Smokers feel the heat with possible ban on smoking in car

Residential property prices in Dubai are in the midst of another boom, but this time it’s fundamentals – and not speculation – at play, a leading global bank has said in a new report published today, indicating that the rally will continue as long as the fundamentals remain in place.

Economic growth, improving demographics, return of investor confidence and improving regulations have been cited as the primary factors fuelling a remarkable recovery in Dubai’s house prices, since bottoming out in 2009.

According to a report titled ‘Dubai housing: Fundamentals not speculation,’ published this morning by Standard Chartered bank, Dubai’s housing market is expanding on the back of improving fundamentals, and a number of factors including subdued mortgage growth, low off-plan sales and increasing housing regulation differentiate this price rally from the one in 2008.

“Housing prices in Dubai are rising on the back of strong demand and much-improved economic fundamentals. Following a sharp contraction in both prices and volume of transactions in 2009, Dubai’s housing market began to recover very gradually in 2011.

“Slowly but steadily, confidence has returned to the market,” writes Carla Slim, the author of the Standard Chartered report.

The pace of recovery has gathered substantial momentum now, with villa price climbing by almost a quarter and apartment prices surging by almost two-fifths in the past year, even as rental increases have been trailing these price-rises.

“The second quarter of 2013 marks the fourth consecutive quarterly increase in residential prices. In the past 12 months, residential prices have increased by 38 per cent for apartments and 24 per cent for villas, with rents increasing by 20 per cent and 17 per cent, respectively,” Slim reckons.

The bank analyses the various factors fuelling this price rally, and concludes that unlike in the past6, the current rally it isn’t driven by speculative excesses.

“We look at the drivers of the recent price action, and assess whether the recent price increases are the result of excessive speculative behaviour which could give rise to another bubble,” the report says.

“Our conclusion is that, at the moment, the market seems to be driven primarily by fundamentals rather than speculation. Although there is a risk that this could change, it is encouraging that regulators are drafting laws to curb excessive speculation in off-plan properties,” it further adds.

Why this time is different

The report notes that the price-rise this time around has been steady rather than sudden, which lends credence to the rally.

“The sharp increases in property prices in 2008 were driven by excessive short-term speculative activity, especially on off-plan properties. For these properties, buyers only had to put down 10 per cent deposits (rather than the full price), so the market became highly leveraged.

“Many buyers never had the intention (or the funds) to pay the future instalments as they planned to flip the property before any payments were due. This turned the housing market into an unsustainable, highly-leveraged derivatives market,” the report says.

Of course, the price declines of 2009 and 2010 are well documented, with some reports maintaining that, during those years, Dubai was one of the worst performing property markets in the world as prices declined by up to 50 per cent in some cases within a span of two years.

“Rents bottomed out in 2009 from their 2008 peak, decreasing by an average of 44 per cent between Q4-2009 and Q4-2008. Similarly, residential sale prices were down by 50 per cent between 2009 and 2008. In 2010, the rental decline slowed, with little to no change in villa and apartment rental prices during the year, which had fallen a substantial 32 and 21 per cent between 2009 and 2010,” the Standard Chartered report says.

According to the report, “2011 marked the beginning of the housing-market recovery, with villa rent and sale prices starting to register positive-sign changes, outperforming the apartment market, which only experienced the same in 2012.”

Last year witnessed a positive uptrend in sale and rent prices, with sale prices improving faster than rents, the report maintains.

“For sales, villa prices outperformed apartment prices again, rising 24 and 12 per cent, respectively, between Q4-2011 and Q4-2012. Rents increased at a slower rate, with villa rents up by 6 per cent and apartment rents up by 7 per cent between Q4-2011 and Q4-2012.”

What’s driving the Dubai housing market?

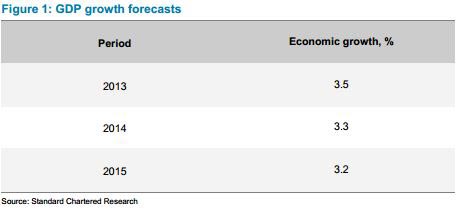

Growing economy: The report highlights that the housing market is influenced by broader economic trends. “Dubai’s economy has experienced solid and sustainable rates of growth over the past three years. The key drivers are logistics, hospitality and retail. This looks set to continue, particularly when it comes to logistics, which contributes 14 per cent to GDP (Dubai Chamber of Commerce and Industry),” says the report.

“We expect trade to increase in the years to come on the back of the increased spending plans of most governments in the region, including Abu Dhabi, Qatar and Saudi Arabia. Tourism is also expected to grow at an average of 6.5 per cent per annum between 2011 and 2021, pushing up employment growth for the sector by 4.1 per cent per year, according to a Dubai Chamber of Commerce and Industry study.

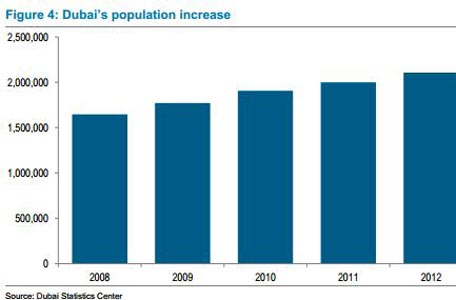

Demographics: As the emirate’s population swells on the back on an improving economy, so does the demand for housing, and with it the sale and rental prices. According to data from the Dubai Statistics Centre, the emirate’s population stands at 2.17 million, up from 1.97m a couple of years ago.

That suggests population growth of about 200,000 in two years. However, unofficial figures for population growth are much higher, with a number of analysts pointing at the traffic situation and lack of school seats as anecdotal evidence of a much higher growth.

“Dubai is cementing its status as a safe haven in a region of political and economic turmoil, attracting people from unstable countries around the Middle East/North Africa region, with property-listing agencies reporting an increasing interest from buyers from countries in political turmoil,” says the StanChart report.

“Additionally, school registrations reflect the influx of families as renters and end-users in the housing market. In fact, schools absorbed 10.35 per cent non-Emirati students during the 2012-13 school year, according to the Dubai Statistics Center,” the report adds.

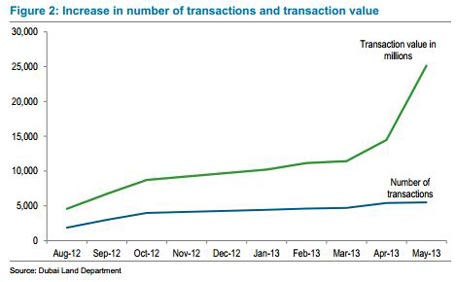

Return of confidence: Improving fundamentals and rising prices are feeding through to improved confidence. This could drive prices further up, with prices and investment feeding off of each other, the report highlights.

It cites the Business Confidence Survey (Q1-2013), led by the Department of Economic Development (DED), which revealed that more than half (55 per cent) of businesses surveyed were expecting higher sale revenues in the second quarter of 2013, and 30 per cent were expecting stable sales thanks to rising activity and volume.

“This optimism in Q2 expectations appears to have resulted from a real economic recovery, since 91 per cent of these businesses reported either improvement or stability in business conditions in Q1,” the report says.

“More importantly, the survey stated that 98 per cent of businesses planned to either increase (23 per cent) or maintain (75 per cent) their employment count for the second quarter.”

Improving regulations: Last year saw a paradigm shift in the emirate’s real estate market with the release of two new laws aiming at increased transparency and better regulation. The Investor Protection Law and the Code of Corporate Governance for Developers, drafted by the Dubai Land Department, were announced in 2012.

“The first intended to protect real estate investors from delays in completion and handover and from unilateral changes consisting of violations of terms and conditions by developers. It allows investors to cancel their contracts in these situations and have their money refunded.

The second law requires disclosure from developers to investors regarding information about their properties, including alternatives in case of delays. This law defines the responsibilities of developers,” the report says.

“This commitment towards improving and strengthening corporate governance practices by protecting property rights has helped gain new investors and maintain existing ones. Stakeholders such as home-owners and tenants have regained confidence in the real estate sector, as reflected in the recovery of market prices,” it says.

Expo 2020: Dubai has emerged as a frontrunner in the bid to host the coveted Expo 2020, and analysts expect a successful bid (results are awaited in November 2013) to result in a massive shot in the arm for the overall economy, as well as property prices in the emirate and across the UAE.

“We expect Expo 2020 to be a meaningful contributor to the sustainability of the housing market, in the event of a positive bid result in November 2013. Expo 2020 is a universal exposition which five cities have bid to host: Izmir (Turkey), Ayutthaya (Thailand), Yekaterinburg (Russia), São Paulo (Brazil) and Dubai (UAE). Since Ayutthaya (Thailand) was disqualified, Dubai’s chances of winning have ncreased,” says the report.

“In the event it does, close to 300,000 more jobs could be created with 25 million people visiting Dubai. 90 per cent of the job opportunities would occur from 2018 to 2021, with most of the jobs created in the travel and tourism sector. This indicates a good chance that a high percentage of these will be converted into permanent jobs, which would benefit the expanded economy in the post-Expo period.”

In conclusion, the report maintains that the current rally is based on solid fundamentals, which suggests that it will continue for the foreseeable period. “The recovery of Dubai’s housing market started in 2011. It has set the scene for a slow, strong and persistent rise in housing prices, pulled by real demand for housing from end users and a steady supply of new developments to match it.

“The market seems to be driven by fundamentals rather than excess speculation, in contrast to what the market went through in 2008. The outlook of the market will therefore depend on how these fundamentals evolve over time. Right now, we conclude that there are no serious indications of a speculative bubble in the housing market.”

(Home page image courtesy Shutterstock)

MUST READ:

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.