- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:25 05:43 12:19 15:46 18:50 20:09

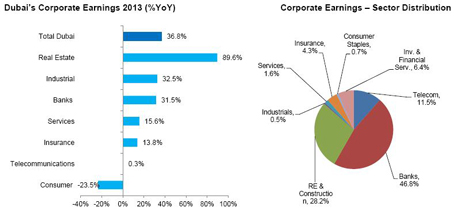

Companies listed on the Dubai bourse posted biggest rise in corporate earnings among the GCC countries in 2013, according to a study by Global Investment House released on Tuesday.

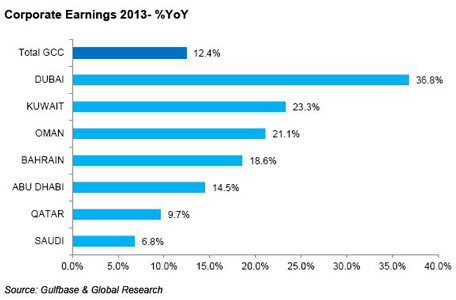

Dubai firms recorded 36.8 per cent growth in corporate earnings, followed by Kuwait (23.3 per cent), Oman, (21.1 per cent), Bahrain (18.6 per cent), Abu Dhabi (14.5 per cent), Qatar (9.7 per cent) and Saudi Arabia (6.8 per cent). Overall, GCC corporate earnings increased 12.4 per cent.

Dubai’s corporate earnings surged 36.8 per cent year-on-year to reach $4.7 billion (Dh17.25 billion) in 2013 mainly propelled by banks, real estate and construction and telecom.

Earnings of the real estate and construction sector increased 89.6 per cent year-on-year to $1.3bn in 2013 driven by robust growth in profits across all listed companies as a result of continued overall recovery.

Earnings growth of the banking sector was driven by Emirates NBD after posting a 27.5 per cent year-on-year increase in growth followed by Dubai Islamic Bank at 41.6 per cent year-on-year and Mashreq bank at 37.6 per cent year-on-year. Emirates NBD reported solid earnings growth mainly due to growth in loans with better margins, while higher earnings of Dubai Islamic Bank can be attributed to increased net operating revenue combined with lower operating expenses and decline in impairment loss.

Abu Dhabi corporate earning up 14.5% to Dh33bn

Abu Dhabi’s corporate earnings increased by 14.5 per cent year-on-year to reach $9 billion (Dh33 billion) in 2013, driven by 13.6 per cent year-on-year growth in the earnings of the Banking sector to $5.5bn in 2013; the banking sector contributed in excess of 60 per cent growth in consolidated earnings.

The growth was ascribed to Abu Dhabi Commercial Bank that posted a growth of 23.0 per cent year-on-year, followed by First Gulf Bank at 14.9 per cent year-on-year growth and National Bank of Abu Dhabi at 9.3 per cent year-on-year growth. Abu Dhabi Commercial Bank’s growth was led by huge increase in trading income and a significant fall in provisions while First Gulf Bank’s profits surged due to sharp growth in non-interest income. National Bank of Abu Dhabi reported higher profits on account of higher net-interest, non-interest income and decline in provisions.

The Real Estate sector posted a growth of 53.1 per cent year-on-year, accounting for 8.3 per cent of the consolidated 2013 earnings. The sector was driven by Al Dar Properties that posted a rise of 67.6 per cent year-on-year as a result of its merger with Sorouh Real Estate as well as the country’s improving real estate markets. Excluding Aldar Properties, the sector’s earnings grew 8.4 per cent year-on-year.

The Insurance sector also contributed significantly during 2013, with its earnings growing 62.4 per cent year-on-year. The growth was contributed by Al Wathba National Insurance and Union Insurance. Al Wathba National Insurance posted a strong growth of 279.3 per cent year-on-year to Dh148.8m, whereas Union Insurance reported a profit of Dh66.7m in 2013 compared to a loss of Dh14.4m in 2012.

The Consumer Staples sector posted the largest decline in earnings (58.9 per cent year-on-year), due to International Fish Farming that witnessed losses increasing from Dh141.3m in 2012 to Dh240.5m in 2013. Excluding the company, the sector’s earnings rose 53.3 per cent year-on-year.

Overall, the UAE market posted robust corporate earnings of 21.3 per cent in 2013, mainly due to a staggering year for Dubai boasting a 36.8 per cent year-on-year growth outperforming Abu Dhabi’s corporate earnings growth registered at 14.5 per cent year-on-year during the same period. The growth is mainly attributed to higher earnings in banking and real estate sectors.

GCC earnings

In the GCC, corporate earnings rose by 12.4 per cent year-on-year to $61.8 billion (Dh227 billion) in 2013, Global said.

The UAE, posting a 21.3 per cent year-on-year increase, led overall earnings and contributed 4.4 per cent to the incremental rise in earnings in the region. Saudi Arabia came in second with a 6.8 per cent year-on-year followed by Qatar with a 9.7 per cent year-on-year increase each accounting to the GCC total earnings with 3.2 per cent and 1.8 per cent, respectively. The other three GCC countries being Kuwait, Oman and Bahrain also recorded incremental year-on-year growth in earnings at 23.3 per cent, 21.1 per cent and 18.6 per cent, respectively.

Consolidated earnings of firms listed on Bahrain Stock Exchange increased by 18.6% YoY to reach $1.8bn in 2013 primarily driven by the banking sector.

Kuwait firms' consolidated earnings rose by 23.3 per cent year-on-year to reach $5.5bn in 2013, primarily led by the financial services and real estate sectors.

Corporate earnings in Oman rose 21.1 per cent year-on-year to $2.1bn in 2013, mainly due to improvements in the earnings of banks and investment firms.

Qatar corporate earnings growth increased by 9.7 per cent year-on-year to reach $11.2bn during 2013 compared to $10.2bn during 2012. Five from the seven sectors posted gains in their earnings.

In Saudi Arabia, TASI’s consolidated earnings rose 6.8 per cent to $27.4bn in 2013 driven mainly by a robust 31.8 per cent growth in the earnings of telecommunication and information technology companies.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.