- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 04:20 05:42 12:28 15:53 19:08 20:30

Falling oil prices will impact end-user demand in Abu Dhabi’s rental market as supply levels will remain lower than historic levels, believes JLL, a global real estate consultancy.

“We expect future residential rental demand to be affected by the decline in oil prices – directly impacting the oil sector and indirectly affecting other sectors due to a reduction in government spending,” the consultancy said in its third quarter report on Abu Dhabi real estate market.

The UAE government plans to cut spending by 4.2 per cent this year, the first such cut for 13 years, leading to job cuts and cost controls in government and delaying the commencement of new mega projects, the report said.

Another factor cited was the increasing cost of living (through the removal of utilities and fuel subsidies and further potential measures to introduce taxes) that could curtail demand for residential units.

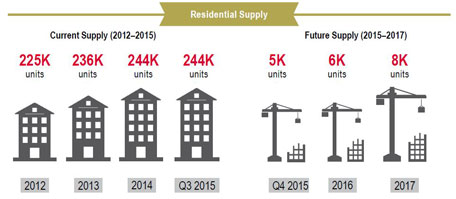

Nearly 700 units were added to the existing market stock during the third quarter 2015, taking the total number of units to 244,000.

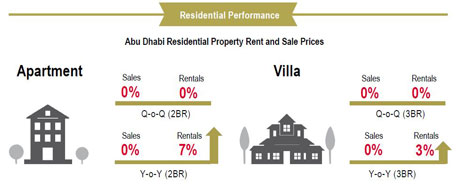

“As we predicted earlier in the year, we are expecting single digit rental growth during 2015, following 17 per cent growth in 2013 and 11 per cent in 2014, as supply and demand become more balanced,” said David Dudley, International Director and Head of Abu Dhabi Office, JLL Mena.

No forecast was given on 2016.

JLL, however, said residential supply remains under control with minimal vacancies in high quality schemes.

It added that circa 5,000 residential units were scheduled to enter the market this year, while 6000 units were expected to be delivered in 2016.

On the property sales side, the consultancy said prices had remained stable, but transaction volumes had dropped due to weaker sentiment, which would continue into the next year.

Last month, JLL said none of the freehold locations in Abu Dhabi currently offer affordable property for sale and therefore the only option for middle-income families is to rent.

On Monday, Abu Dhabi Urban Planning Council signed a pact with 19 top developers to creating a database on real estate developments which will help it to enhance land management and effectively implement its strategy on development of middle-income housing.

In tandem with the residential market, the office sector also witnessed subdued demand, driven by declining oil prices impacting the dominant oil industry and leading to reduced government spending impacting other sectors.

Supply remains relatively stable and with minimal vacancy in quality buildings.

Grade A rental performance remained positive.

However, market-wide vacancy rose marginally to 27 per cent in the third quarter.

“Vacancy rates are expected to increase further with the delivery of more space at a time of weaker demand – although the majority of new office space which has not been pre-committed will be Grade B,” the report said.

On Monday, Brent crude fell 4.5 per cent to $50.26 a barrel, while West Texas Crude was at $47.04 a barrel.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.