- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

Banks in the UAE and across the GCC should get their act together by offering a better online banking experience to their customers or be ready to lose them to rivals that are willing to do so.

That’s the message from a survey by professional services advisory Ernst & Young (EY), which polled 2,000 customers across UAE, Saudi Arabia, Qatar and Kuwait, and analysed 700,000 customer sentiments on social networks for its new ‘GCC Digital Banking Report 2015’.

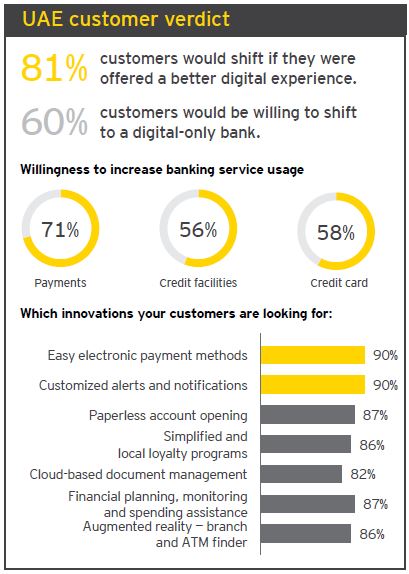

According to the report, 81 per cent of UAE customers say they will ditch their current bank if another one meets their desire for a ‘bank in pocket’ – i.e., offers them the option of complete smartphone-based banking.

In fact, 60 per cent UAE residents said they were willing to shift to a digital-only bank. The firm maintains that its study confirms that “the future of retail banking in the GCC is a smartphone experience that delights”.

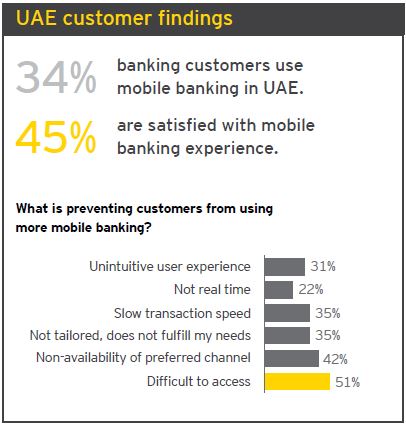

Among reasons cited for this low take-up is the lack of convenience and simplicity. “Customers are generally not impressed with the mobile proposition on offer, it appears, and this holds true for both traditional and Islamic banks,” the report notes.

Less than half of UAE customers surveyed (45 per cent) were happy with their mobile banking experience, with 51 per cent stating that difficulty to access mobile banking features is one of the primary reasons preventing them from using mobile banking more extensively.

Customers expect banks to provide more convenience, less paper, more speed, pinpoint accuracy and a friendly service environment. The overwhelming majority of customers asked for an improved banking experience.

Smartphones are a way of life for almost all surveyed customers in the GCC, with 98 per cent of those polled being equipped with modern smartphones.

“Only a limited number of banking transactions are mobile. This is very surprising given the extremely high number of banking customers that use smartphones. Outside of the region, digital-only banks, which don’t have a branch network, have been rising in popularity due to their agility and lower cost base,” he said.

Customers are not loyal to GCC banks

The survey highlighted that 78 per cent of GCC customers would be ready to switch bank for a better digital experience and up to 64 per cent would feel comfortable switching to a digital-first bank, with less reliance on branch network.

“The disconnect between customer expectations and what banks in the GCC can deliver is more distinct than ever,” said Robert Abboud, Mena Financial Services Advisory Leader at EY.

EY research suggests that without introducing digital initiatives, up to 50 per cent of GCC’s retail banks’ net profit could be at stake.

“Addressing customer needs in an increasingly digital world means disrupting and rewiring existing business models for a fresh customer experience. Our research suggests that up to 50 per cent of retail banks’ net profit could be at stake,” added Abboud.

“A clear consensus emerged on the GCC customer priorities of: anytime, anywhere, paperless interaction, fast, accurate and friendly. This is a huge opportunity to engage customers in a bigger and better way,” said Ashar Nazim, Partner, Global Islamic Banking Centre at EY.

“The banks that start listening closer to their customers’ needs will have a competitive advantage over others. As yet, there is no clear leader in the GCC digital banking space. The challenge will be in execution, and the majority of banks appear to be struggling with rapid prototyping and market adoption. Our message to banks is to be the one — win the digital talent war by creating an ecosystem of partnerships to make life better for your customers,” he added.

Putting customers first

The report reveals that trust, convenience and personalisation form the foundation of customers establishing a digital relationship with their bank — and technology is the enabler. Seven in 10 GCC customers (71 per cent) would increase their usage of payment services if their banking relationship was made convenient simple and accessible, findings reveal.

Banks hold a wealth of data on their customers that can be used to create more targeted customer journeys, improve experience and increase engagement, which is true across channels. Engaged customers are more willing to invest with their bank (by paying a little more, or adding more accounts and services).

“Mobile-first is the future of retail banking in the GCC, but it is not enough for banks to just introduce new digital channels. They must reinvent their customer processes to offer technology-enabled, simple, end-to-end banking experiences. The key solutions in demand that could benefit tremendously from digitization are payments, account opening and mortgages, with a significant potential to increase value per customer for banks,” concludes Sommerin.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.