- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

Small traders could set up their accounts and open an online store with a basic plan for as little as Dh49 per month

Dubai is all set to unveil a new e-commerce solution to help merchants and businesses trade online. Called Shari, the end-to-end cloud-based solution enables users to create their own customised shops in 10 minutes.

The system will fully integrate PCI DSS certified payment gateway through Naqodi and even offer the services of shipment delivery provider Zajel.

The solution was being showcased at the Emaratech stand at the Cards and Payments Middle East exhibition in Dubai. The exhibition has, meanwhile, been rebranded and will be called Seamless starting next year.

Commenting on the need for creating a platform like Shari, an official who has been instrumental in the project told Emirates 24|7, "Our idea behind creating the solution is to enable small and medium size businesses who otherwise do not have the capacity and financial muscle to set up their own online store,” said Ahmad from Emaratech.

The facility will incorporate features offered by similar service providers such as Shopify, Magento and BigCommerce.

“Our main advantage is that you will be able to build your own brand. We also aim to keep the service charge at bare minimum to encourage online trade and payments in the region,” he said.

Small traders could set up their accounts and open an online store with a basic plan for as little as Dh49 per month, which allows them to list 10 products and provides 5GB of bandwidth and 1GB of storage. An Advance Plan will cost Dh79 per month and allow a business to list 30 products offering 10GB of bandwidth and 3GB of disk space. An enterprise package will cost Dh245 and will allow listing of unlimited products with unlimited bandwidth and disc space.

A month-long free trial will be available for basic users as a promotional offer. Registrations can be completed by entering a valid email address, choosing the name of the business and entering business licence details along with the expiry date.

Merchants will be able to use their own white label/branding, offer discounts and deals and have full administrative control. There would also be scope for social media integration product reviews and advanced web analytics. Businesses can choose from ready to use templates that will have mobile friendly user interface. The built in delivery service will enable the end customers or the buyers to choose and pay for their delivery. Zajel offers national and international services with call centre support, online shipment tracking.

Will e-trader be a game changer?

Dubai Economic Department is also working on introducing a new licencing solution to enable small home based businesses to legally trade online and participate in fairs and exhibitions.

Called e-trader, the licence is mainly aimed at streamlining the fast growing online and social media trading by mostly home based freelancers without a trade license.

The e-trader certificate will also enable such individuals to get onto the Shari platform.

However it is still not clear if the e-trader is a mere rebranding of the already existing "Intelaq" programme that is available for UAE nationals wherein they can set up home-based businesses for almost any type of professional, trade or artisan business.

The conditions for issuing an Intelaq certificate are that the business must be reasonable for operation in a residential environment; must not harm the environment or the health of any person, and should not generate noise or other irritants that could negatively impact neighbours.

An individual can have only one trade or professional Intelaq license, using which he can operate more than one related activity. An Intelaq license also does not allow the business owner to hire staff but may engage contractors.

The move could be aimed at assisting and regulating the growth of online trading especially through social media by home based businesses.

UAE has the highest percentage share of women online shoppers in the region

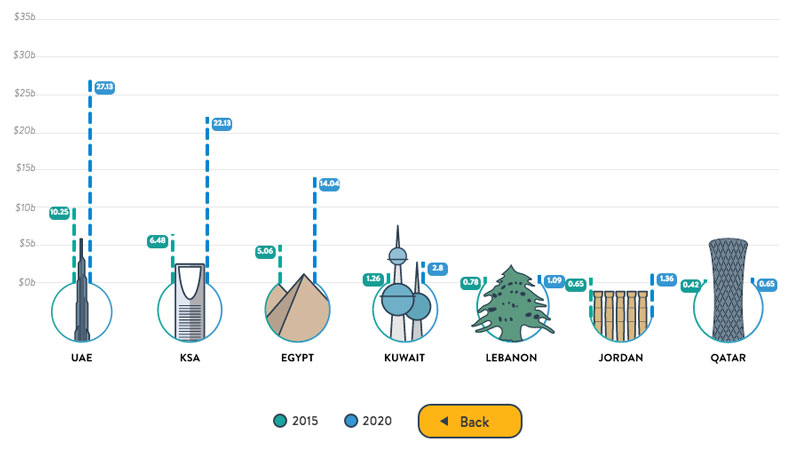

According to a report Payfort, Arab World witnessed a 23 per cent increase in online payments in 2015 with UAE witnessing a 24 per cent year on year growth. According to the “State of Payments in the Arab World” report, the volume of online payments in the Arab world could be around $69 billion annually.

Not surprisingly airline bookings and B2B business continued to gain major acceptance and drive the online payment ecosystem. While airline bookings increased by 18 per cent in 2015 compared to the previous year, the transactions in e-commerce was up by 31 per cent, entertainment by 34 per cent and travel sector up by 39 per cent. The UAE continues to lead the region in terms of adoption with 71 per cent of the country shopping online.

Although male shoppers continued to dominate the scene buying online more compared to women, UAE registered the highest number of women online shoppers. While 40 per cent of all online shopping in the country is being done by women, Egypt registered the least with just 22 per cent of the ratio. UAE is followed by Lebanon with 37.5 per cent, Qatar with 34.3 per cent and KSA with 33.5 per cent.

Although Cash on Delivery is the most popular mode of payment across the region, credit card usage for online payment is the highest in the UAE with a third of all online payments made using credit cards.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.