- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

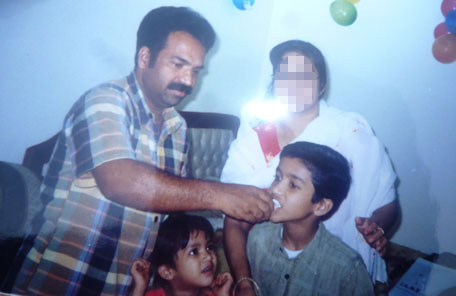

An Indian grocer neck deep in debt has been contemplating suicide, after all his businesses failed and his life partner for 18 years absconded with a major chunk of his savings and two children to live with another man.

Ali Mon (42) has been doing various businesses in the UAE, running groceries and selling toys, cosmetics and stationery to groceries, is stuck in a cobweb of money lenders and bank loans back home and an emotional setback from his wife who eloped with her young boyfriend with about Rs 4 million (Dh0.2m) that he raised by selling his shop and borrowing from money lenders.

Ali Mon, from Pattambi in the southern Indian state of Kerala, has been in the UAE for 19 years and lost heavily in his grocery business due to the entry of big supermarket chains into his traditional field and stoppage of credit facility by traders. The desperate man has been calling up Indian embassy officials, social workers and community groups that discouraging expatriates from committing suicide.

Ali told ‘Emirates24|7’: “My shop in Al Musaffa is closed and the rent cheque for Dh250,000 bounced. The Abu Dhabi Commercial Bank filed a cheque bouncing case as the rent has been overdue for nine months. I could not reopen my shop as the grocery business is not doing well and my passport was pledged with a money lender who lent me Dh20,000.”

He said out of nearly 1,000 groceries in Abu Dhabi several have either closed or are on the verge of closure because big supermarket chains have entered their domain, new express outlets are being opened and big neighbourhood stores eat into grocers’ business.

“Small groceries are either closing down or the owners are absconding, nobody is now giving goods on credit, that is why I had to borrow Dh20,000 from a money lender at a very high interest. During the good old days, I could easily make Dh 6,000 per month,” he says.

He had bought a new grocery in May 2007 with Dh80,000, part of the stock was on credit, but the business was not very profitable, so he sold the shop to another Indian businessman for Dh120,000. When business dropped, he sacked an employee and his business became a one-man show. “I am in a terrible mental state and my options are limited,” he said.

His wife Haseena, who had been living with him in the UAE and back in India for about 18 years, and mother of their two children, insisted that the money be used to buy a new flat back home. “I sent the entire money from the grocery shop sale to her to buy a new flat at Edappally, Kochi, thinking that property prices will double soon and so the losses of the Al Ain grocery would be compensated. I took Dh 27,000 from a chit fund of Dh40,000 incurring a loss of Dh13,000 and sent that money also to her. When she was here, I handed over the money, without even counting, thinking that she is my life partner. She did not buy the flat but took the money and eloped with a young tuition master who was engaged to improve her spoken English skills,” Ali Mon said.

She is also keeping about 100 sovereigns of gold (one sovereign is eight grams) that he got as dowry.

“I took a home loan of Rs4m from the State Bank of India and a power of attorney was given in her name. We started building a house of 28,000 square feet in December 2009, but she did not use the money for the house. The house construction was left halfway through,” he said.

“I gave ten cents of land in her name, but she sold it without my knowledge. When I called her last in January 2012, I was stunned when she introduced herself as Shafeena Shameer, not Shameera Ali. Shameer is a tuition master who was assigned to teach her English. I have a record of Rs4m sent to her for various purposes. We have been married for nearly two decades and my children aged 15 and 9 are with her. She has pledged the family gold worth Rs 600,000 to a branch of Manappuram Finance without my knowledge,” Ali Moan alleged.

He has to pay Rs 35,000 per month for the housing loan taken in her name. He is trying to convince the bank manager about the cheating. “I did not know that even my wife would cheat me. I am left with about forty family albums of our good old family life here and back home and a huge debt and a court case. I can’t believe that she has cheated me,” Ali Mon said.

Ali has worked as a wholesale supplier to more than 100 stationery outlets on the Al Ain-Abu Dhabi route. This business is no longer profitable because of the closure of groceries. He used to buy goods from the Dubai market on one month to forty five days credit, but since many groceries have closed or the owners are absconding without paying their creditors, not many people now give goods on credit.

“I took Dh 20,000 on interest from an Indian money lender from Hyderabad. In October 2010, I took Dh 18,400 from the money lender after deducting the first month’s interest of Dh1,600. I have been paying monthly interest of Dh1,600.

From my shrinking income, I managed to pay interest for more than one and half years, but later defaulted on interest repayment. Even after paying Dh16,000 interest for a loan of Dh20,000, my outstanding now to the money lender is Dh34,000. My passport and a security cheque have been pledged with him, and after the interest payment default, I had to give another security cheque for a higher amount. Now the money lender is threatening to put me in jail if I fail to make the payments,” he said.

In between, he had to spend two nights in jail in a rent cheque bouncing case and his passport is now kept at an Abu Dhabi police station. Before taking the high-interest loan from the money lender, Ali had sold his delivery van, car and the grocery shop in Al Ain. For business and to maintain his family here, he had taken another loan of Dh10,000 on ten per cent interest per month and the amount has accumulated to Dh 15,000.

“Then I realised that she has been cheating me. When I used to call her, the phone was engaged for hours and she consoled me by saying that she was clearing her doubts about the English language from the tuition master. She is now living with the tuition master and is not allowing me to speak to my two children who are with them. I cannot go home to make a police complaint because my passport is pledged in a police station in UAE and it is due to renewal in a few months’ time. I don’t know what will happen if the passport expires. I have limited options and I did not make a police complaint thinking about my two children,” Ali said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.