- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:18 05:40 12:28 15:52 19:10 20:33

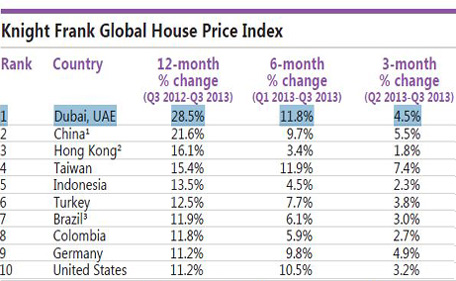

House prices in Dubai rose by a world-beating 28.5 per cent in the 12-month period ended September 30, 2013, according to property research firm Knight Frank.

The report maintains that the average global house prices reached a new peak in the most recent quarter, surpassing their previous peak in the second quarter of 2008, after which the subprime crisis led to a worldwide decline in property and asset prices.

Now, more than five years after the decline set in, prices have once again scaled to new peaks, according to Knight Frank’s Global House Price Index, which tracks mainstream residential prices in 53 countries, as well as city states Dubai and Hong Kong.

Dubai housing’s meteoric rise of 28.5 per cent year-on-year is followed by China’s 21.6 per cent and Hong Kong’s 16.1 per cent. “The index’s strong performance has been assisted not just by headline grabbing price rises in Dubai, China and Hong Kong, but also in a number of emerging markets,” says Kate Everett-Allen, the author of the Knight Frank report.

The Index shows that house prices in Dubai have surged by 11.8 per cent in the past six months, and by 4.5 per cent in the previous 3 months. In addition, with the emirate winning the rights to host World Expo 2020, a number of analysts now maintain that this will see a new growth chapter for Dubai and the UAE’s economy, and property prices may continue to rise in the near future.

In the preceding quarter too, Dubai witnessed a record rise when house prices rose by 21.7 per cent year-on-year, also the most in the world. Read: Dubai house prices surge the most in the world. Dubai was then followed by Hong Kong (19.1 per cent) and Taiwan (15.4 per cent). However, this quarter the gap between Dubai and the rest of the world has grown larger, with prices in Dubai clearly breaking free and racing towards the 30 per cent-mark.

A number of key emerging markets recorded price growth of more than 10 per cent, including Taiwan (15.4 per cent), Indonesia (13.5 per cent), Turkey (12.5 per cent) and Brazil (11.9 per cent) in the year.

Last year, same quarter, house prices in Dubai had inched up by a mere 2 per cent according to the Knight Frank Global House Price Index, and the emirate was ranked at No. 23 in the world in terms of rising house prices. Its surge to the top in this year’s report puts the sharp rise in perspective as investors have returned in droves to their favourite property market in the region and indeed the world.

In fact, the emirate was the worst performing destination surveyed by the company in Q3 2009, when average house prices in Dubai fell by a massive 47 per cent year-on-year, landing the emirate at the bottom of the 42 countries ranked by the Global House Price Index. This year’s report maintains that Dubai’s rebound has been impressive.

In September this year, the Dubai Land Department (DLD) announced the doubling of the property registration fee from 2 per cent to 4 per cent in a bid to stem the spiralling property prices. The new fee structure came into effect on October 6, 2013. DLD Director-General Sultan Butti bin Mejren said that the move was aimed at speculators, and was unlikely to have any negative impact on the general property market. "The move is aimed to stop quick transactions [flipping] which are unhealthy for the market and result in sudden price increases," he said.

A report issued by Standard Chartered Bank in September said Dubai's property price escalations this time around are based on fundamentals, and reiterated that any bubble talk was premature. Read: Attention Dubai property investors: These areas saw biggest rally in prices, rents. Dubai’s housing market is expanding on the back of improving fundamentals, and a number of factors including subdued mortgage growth, low off-plan sales and increasing housing regulation differentiate this price rally from the one in 2008.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.