- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

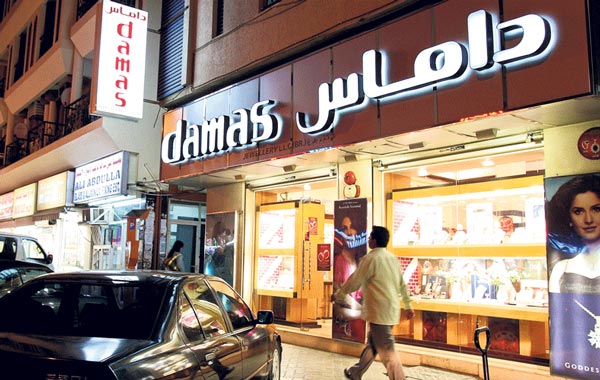

Damas’ six-months net profits stand at Dh4.25m compared with a net loss of Dh714.87m during the same period of 2009. (FILE)

Damas International, the Dubai-based listed gold and jewellery group, recorded marginal profits for the six months period ended September 30, 2010, compared with a net loss during the corresponding period of last year, the company announced.

Damas’ six-months net profits stand at Dh4.25m compared with a net loss of Dh714.87m during the same period of 2009.

The company’s profits are largely on the basis of a reversal of impairment losses on equity accounted investments (based on settlement agreement entered with a related party), which boosted its bottom line by over Dh12m, compared with a net impairment provision of over Dh138m last year.

Further, the company said in its financial statements that it did not recognise any impairment loss on investments in subsidiaries for the period ended September 30, 2010. It had recorded losses of Dh16m for the same during the corresponding period of 2009.

The company also announced that one of its joint venture partners has filed a claim of Dh114.7m in Abu Dhabi courts against its subsidiary Damas Jewellery LLC, for an alleged breach of the joint participation agreement that the subsidiary had signed wen establishing the business. It added that Damas intends to “vigorously defend” its interests in the action.

Damas’ revenues for the period declined more than 20 per cent year-on-year, from Dh1.67b in the same period last year to Dh1.32b for the six-months period ended September 30, 2010.

Standstill extension

Damas said the steering committee of its bank lenders has agreed to extend the standstill period for its banking facilities to December 31, 2010 and its restructuring plan is progressing well.

“The restructuring of bank facilities is complex and involves negotiations with in excess of 20 bank lenders. However, with the continued support of such bank lenders it is currently intended to complete the restructuring in December,” a company statement said.

"Negotiations with the banks have progressed positively and are nearing finalisation and the agreement of the steering committee to the standstill extension shows the confidence that the bank lenders have in a successful restructuring of the company," it said.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.