- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:19 05:39 12:19 15:45 18:53 20:13

Dubai has invested a large portion of its budget spend on developing the city’s infrastructure. (Supplied)

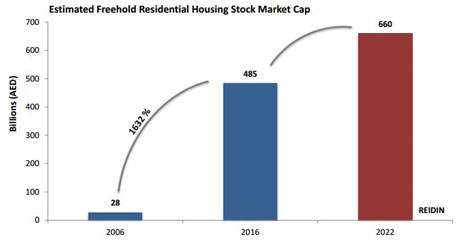

The market capitalisation of completed units in Dubai’s freehold housing market has risen a whopping 1,632 per cent in the past one decade, according to figures released by Unitas Consultancy.

In 2006, the market was worth Dh28 billion which increased to Dh485 billion in 2016.

“With the projection of projects now launched (there remains a substantial pipeline that has not yet been announced), this market cap is further expected to grow to Dh660 billion by 2022; when we project a value to the levels of unannounced stock in master communities that have been launched, this figure further rises to Dh1 trillion,” the consultancy said.

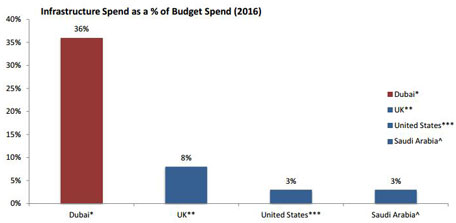

Dubai has invested a large portion of its budget spend on developing the city’s infrastructure. In 2016, Dubai allocated 35 per cent of its budget expenditure, which is 10 times more than most developed countries.

In comparison, the United Kingdom has allocated only 8 per cent of its budget expenditure for transport, housing and environment, while the United States has assigned three per cent for transportation and environment, while Saudi Arabia has earmarked three per cent for infrastructure development.

# Largest asset base

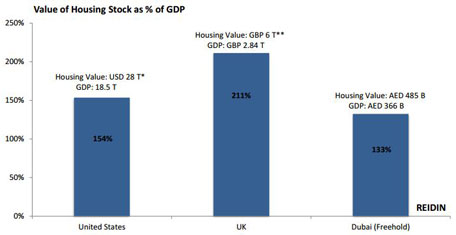

The housing market is typically the largest asset of a country’s economy and in most cases the housing market is worth more than the gross domestic product of the country.

The Unitas report reveals that the value of housing stock in the US is $28 trillion (GDP: $18.5 trillion), while in the UK it is 6 trillion pound (GDP: 2.84 trillion).

In Dubai, the present value of housing stock is Dh485 billion (GDP: Dh366 billion).

“We opine that with debt levels having room to grow, and with rapidly rising population growth rates, it appears likely that although the growth rates of asset values may well be lower than what was achieved historically, there will be an expansion of both the values and the quantum of real estate assets and it is this prime pump along with infrastructure spending that will continue to underpin economic growth,” the report states.

# Economic growth

An examination of the debt levels of the global economy reveals that the UAE and Dubai are still below the acceptable threshold.

“As Dubai continues to push forward with an expansive fiscal policy, it appears likely that there is room in the system to accommodate this fiscal stance, despite the fall in oil prices. This expansive stance in infrastructure spending, appears to be the prime pump that will accelerate the growth of the economy and in particular the real estate sector,” the report mentions.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.