- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

The number of arbitrary rent increases by landlords, post removal of the rent cap in Abu Dhabi in November 2013, seems to have declined as the pace of rental increase in the emirate has slowed down.

CBRE, a global property consultancy, said on Monday, average rents in Abu Dhabi rose by mere 2 per cent in the third quarter 2014 after lease rates jumped 12 per cent in the first six months.

Tenants have complained of arbitrary rent hikes post removal of the rent cap. In fact, the increases had ranged between 50 and 70 per cent.

The market, however, continues to remain fragmented with some properties seeing rates unchanged and ‘inferior’ products likely to see a further rental decline, the consultancy said in its latest Abu Dhabi MarketView.

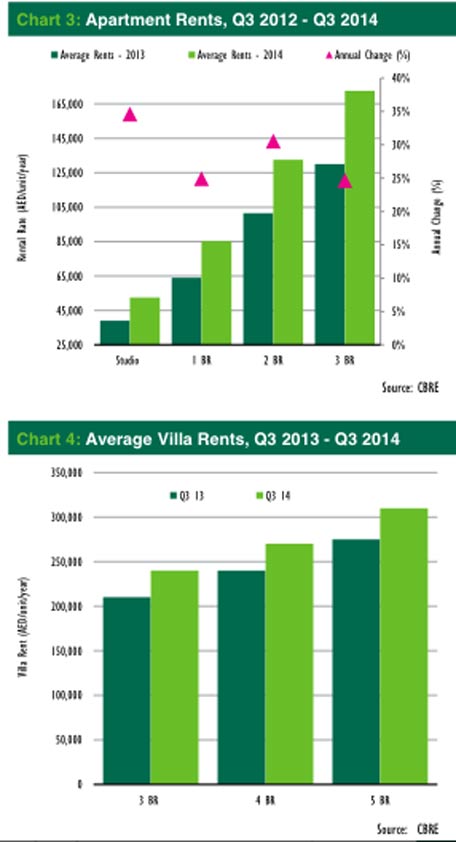

“On average, high-end rents for two-bedroom apartments range between Dh140,000 and Dh195,000 per annum on the main Abu Dhabi island. This translates to about 45 to 65 per cent premium when compared to similar types of unit situated off-island, whereby rents range between Dh70,000 and Dh95,000 per annum,” Mat Green, Head of Research & Consultancy UAE, CBRE Middle East, wrote in the report.

Price variation, however, becomes wider when comparing luxury residences in prime locations. Average rents for two-bed units in prime developments on Saadiyat Island, Al Raha Beach and Corniche range between Dh160,000 and Dh200,000 per annum.

According to CBRE, well-established locations, access to a wide range of services and amenities, and the overall feel of luxury living is prompting tenants to pay an “extra premium” to be situated in upscale residential communities.

The villa market has remained strong amid limited supply particularly on Abu Dhabi Island. The combined effects of limited available lease options and strong tenant loyalty has resulted in limited volatility of rental rates for this property type.

During the quarter, annual rents for a typical four-bedroom villas on Abu Dhabi Island ranged between Dh190,000 per annum to Dh350,000 per annum. Similar residential types in off-island locations are currently being rented between Dh140,000 and Dh180,000 per annum.

Abu Dhabi has seen strong demand for housing requirements coming from major corporate clients with bulk deals arising from the medical, educational, and hospitality sectors to house employees remains a key source of overall residential demand.

Sales prices up

The residential sales market has seen a revival over the last six quarters, with average prices for key investment locations growing by 22 per cent, CBRE said.

During the third quarter, sales values increased by around three per cent, with rates ranging between Dh13,725 and Dh17,760 per square metres.

Prices for affordable developments such as Hydra Village and Al Reef remained unchanged during the quarter at around Dh7,500-Dh12,375 per square metre.

“The limited number of affordable investment options in the market at this time has given these developments a competitive edge in recent times with healthy rental and price growth achieved over the past year,” Green added.

CBRE believes that while the third quarter produced a relatively subdued performance, improvements in both sale and lease rates are likely to continue, albeit at a steadier pace than was evident during the first half of the year.

“As has been the trend, the market will remain fragmented with well-located and well positioned properties able to outperform the wider market. On the flip-side, we expect to see rental rates drop further for inferior real estate products as competition continues to rise,” Green said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.