- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:25 05:43 12:19 15:46 18:50 20:09

No details available on which communities registered drop in rental rates. (Supplied)

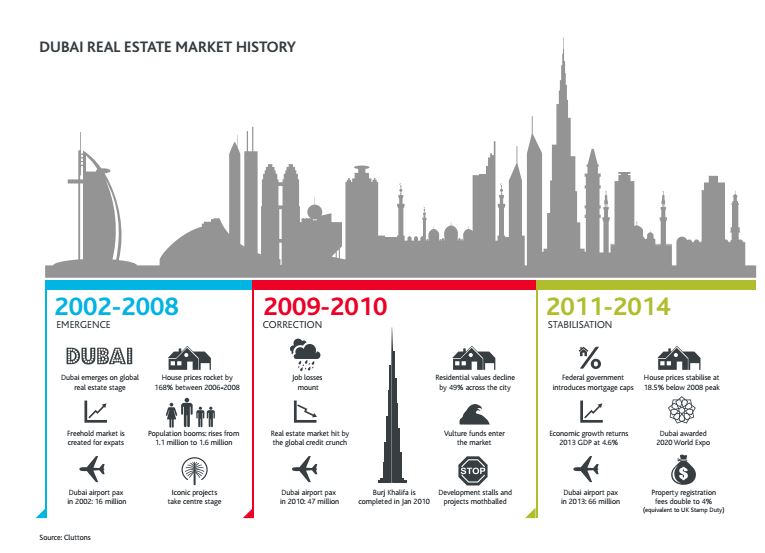

Average rents across Dubai’s freehold areas have declined in the third quarter 2014 compared to the second quarter, falling 0.4 per cent, according to Cluttons.

The real estate consultancy in its 'Dubai Winter 2014 Residential Market Outlook' report, however, states that average rental values are up nearly five per cent in the third quarter 2014 compared to the same period last year.

No information was given on which communities registered a decline in the third quarter.

Cluttons said that despite the “cooling” of rents tenant demand remains exceptionally strong, underpinned by economic expansion and the subsequent rise in the level of jobs being created across the emirate.

“In particular, the leisure, hospitality, aviation, finance, banking and real estate sectors have seen rapid expansion, as evidenced by the level of housing requirements from these sectors. In the short to medium term, we do not anticipate a slowdown in the rate of job creation, which suggests that the current period of rental stagnation is likely to be short lived. Furthermore, supply is projected to fall well short of demand in the villa segment of the market in the medium to long term,” said Cluttons’ international research and business development manager, Faisal Durrani.

On Tuesday, CBRE a global real estate consultancy, said new supply could have a deflationary impact on sales and rental rates.

Will residential rents in Dubai decline in 2015?

Despite the stagnation in capital value growth and the fall in the overall level of transactions, the off plan sales market in Dubai has for the most part retained its momentum, with investors taking a longer term view of the market.

Cluttons said freehold transactions fell by almost one third in total during the third quarter 2014, but off-plan residential sales market is still buoyant and continues to attract regional and international investors.

“Many households that are determined to purchase, now view off-plan properties, as good value,” Steve Morgan, Chief Executive Officer, Cluttons, Middle East, added.

Emirates 24/7 reported earlier that at least 42 new projects have been unveiled this year till August.

The consultancy believes investment appetite continues to remain strong, as investors are keen to free up capital to move on to their next purchase.

“Positively, we are seeing nearly four out of every five transactions being refinanced once buyers have met developer restrictions, if any, on the transfer of title deeds. While the market continues to adjust to the changes in the financing landscape, we expect the gradual softening in values to persist over the next three to six months while the market adjusts to the evolving conditions,” said Durrani.

Major improvements to Dubai’s infrastructure are also set to bolster long term capital value growth across the city.

In Dubai Marina, for instance, investors are already actively seeking to acquire properties in close proximity to the Marina’s Metro stations, The Beach, and Jumeirah Beach Residence and it is expected that the Dubai Tram stations dotted around the Marina will similarly drive demand up in their immediate vicinity.

Cluttons found that one year after the introduction of the Federal Mortgage Cap the market is now showing signs of succumbing to deposit requirements imposed on buyers, and is entering an anticipated period of more measured and sustainable expansion.

During the third quarter of 2014, the rate of house price growth slipped by 0.3 per cent, marking the first decline since first quarter 2011. Average values are still however 10 per cent up on third quarter 2013 and currently stand at Dh1,493 per square feet. Apartments gained a 0.4 per cent rise in average prices, while villa values decreased by 1.2 per cent during the third quarter.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.