- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

(Dennis B. Mallari)

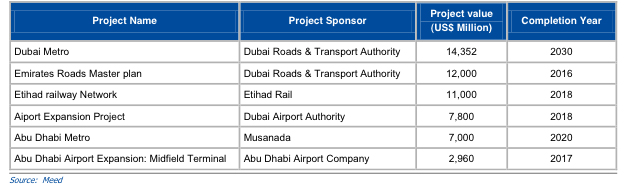

The estimated value of six mega projects in the UAE’s infrastructure construction sector is over Dh202.25 billion ($55.11bn), according to a new report.

With a targeted completion date of 2030, Dubai Metro by Dubai Roads and Transport Authority (RTA) is by far the biggest project to be undertaken in the country at the cost of $14.35 billion, Alpen Capital said in its June 2015 ‘GCC Construction Report’.

Second on the list is Emirates Roads master plan by Dubai RTA, which is valued at $12bn and slated for completion in 2016 followed by Etihad Railway network by Etihad Rail at an estimated cost of $11bn and a completion date of 2018.

Fourth on the list is the Airport Expansion Project by Dubai Airport Authority with an estimated value of $7.8bn (completion 2018) followed by Abu Dhabi Metro by Musanada with a projected value of $7bn (completion 2020) and Abu Dhabi Airport Expansion Midfield Terminal Complex by Abu Dhabi Airport Company valued at $2.96 billion (completion 2017).

The report says the UAE’s infrastructure construction sector is seeing the recommencement of several major development projects that were stalled during the 2008 economic downturn.

“The governments of Abu Dhabi and Dubai led the revival in 2012, fueled by increased spending towards their infrastructure, especially the upgrades to airports, ports and roadways,” it adds.

The UAE has invested heavily towards strengthening its infrastructure in recent years, to deal with the rapid population growth in Abu Dhabi and Dubai, hosting of Expo 2020, as well as to position itself as a shipping and aviation hub.

“The GCC construction industry foresees growth from 2015-2018, encouraged by factors such as favourable macroeconomics, positive demographics, and rising tourism activities. Higher budget allocation towards construction sector, as part of the strategic vision of the member nations, lends an added push to the industry,” says Sameena Ahmad, Managing Director, Alpen Capital (ME) Limited.

Factors driving growth

Highlighting the growth drivers, the report states that the on-going efforts to reduce the dependency on the hydrocarbons sector across the GCC have resulted in an increase of capital investment (as a percentage of the GDP) in the construction industry. This increase is expected to be channeled towards meeting the high construction demand across the region.

The region’s population is expected to grow at a CAGR of 2.5 per cent from 2014 to 2018 to reach 56.9 million and a growing population base is likely to translate into higher demand for residential, commercial, retail, hospitality, healthcare, leisure and infrastructure sectors across the region.

Also, with the run up to the mega-events (UAE Expo 2020 and Qatar 2022 Fifa World Cup) being hosted by some countries, the region is slated to open up opportunities across the sectors of tourism, hospitality, and retail, translating into growth for construction activities, the report mentions.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.