies from Brazil, Russia, India, and China in our research was critical, given the growth in emerging economies.

To be included, a CEO had to have assumed the job no earlier than January 1995 and no later than December 2007.

That's one reason why you won't find CEOs such as Jack Welch, Warren Buffett, Larry Ellison, and Bill Gates here. They all took the helm before 1995, though they probably would have done well if included.

All told, 1,999 chief executives made our first cut, and of those, 731 were still in office on the date we stopped measuring performance. The entire group represented 48 nationalities and came from companies based in 33 countries. The median age at which these executives had become CEO was 52, and those still in office had an average tenure of six years.

Only 1.5 per cent were women, and only 15 per cent of the CEOs worked for companies based in a country that was not their country of origin.

It is still not a global labour market for chief executives.

Then we looked at the list of 1,999 executives and asked: "Who led firms that, on the basis of stock returns, outperformed other firms in the same country and industry?"

Our ranking combines three measures: country-adjusted return, industry-adjusted return and change in market capitalization during tenure. Of course, shareholder return is not the only measure of performance, and it omits contributions firms make to a wide group of stakeholders. But it is the fundamental scorecard for CEOs of public firms. And it's the same scorecard for everyone.

Just how good were the top CEOs?

As a leader, you had to produce remarkable performance to make it into our top 50. On average, those CEOs delivered a total shareholder return of 997 per cent (adjusted for exchange-rate effects) during their time in office. That translates into a spectacular annual return of 32 per cent.

Subtracting industry effects, the annual return is 30 per cent, and country effects, it's 29 per cent. On average the top 50 increased the wealth of their companies' shareholders by $48.2 billion (Dh177bn) – adjusted for inflation, dividends, share repurchases, and share issues. Now compare that with the average performance of the 50 CEOs at the bottom of the full list of 1,999, who during their tenures produced a total shareholder return of -70 per cent, which corresponds to an annual return of -20 per cent. On average these poor performers presided over a loss of $18.3bn in shareholder value.

The No1 CEO on the list, Steve Jobs, delivered a whopping 3,188 per cent industry-adjusted return (34 per cent compounded annually) after he rejoined Apple as CEO in 1997, when the firm was in dire shape. From that time until the end of September 2009, Apple's market value increased by $150bn.

The No2 CEO, Yun Jong-Yong, ran South Korea's Samsung Electronics from 1996 to 2008. Yun is an example of a leader who has stayed out of the limelight. During his tenure he capably transformed Samsung from a maker of memory chips and me-too products into an innovator selling digital products such as leading-edge cell phones.

Under Yun shareholder wealth increased by $127bn and the total industry-adjusted return was 1,458 per cent.

Yun is also the No1 performer among the executives who have completed their tenure. For this group, the track record is in.

For current chief executives, in contrast, we need to be cautious – their record could change a lot.

Another top performer who has kept a strikingly low profile is John Martin (No6), who has led Gilead Sciences, a California-based biopharmaceutical company, since 1996. During his tenure he delivered an industry-adjusted return of 2,054 per cent, or 26 per cent on an annualised basis. Described as a "quiet leader", Martin is figuring out how to make lifesaving drugs available in developing countries. He presided over the development of Gilead's one-pill-per-day Aids drug and also the antiviral drug Tamiflu.

Did star CEOs make the cut?

When we compared this list with others rating CEOs, one of the most interesting things we noticed was who didn't appear on our list. Take the Barron's 2009 list of the 30 most respected chief executives in the world, which a group of editors had selected after speaking with investors, analysts, and executives.

Five executives appear in both the Barron's list and our top 30: Steve Jobs of Apple, John Chambers of Cisco, Jeff Bezos of Amazon, Hugh Grant of Monsanto and Terry Leahy of Tesco. But several CEOs that were "most respected" according to Barron's are nowhere near our top 50 (or even our top 200) —namely, Jamie Dimon of JPMorgan Chase, Satoru Iwata of Nintendo, Sam Palmisano of IBM and Rex Tillerson of Exxon Mobil.

Many other celebrity CEOs also failed to make the cut, including Carlos Ghosn of Renault-Nissan, Sergio Marchionne of Fiat, John Mack of Morgan Stanley, Jeffrey Immelt of General Electric, Daniel Vasella of Novartis and Robert Iger of Walt Disney.

Some of these well-known CEOs have not necessarily done poorly; they're just not among the top performers in the world according to the total shareholder return they've delivered so far.

When we looked at rankings of the highest-paid chief executives in America, we also found little overlap with our top 50. This might be due to different time frames; although we cover the CEOs' long-term performance, some lists cover annual compensation only. Nevertheless, it's interesting that none of the people on the Associated Press list of the 10 highest-paid S&P 500 CEOs for 2008, for example, are in our top 50. There is, however, a bit of overlap with rankings that look at longer compensation time frames.

What helps a CEO perform well?

If you are a newly appointed chief executive, how much does the situation that you inherited or your own background predict your placement in the ranking? Our analysis teased out some insights into the factors that matter. While far from exhaustive, these insights can inform today's debates.

Country and industry

A quick glance at the list reveals how geographically widespread strong performance is; no one country dominates the list. CEOs from US-based companies fill 19, or 38 per cent, of the slots on our top 50 list, but that is not unexpected, since 42 per cent of the 1,999 CEOs in the study were from US firms.

Sixteen countries are represented in the top 50, while 25 countries are represented in the top 200. CEO performance doesn't cluster heavily in either free-market-oriented countries or emerging markets. In fact, our analysis shows that only eight per cent of the variance in chief executives' performance in the ranking can be attributed to country-by-country differences.

While we noticed some clustering of performance by industry, our analysis showed that 11 per cent of the variance in performance could be attributed to the industries the CEOs came from. Some industries are overrepresented in the top 200 – notably, energy, telecommunications, health-care equipment and providers and retailing.

Only four per cent of the entire group we studied came from the energy industry, but 12 per cent of the top 200 slots are filled by CEOs from energy companies. Though it is not surprising that the energy sector is overrepresented, it is revealing that some low-growth industries, such as retailing, are well represented, too. This shows that CEOs can attain exceptional performance even if they are not in a booming industry.

Being an insider

Whether outsiders or insiders make better CEOs is a topic of much debate. One piece of conventional wisdom is that outsiders are more capable of instilling change and improving results, especially at underperforming companies, because they are more objective and beholden to fewer internal stakeholders and sacred cows.

The alternative view, espoused by Harvard Business School's Joseph Bower and Rakesh Khurana and other management researchers, is that tapping insider talent for the CEO's office is the better option. They argue that outsiders are expensive and that industry- and firm-specific knowledge is critical when it comes to generating long-term growth. In our analysis of the 1,999 CEOs, however, we determined that insiders tend to do better.

Having an MBA degree

In the aftermath of the financial crisis, pundits criticised MBAs, arguing that business schools had fostered destructive greedy behaviour taught executives the wrong models of management. So we decided to see whether CEOs with MBAs did any better or worse. When we looked at the CEOs from companies based in Germany, Britain, France, and the United States, where reliable information on degrees is available (1,109 CEOs in total), we found that the 32 per cent of CEOs who had an MBA ranked, on average, 40 places better than the CEOs without an MBA. Even in the beleaguered financial sector, the MBAs tended to rank better than the non-MBAs.

A runway for performance

As a CEO, are you more likely to produce stellar performance if you inherit a struggling company from a mediocre predecessor? Or if you take over a strong company from a successful predecessor? Many would argue that a strong company is the best platform for generating superior results. We found that to be far from the case. The average rank of the CEOs who took over companies that performed poorly in the two years before they entered the job was 96 places better than the average rank of those who took over firms with great prior performance.

The gold standard

Because success seems so hard to sustain, perhaps the best measure of a CEO's performance should go beyond his or her time in office. But most measures of performance, ours included, don't look at whether a CEO leaves behind a strong or a weak company. The ultimate gold-plated list, then, would comprise CEOs whose companies performed well not only during their tenure but after it. To construct such a ranking, we extracted from our database the executives who retired from their post three or more years ago, arriving at a list of 803 CEOs, whom we then ranked according to their company's performance during their tenure and for the three years after their departure.

While CEO rankings have exploded into a cottage industry, they haven't really improved our understanding of what drives CEO success, because of the continued fixation on short-term performance and the paucity of data on CEOs outside the US. We have tried to overcome those two obstacles. We believe that examining CEOs' contributions through a longer-term lens will give us a clearer view and better insights.

-Morten T Hansen is a management professor at the University of California, Berkeley, School of Information, and at Insead, in Fontainebleau, France. Herminia Ibarra is a professor of organisational behaviour and the Cora Chaired Professor of Leadership and Learning at Insead. Urs Peyer is an associate professor of finance at Insead

Bst of the rest

11. Robert L Tillman

Lowe's 1996–2005

12. William E Greehey

Valero Energy 1997–2005

13. Gareth Davis

Imperial Tobacco Group 1996–Present

14. William J Doyle

PotashCorp 1999–Present

15. Benjamin Steinbruch

Companhia Siderúrgica Nacional 2002–Present

16. Bart Becht

Reckitt Benckiser Group 1999–Present

17. Masahiro Sakane

Komatsu 2003–2007

18. Terry Leahy

Tesco 1997–Present

19. John W Thompson

Symantec 1999–2009

20. Graham Mackay

SABMiller 1997–Present

21. Mikael Lilius

Fortum 2000–2009

22. Mikhail Prokhorov

Norilsk Nickel 2001–2007

23. Mark G Papa

EOG Resources 1998–Present

24. C John Wilder

TXU 2004–2007

25. Frank Chapman

BG Group 2000–Present

26. Paul Chisholm

Colt Telecom Group 1996–2001

27. David B Snow Jr

Medco Health Solutions 2003–Present

28. Tomeo Kanbayashi

NTT Data 1995–1999

29. Chung Mong-Koo

Hyundai Motor 1998–Present

30. John CS Lau

Husky Energy 2000–Present

31. Stanley Fink

Man Group 2000–2007

32. Antoine Zacharias

Vinci 1997–2006

33. J Villalonga Navarro

Telefónica 1996–2000

34. Harry Roels

RWE 2003–2007

35. Charles Goodyear

BHP Billiton

2003–2007

36. Matteo Arpe

Capitalia 2003–2007

37. Florentino Pérez Rodríguez

Grupo ACS 1997–Present

38. Fujio Mitarai

Canon 1995–Present

39. Roy Gardner

Centrica 1997–2006

40. Thierry Desmarest

Total 1995–2007

41. Wang Jianzhou

China Mobile 2004–Present

42. Fu Chengyu

CNOOC Limited 2003–Present

43. Mark C. Pigott

Paccar 1997–Present

44. William A. Osborn

Northern Trust 1995–2008

45. Craig S Donohue

CME Group 2004–Present

46. David Simon

Simon Property Group 1995–Present

47. Larry C Glasscock

WellPoint 1999–2007

48. AJ Scheepbouwer

Royal KPN 2001–Present

49. Fred Kindle

ABB 2005–2008

50. David EI Pyott

Allergan 1998–Present

Keep up with the latest business news from the region with the Emirates Business 24|7 daily newsletter. To subscribe to the newsletter, please click here.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.